NEW public attitudes research on tax from @TaxJusticeUK:

- Conservative voters shift in favour of tax rises under lockdown

- The broader public support higher taxes

- There’s wide support for taxing wealth more

Read the full report: https://www.taxjustice.uk/blog/conservative-voters-shift-in-favour-of-tax-rises-under-lockdown

1/

- Conservative voters shift in favour of tax rises under lockdown

- The broader public support higher taxes

- There’s wide support for taxing wealth more

Read the full report: https://www.taxjustice.uk/blog/conservative-voters-shift-in-favour-of-tax-rises-under-lockdown

1/

We worked with @Survation & @speri to understand what people think about public spending, tax and wealth. We did 2 polls and 11 focus groups between December and June.

2/

2/

During lockdown Conservative voter support for taxes went up, including for a range of taxes on wealth. E.g. there was a big jump in support for higher corporation tax. We saw a similar jump in Conservative support for higher capital gains tax

3/

3/

People have had enough of austerity and expect proper investment in their communities. Almost half of people are prepared to pay more tax themselves

4/

4/

Treasury leaks suggest @RishiSunak is looking at higher taxes on wealth. The public back these changes:

- 61% want capital gains tax set at income tax levels

- 56% want pension tax relief for higher earners cut

- 66% support higher corporation tax

https://www.thetimes.co.uk/article/coronavirus-rishi-sunak-plans-triple-tax-raid-on-the-wealthy-2wlqpq9v6

5/

- 61% want capital gains tax set at income tax levels

- 56% want pension tax relief for higher earners cut

- 66% support higher corporation tax

https://www.thetimes.co.uk/article/coronavirus-rishi-sunak-plans-triple-tax-raid-on-the-wealthy-2wlqpq9v6

5/

In fact, Conservative voters are even more supportive of these proposals than the general public.

6/

6/

But framing is important - generic bashing of the rich goes down badly. People believe accumulating wealth is the morally right thing to do. It’s about security for yourself and your family

8/

8/

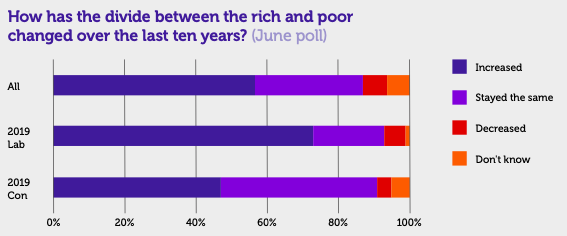

At the same time, people are concerned about inequality, with a majority believing that the divide between the rich and poor has increased over the last 10 years.

9/

9/

We’ve got a set of top tips for campaigners

- give people hope the system can change

- people want more investment & are open to higher taxes, inc on wealth

- don’t talk about wealth as if it’s inherently bad

10/

- give people hope the system can change

- people want more investment & are open to higher taxes, inc on wealth

- don’t talk about wealth as if it’s inherently bad

10/

Most economists agree that tax rises during a recession are a bad idea as they choke off recovery (there's some debate about the impact of taxes on the rich). But in the long run higher taxes are on the cards to support more govt spending & to tackle inequality

11/

11/

Read the full report here: https://www.taxjustice.uk/uploads/1/0/0/3/100363766/talking_tax_-_how_to_win_support_for_taxing_wealth.pdf

Thanks to @FProvFoundation & @SPERIshefuni for funding the work & to everyone who helped with the research & report writing

12/

Thanks to @FProvFoundation & @SPERIshefuni for funding the work & to everyone who helped with the research & report writing

12/

A few thanks for those who helped throughout. @prformativcontr - an amazing lead author & colleague, @matthew1butcher who's idea this was, Jane Carn @Survation for such thorough research, @tomhunt100 & @liamstanley for academic support, @MissEllieMae for vigorous editing & advice

Plus our excellent advisors on the report @KarenRowlingson @rfbramall @bengglover @CharlesSeaford1 @meadwaj @tweetingantonia @adymusgrave @shreyagnanda @TimPitt11 @SamEPRobinson @sofiejenkinson @clifford

@alfie_stirling Emma Rose ( @Unchecked_UK) @SallyRuane

@alfie_stirling Emma Rose ( @Unchecked_UK) @SallyRuane

Read on Twitter

Read on Twitter