Some thoughts on the future of AMMs given the @UniswapProtocol @SushiSwap saga. Thread:

1) Firstly, it’s important to realize that whilst there are 2 types of AMM users - LPs and traders. Aggregators (1inch, Matcha, etc) are/will service the traders (takers). Hence, AMMs really are/should be built with the LPs interests top of mind. So what do LPs care about?

2) LPs (market makers) care about: not getting run over; capital efficiency; being able to adjust as market changes. What does this mean in AMMs? These factors can all be addressed via: 1) pool fees, 2) pool % compositions, 3) shape and position of the bonding curve.

3) This is why it’s exciting to think about how the governance spectrum can extend beyond just token distribution/rewards. In particular, dynamic/adjustable 1s, 2s, and 3s are where the potential of AMMs start to become real fascinating.

4) These already exist, but in silo:ed formats. @BalancerLabs smart pools = continuously adjustable pool weights. @CurveFinance = alternate shape of bonding curve for stable/mean-reverting assets. @BreederDodo = continuously adjusting bonding curve mids to minimize IL.

5) Using token governance to adjust these parameters (or the parameters that programmatically sets these parameters) on the fly feels like a logical next step in the AMM evolution.

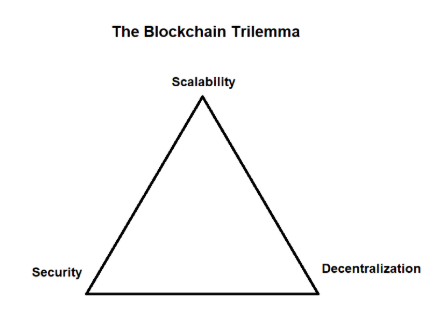

Remember when we were all passionately discussing tradeoffs for layer 1s?

Remember when we were all passionately discussing tradeoffs for layer 1s?

6) Well, the equivalent in AMMs would be spreads<>depth<>capital efficiency. It’s a trilemma, we can’t have it all. But using governance, perhaps we can decide where we want to be in the AMM triangle as markets change over time.

7) Bull/bear/sideways/choppy markets should warrant different liquidity profiles (and hence different parameters for curve shape/curve mid/fees/pool composition). It'd be equivalent of adjusting spreads/skew/depth of an MM algo on the fly in accordance with the protocol “axes".

8) The addition of native tokens as a fee subsidy extends the design space further. Tokens can (and already have been, to some extent) used as backstop to subsidize IL on more volatile pairs, as opposed to equally distributed to LPs without regard for underlying assets.

9) In summary: We are seeing the rise of many different types of AMMs, all with their own position in the ‘AMM triangle’. Looking ahead, we may see consolidation/fewer AMMs, but with their positions in this triangle continually adjust over time instead, via governance.

Read on Twitter

Read on Twitter