Companies have for decades been gorging on debt and let their creditworthiness crumble, leaving many in terrible shape to deal with Covid-19. That has major implications for the era of "shareholder friendliness". By me and @katie_martin_fx https://www.ft.com/content/2719966c-b228-4300-bdc0-dcbe2f7050fd

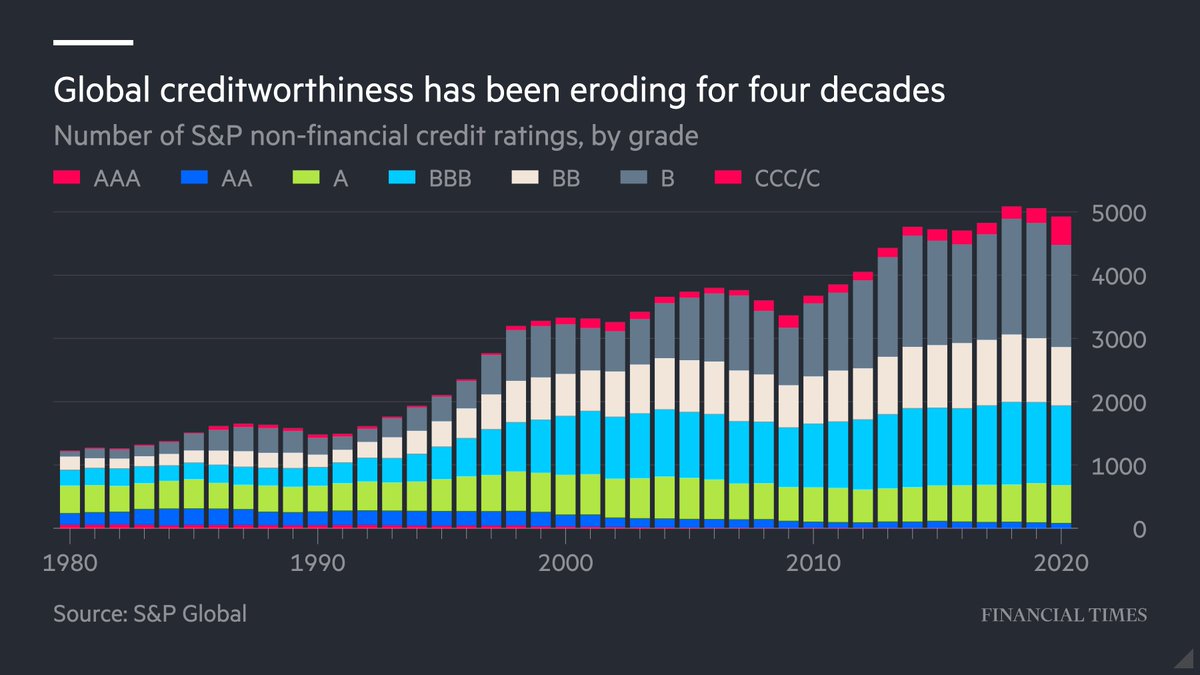

As the previous chart shows, the average credit rating of companies globally has been atrophying for 40 years. In 1980 there were 65 triple-A companies, and half of all credit ratings were in the A-range. Today there are just five triple-A companies, and only 14% are in A-range.

The core reasons for the shift in what some proponents termed "efficient" balance sheets has been the tax advantages of debt, falling interest rates, and a encouragement to make companies return more money to shareholders.

However, Covid-19 has brutally exposed the dangers of "efficient" balance sheets. For the past decade, investors didn't really care, but now they REALLY do.

In the short run, this obviously has huge implications for dividends and buybacks - which have amounted to trillions and trillions over the past decade - especially at a time when the public sector has gone to do extraordinary lengths to prop up the private sector.

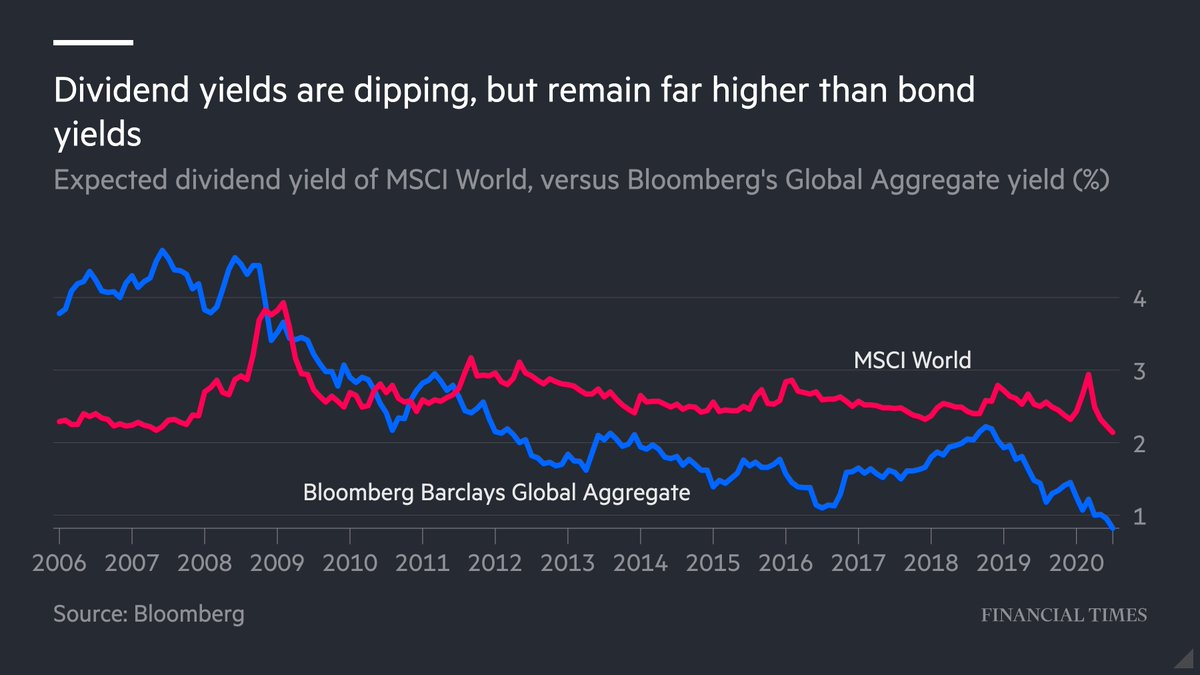

As Schroders' @DuncanLamont2 points out, dividend bear markets tend to be stubbornly long, and dividend futures aren't pricing in a return to 2019 for years to come. https://www.schroders.com/en/insights/economics/dividend-bear-markets-the-grizzly-facts/

This could have huge socio-economic consequences, given that many pension funds and individual investors depend on dividend income - especially at a time when bond yields are even lower.

Read on Twitter

Read on Twitter