1/ A crypto story

In March/April when markets were crashing I got an offer for a zero interest balance transfer credit card for $12k. I wrote myself a check from the account for $5k and transferred an existing CC balance for another $5k.

In March/April when markets were crashing I got an offer for a zero interest balance transfer credit card for $12k. I wrote myself a check from the account for $5k and transferred an existing CC balance for another $5k.

2/ My thought was that I could invest the $5k in $AAPL or some stock that would surely bounce back since the interest rate on the loan was 0% for 21 months. I checked in on #Bitcoin  and saw prices were low so decided to transfer some of my spot holdings and this $5k to trade.

and saw prices were low so decided to transfer some of my spot holdings and this $5k to trade.

and saw prices were low so decided to transfer some of my spot holdings and this $5k to trade.

and saw prices were low so decided to transfer some of my spot holdings and this $5k to trade.

3/ I had about $12k to start and quickly rode some $BTC and $ETH longs to turn that into $32k. I hovered between $32k and $40k for a while until July. After $BTC tapped $9k support for like the 10th time, I opened some big (relatively speaking) longs on $BTC and $ETH.

4/ I rode those to longs to a PNL as high as $175k at one point, taking profits along the way. Best day ever was +$63k, worst day ever was -$69k.

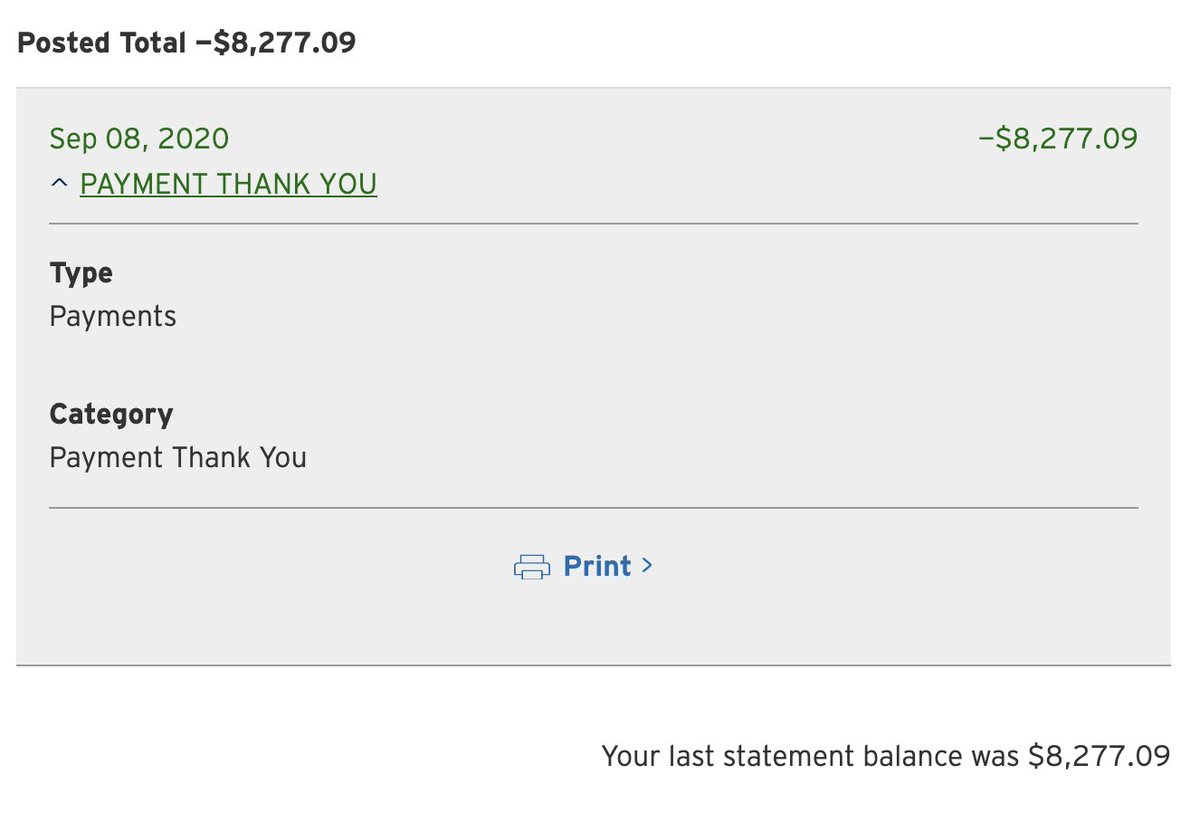

5/ I’ve since cashed out my initial & then some and have paid off that credit card, bought myself a sick electric bike, paid the entire tuition for my daughter’s school this year, and we are re-doing our backyard, getting new floors, and new roof on our house.

7/ All this to say, you don’t need a huge bankroll, but $10-$20k is ideal because you need to be able to withstand drawdowns and not get liquidated. One of my core strategies was to be okay with significant drawdowns (this will not always work). I did not use stop losses.

8/ A few other points. I started buying $BTC in 2016 and at one point my 2017 portfolio was worth well over $110K. I cashed out $25k back then, but watched the rest draw basically back down to where I started. All that experience was necessary for this run to be successful.

9/ Following @TradySlim @Dr_Crypto14 @Chainlinkjunkie @pentoshi were crucial in this success. Very different styles but I used their analysis and posts to inform all my decisions. All recommended by @DefusoRita. Check out my “bitcoin” twitter list for more good follows.

10/ Muting certain accounts was also necessary. I won’t put them on here, but DM me and I’ll tell you who I’ve muted if you’re interested. I found certain accounts toxic, negative, and not helpful. The 4 I mentioned will often flip bull/bear and don’t trade with bias.

11/ I’m still trading with a good stack, but taking profits and literally sending the money into my bank account was the smartest thing I’ve done. At times the money doesn’t feel real, but it very much is when it hits your account and you can do IRL things with it.

12/ None of this is easy, but it is fun. My wife will tell you I am on my phone too often. I’ve slept like absolute shit since April, but I would do it again. The goal is and always has been to not liquidated, stay solvent, and ride the wave.

13/ I have no moon boy predictions, just playing it level by level. I definitely made money shorting BTC, but mostly as hedges to my longs. Bears are miserable and always will be.

14/ When I opened those big (relative) longs before the run from 9k-12k, I was willing to lose it all. My liq prices were far away and I always used cross margin so that was unlikely. Once I reached numbers where I wasn’t willing to lose, I started taking $ out.

END / Catching the longs was the easy/easier part. Not giving it all back and actually taking profits was the hard part. Let's ride the next leg up.

Read on Twitter

Read on Twitter