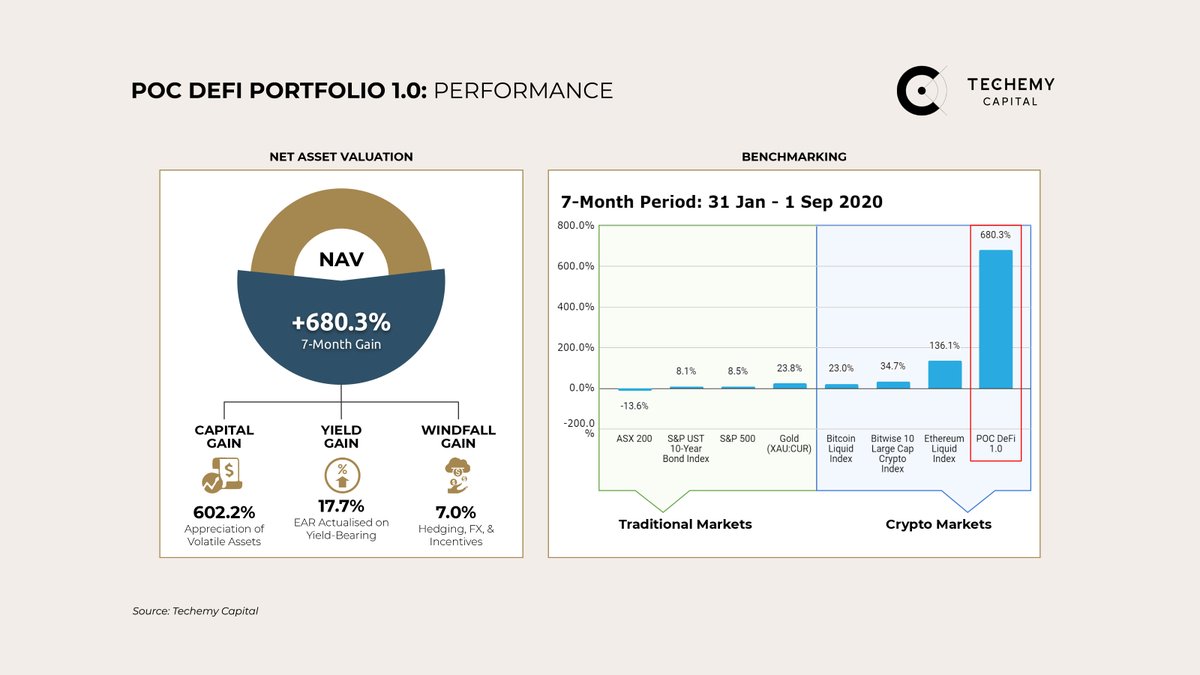

1. Techemy Capital’s private DeFi portfolio has just turned 7-months old, following its inception in Jan 2020. We are satisfied with the progress, but it’s the numbers that tell the story: the NAV is up 680%. This sets the perfect base for our upcoming public fund launch....

2. Thesis: Our Proof of Concept (POC) #DeFi Portfolio is a high-risk test vehicle to interact with protocols, understand contingencies, & work out best risk management techniques. Most initial positions represented yield-bearing instruments, supplemented by capital appreciation

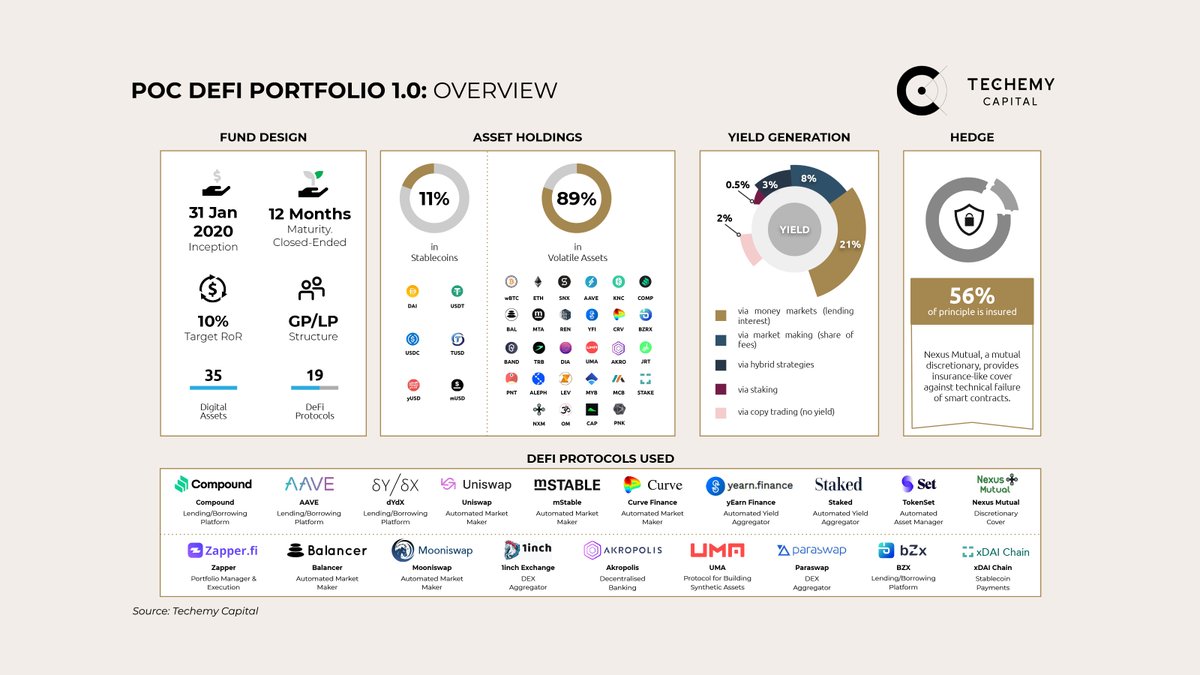

3. What does it take to get 680% NAV growth? 35 digital assets, 19 #DeFi protocols & some hedging tools. Plus hours of research & conversations that go into the portfolio construction and asset allocation. The true IP lies in the ability to separate signal from noise...

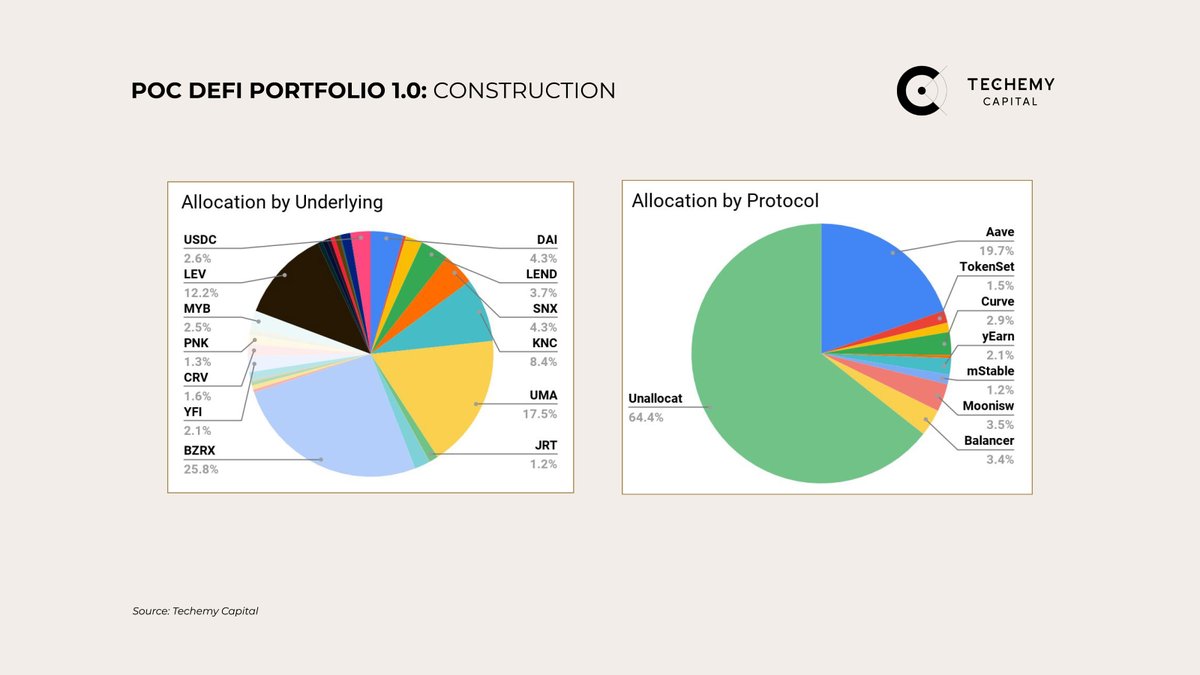

4. Fund allocation across the underlying assets / protocols is not locked and flows freely following our risk threshold. This snap captures the distribution as of Sep 1, however, we have explored many other positions, including those yet to catch mainstream attention...

5. A seasoned #DeFi user may ask “why no $LINK ”? Techemy was involved in @Chainlink’s ICO back in 2017, so we are very comfortable with $LINK as an investment, hence it was out of the scope for this particular portfolio.

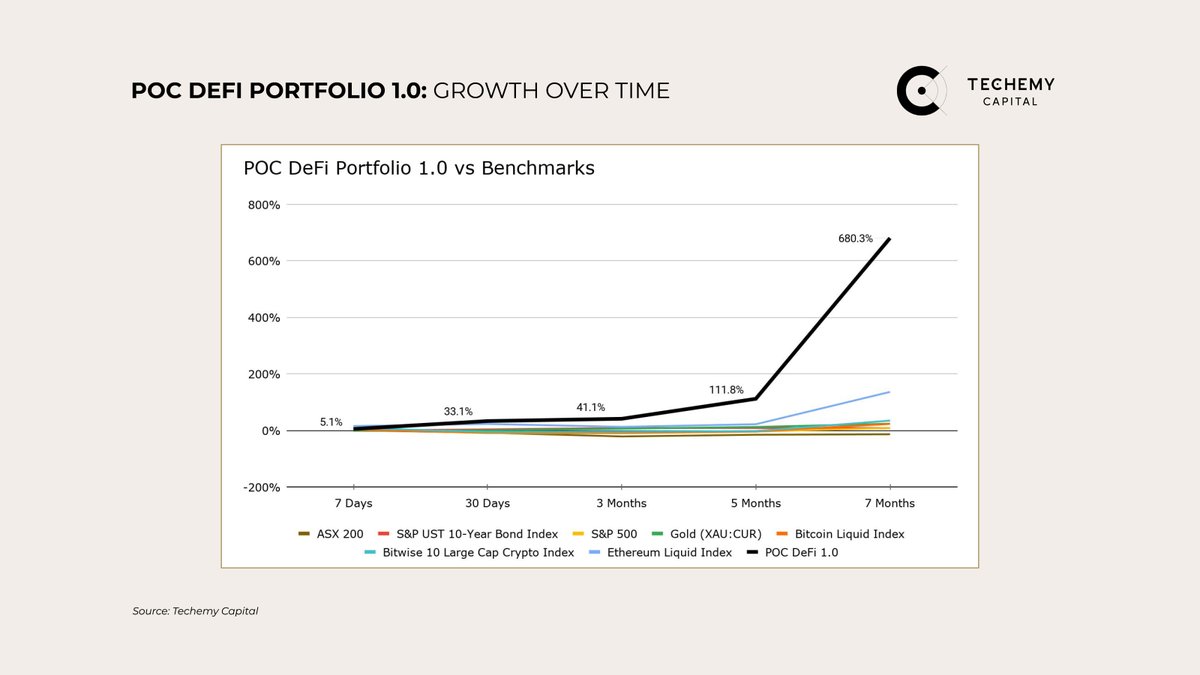

6. The NAV growth over time shows exponential performance against our benchmarks, despite the March crash and the September correction. Active portfolio management with a solid thesis can beat passive index holding, whether it’s equities, bonds, gold, $BTC or $ETH

7. What happens next? Was the Sept correction a bear trap before a parabolic rise for ETH / BTC? Or a bull trap before capitulation? Our view is the former, there weren’t any fundamental reasons for the fall, other than a high correlation to S&P & over-exhausted farming...

8. Meanwhile, #DeFi continues to break records in terms of DAU, new ETH wallets, TVL, and trading volumes are catching up to tier-1 CEXs like @Coinbase...

9. The token narrative has shifted with users now demanding tokens with governance/revenue rights. Liquidity moves freely in #DeFi, as millions of $ flow from protocol to protocol chasing yield. We are yet to see new cash inflows into DeFi, as most $ is recycled crypto wealth.

10. One concern is Oct-Nov: the US election will likely result in high volatility. The risks are high, but rewards are higher. + CeFi is chasing DeFi token listings & experimenting with protocols, opening the door for more crypto users to enter DeFi. The future looks bright...

11. How bright is the future? Very bright indeed… https://twitter.com/TechemyCapital/status/1299126257167204353

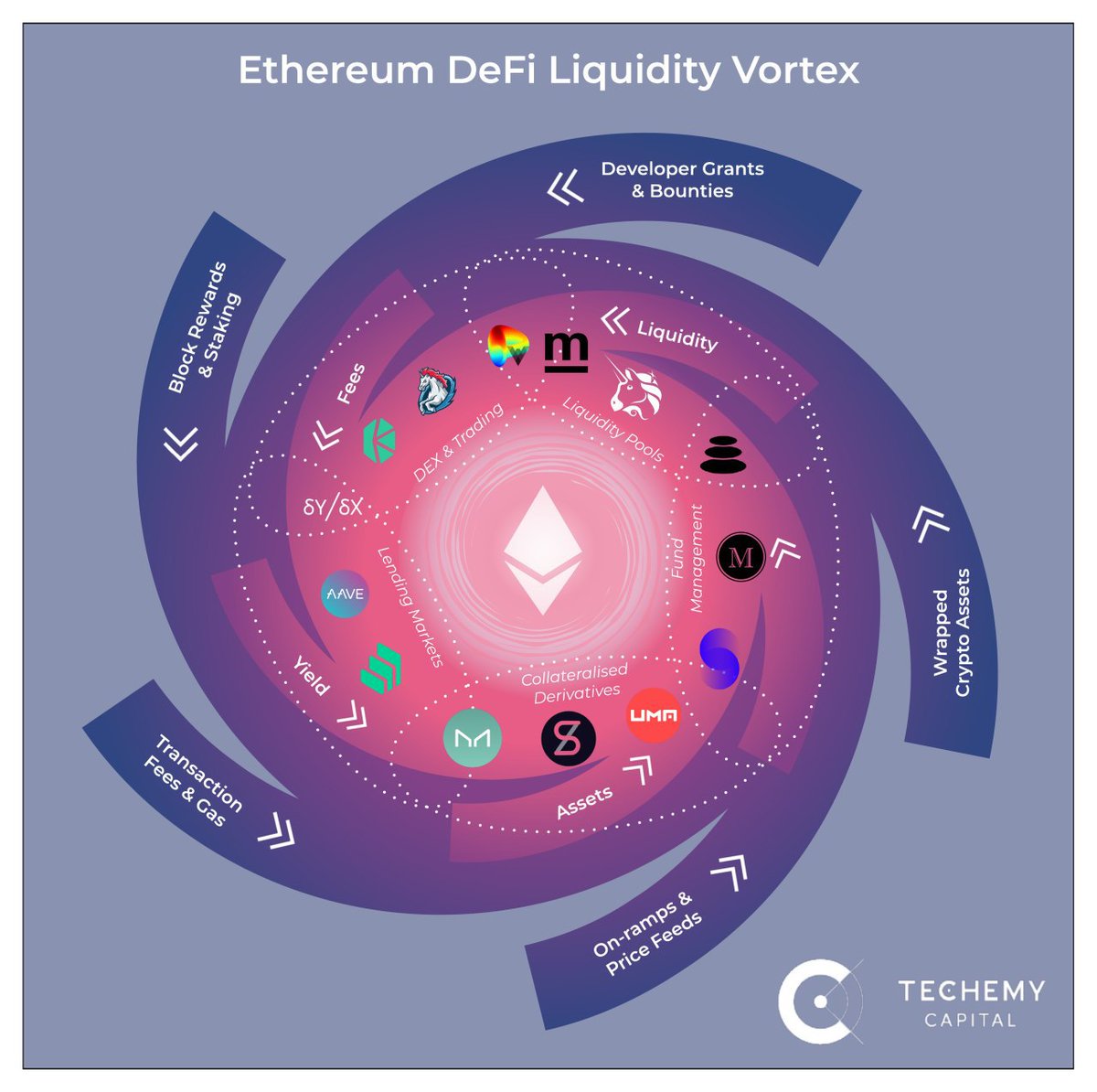

12. Meanwhile, liquidity begets liquidity, so the #DeFiVortex will continue to accelerate. #DeFi is on a path to consume all assets, financial or otherwise, both inside and outside of crypto... https://twitter.com/paulsalis/status/1278920299136741378

13. For more information on #DeFi and our funds, get in touch via https://techemy.capital/

Read on Twitter

Read on Twitter