I did a test for which AMM currently gives the best price. Keep in mind it's extremely early to be looking at this as liquidity can easily still migrate back to Uniswap. SushiSwap is currently quoting better prices for 100 ETH orders while Uniswap better for 10 ETH orders.

Take both of these with a grain of salt as it's literally just screenshots of which gave a better price. What will matter long term is whether SushiSwap can retain LPs with a rent-seeking model and which protocol captures larger volumes in the coming weeks.

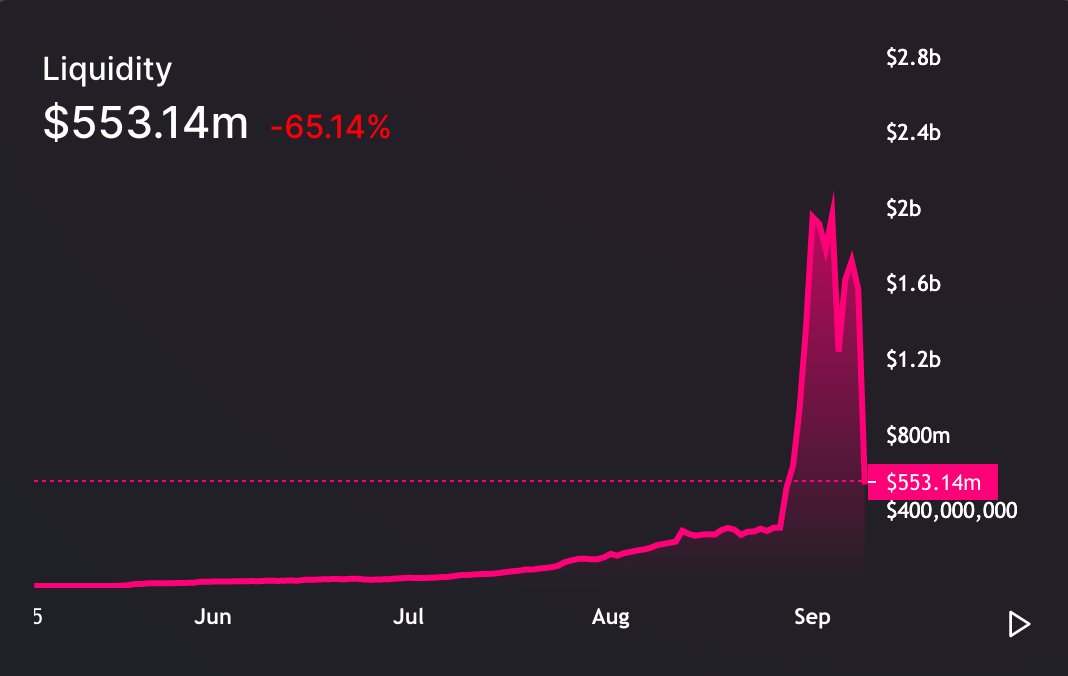

If I remember correctly, Uniswap was at a little over $300M of liquidity prior to Sushi. So it did actually gain $200M+ from this experiment and will potentially gain much more long term. Awareness of what being an LP skyrocketed in the recent weeks

Read on Twitter

Read on Twitter