This is an opinion piece about a topic that's been gaining attention over past years. And we all have our own opinions. But I have a few comments on some data in the piece, esp on China's crude imports from #Iraq: https://twitter.com/financialtimes/status/1303543718897741825

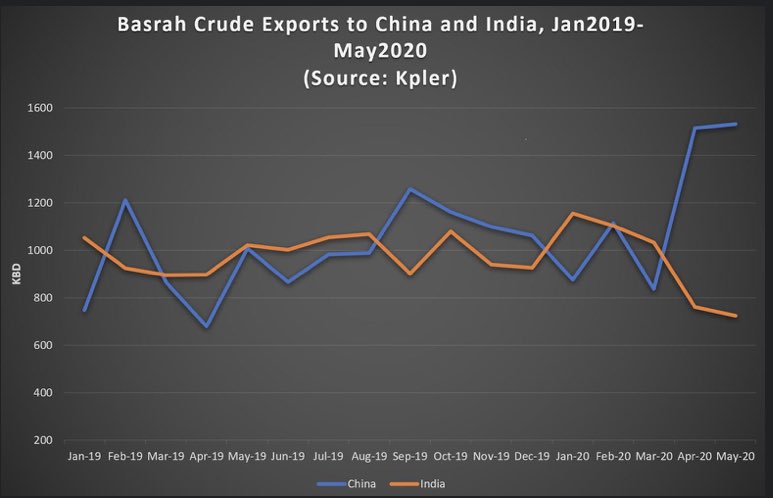

1) The piece says that in H12020"Iraq oil shipments to China rose by around 30 percent from a year earlier." The rise in imports wasn’t related to politics but trading activities& impact of pandemic on prices esp in April/May. I wrote about it: https://www.forbes.com/sites/noamraydan/2020/06/12/demand-and-storage-cause-notable-shifts-in-iraqs-oil-flow-to-india-china/#1fa7adfc2c78

2)In April/May, #Iraq crude exports to China  to all-time high (around 1.5mnbpd-incredible rise compared to 2019 avrg).China was taking advantage of low oil prices.There was opportunistic buying for storage-Investors betting on rebound in oil prices (situation now changed).

to all-time high (around 1.5mnbpd-incredible rise compared to 2019 avrg).China was taking advantage of low oil prices.There was opportunistic buying for storage-Investors betting on rebound in oil prices (situation now changed).

to all-time high (around 1.5mnbpd-incredible rise compared to 2019 avrg).China was taking advantage of low oil prices.There was opportunistic buying for storage-Investors betting on rebound in oil prices (situation now changed).

to all-time high (around 1.5mnbpd-incredible rise compared to 2019 avrg).China was taking advantage of low oil prices.There was opportunistic buying for storage-Investors betting on rebound in oil prices (situation now changed).

3)Lower Iraqi crude exports to US also not linked to politics. US oil needs have changed esp since shale revolution. In addition sanctions on Iran led to increase in Iraq oil supplies to Asia to fill gap left by Iran barrels (~70% of Iraq exports head to Asia-top market,not US).

4)Lastly, if Saudi crude exports to China slipped in July this does not mean it is no longer giant supplier to China. Piece says China is " Iraq's biggest trading partner. Only Russia sells more oil to Beijing". In June Saudi was 1st supplier, Russia 2nd, Iraq 3rd.

It’s a good piece. It starts a discussion. But market factors ( esp pandemic impact this year),and not politics, have been driving the change in oil flows to China (same goes for India,another key Asian consumer).

Read on Twitter

Read on Twitter