1/ There's a new liquidity black hole in town, and its name is @CreamdotFinance

2/ What is @CreamdotFinance?

They started out as a @compoundfinance fork, but have signalled their intention to create a full stack crypto ecosystem with a @BalancerLabs fork and additional products in the pipeline

H/T @DonYakka

They started out as a @compoundfinance fork, but have signalled their intention to create a full stack crypto ecosystem with a @BalancerLabs fork and additional products in the pipeline

H/T @DonYakka

3/ Forks can be boring if they don't bring anything new to the table, but that's not the case here.

Money Markets like @compoundfinance and @AaveAave are permissioned platforms. It's not easy to get listed on either and even harder to be accepted as collateral

Money Markets like @compoundfinance and @AaveAave are permissioned platforms. It's not easy to get listed on either and even harder to be accepted as collateral

4/ @CreamdotFinance is different because they take the @binance listing strategy instead of the @coinbase listing strategy

Creating both trading & borrow/lend liquidity for the long tail of shitcoins

Creating both trading & borrow/lend liquidity for the long tail of shitcoins

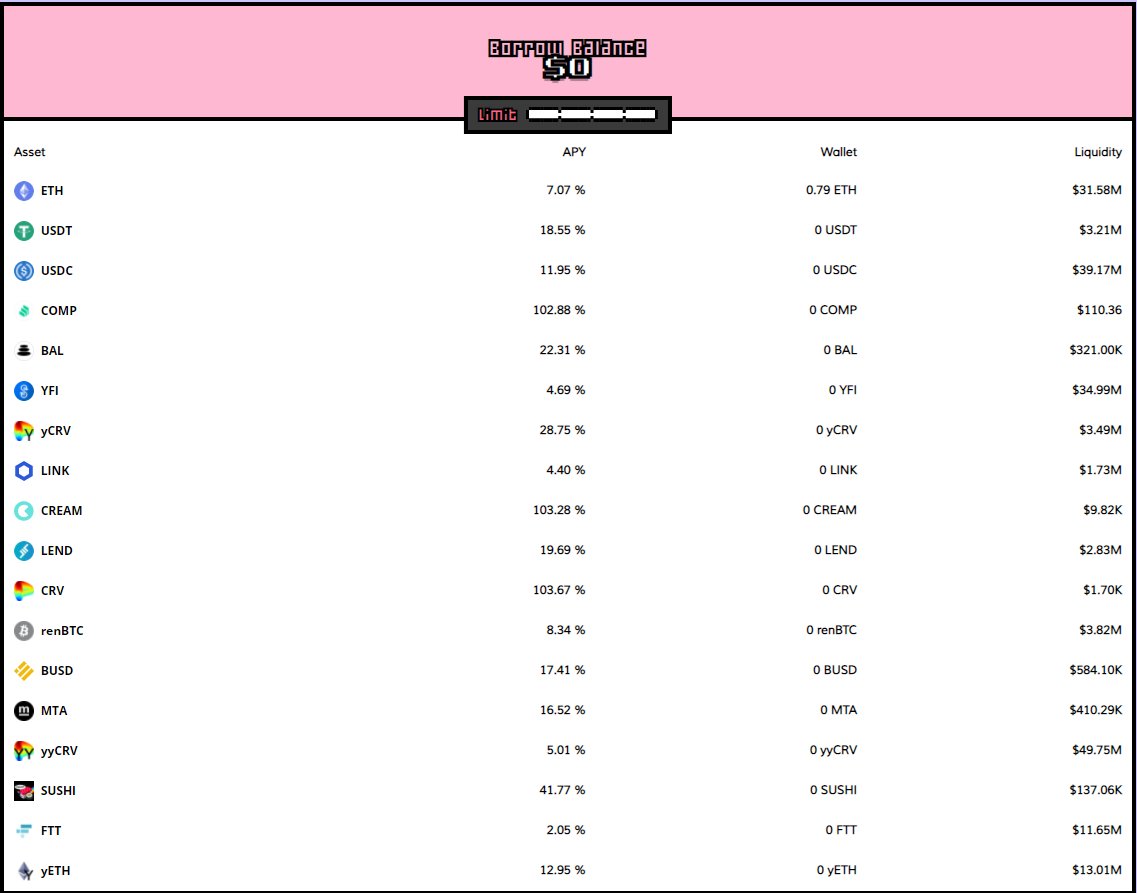

5/ The listing process is less onerous (initially centrally managed), while still managing risk. CREAM was the first platform to list $YFI.

Many of the coins listed have greater liquidity than coins listed on Compound or Aave (Sushi, FTT, BAL, etc.)

Many of the coins listed have greater liquidity than coins listed on Compound or Aave (Sushi, FTT, BAL, etc.)

6/ What's interesting is the listing of derivative shitcoins e.g. yCRV, yyCRV, yETH - synergizes with the @iearnfinance ecosystem

So you can deposit stables to receive yCRV, deposit that to yVault to receive yyCRV, and then use as collat to borrow stables and repeat

So you can deposit stables to receive yCRV, deposit that to yVault to receive yyCRV, and then use as collat to borrow stables and repeat

7/ Will this further increase potential yields? Yes

Is this reminiscent of the activity that led to a financial crisis? Yes

Is the crypto space degen enough to accept it? Also Yes

At least we have transparency.

Is this reminiscent of the activity that led to a financial crisis? Yes

Is the crypto space degen enough to accept it? Also Yes

At least we have transparency.

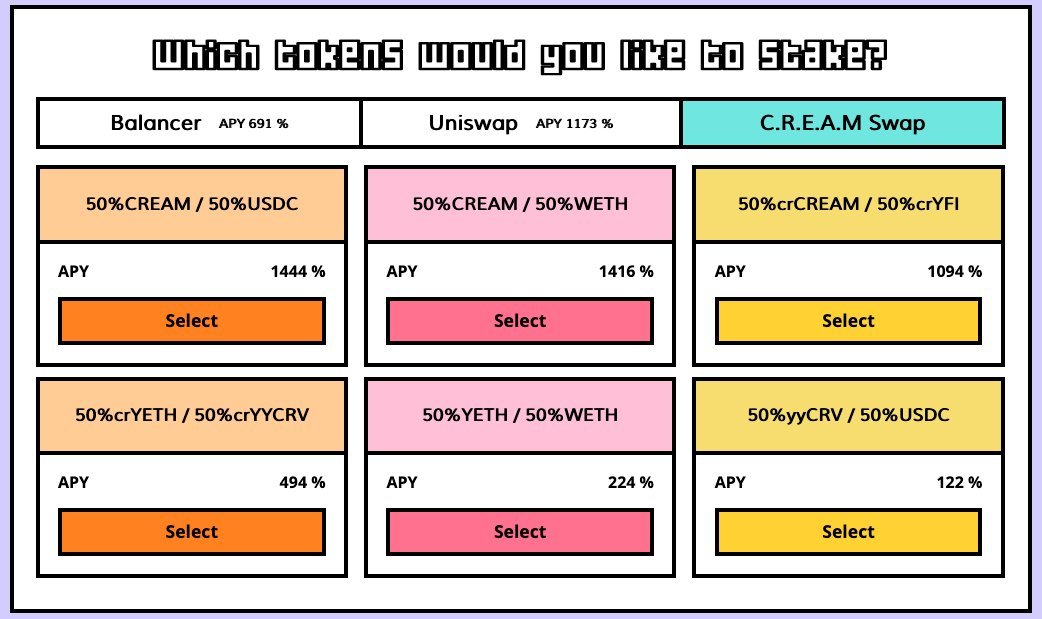

8/ The best part is that if projects that users want listed don't yet have enough liquidity, that liquidity can be bootstrapped through an incentive program on CREAM swap. This allows CREAM to accrue value through the full stack.

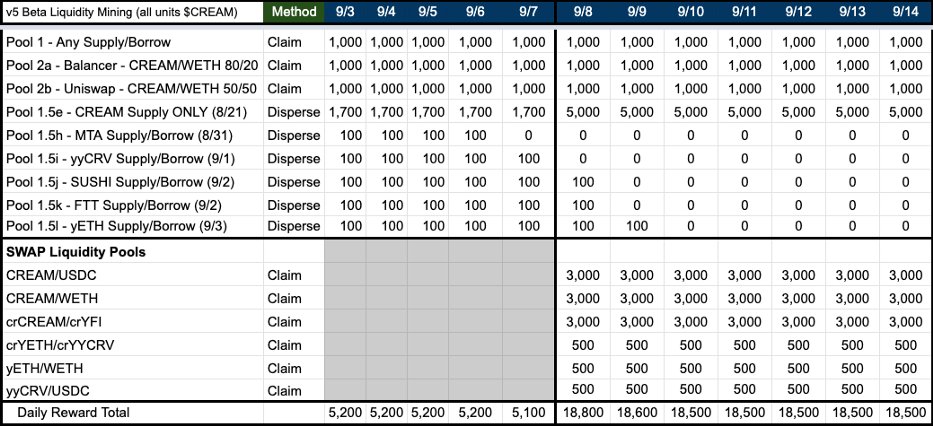

9/ Right now, there are around 15 different liquidity reward pools.

The most notable is that there are heavy rewards for CREAM and the derivative assets in CREAMSWAP

The most notable is that there are heavy rewards for CREAM and the derivative assets in CREAMSWAP

10/ There are a few hundred ways you could stack liquidity mining rewards here, but I'm not going to get into all of them https://twitter.com/DegenSpartan/status/1303390175511212032

11/ All you need to know is that the incentives for supplying CREAM liquidity in both CREAMSwap and lending make it super liquid collateral allowing people to leverage the CREAM they buy to borrow CREAM so that they can supply CREAM liquidity and receive CREAM rewards.

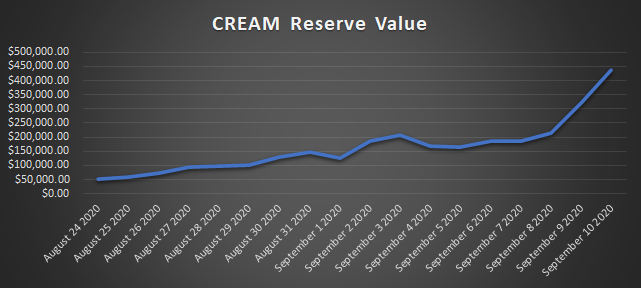

12/ What we get in the short-medium term is a flywheel effect on CREAM price and liquidity. As the liquidity in the platform grows, people believe CREAM should be more valuable, buying & increasing price which leads to higher yields for providing liquidity and so on

13/ This is essentially the liquidity black hole concept squared because of the CREAM collateral factor

Top 5 on @defipulse by end of month IMO https://twitter.com/Rewkang/status/1272631214684295168

Top 5 on @defipulse by end of month IMO https://twitter.com/Rewkang/status/1272631214684295168

14/ The most bullish part? The meme potential.

But I'll leave that to you guys https://twitter.com/Alexintosh/status/1303068563318738944

But I'll leave that to you guys https://twitter.com/Alexintosh/status/1303068563318738944

Read on Twitter

Read on Twitter