Thread on Tesla.

After a massive rally $TSLA has taken a breather. Good time to revisit the cult phenomena.

Is $TSLA an Auto company or a Tech company?

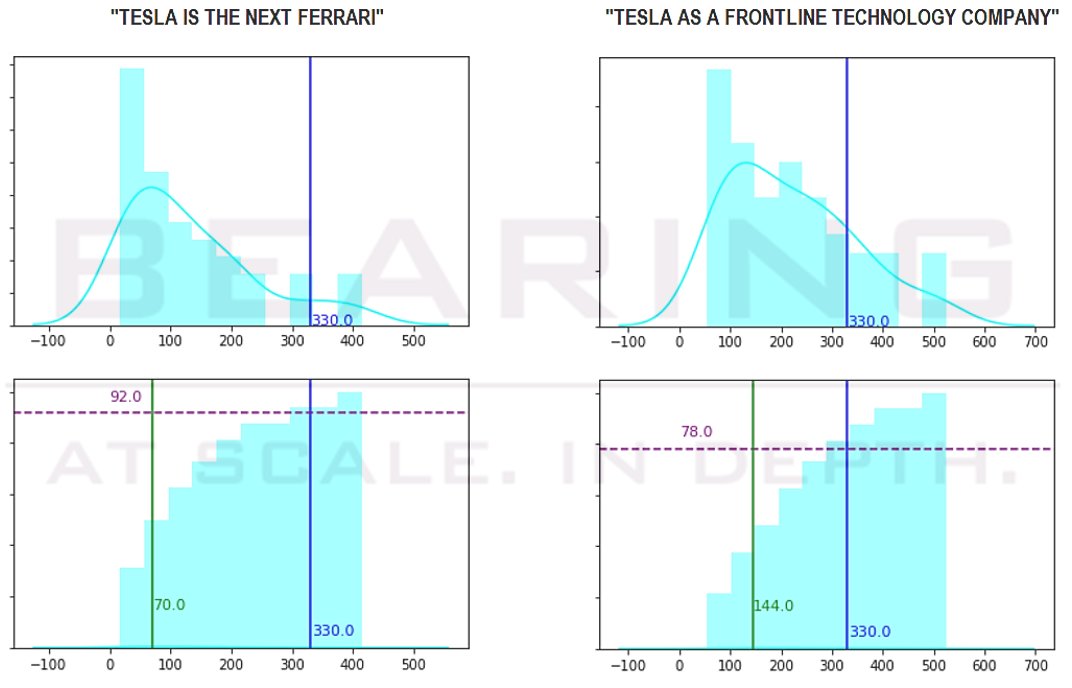

Histogram = Range of Fair Values.

Blue line = Last Close. Green = 'Fair Value'.

Purple = Percentile of valuation range.

After a massive rally $TSLA has taken a breather. Good time to revisit the cult phenomena.

Is $TSLA an Auto company or a Tech company?

Histogram = Range of Fair Values.

Blue line = Last Close. Green = 'Fair Value'.

Purple = Percentile of valuation range.

2. Tesla is the next Ferrari.

Implicit in this narrative is the collective belief that Tesla will evolve into Ferrari-like (luxury brand) unit economics. Tesla will need to achieve this on much higher (non-Ferrari-like) unit volumes.

Fair value ranges capture extreme scenarios.

Implicit in this narrative is the collective belief that Tesla will evolve into Ferrari-like (luxury brand) unit economics. Tesla will need to achieve this on much higher (non-Ferrari-like) unit volumes.

Fair value ranges capture extreme scenarios.

3. In this model of reality, a disruptive upstart is posited to upend business models (e.g. D2C, rather than Dealerships as primary outreach). However, Tesla would have to deliver something unprecedented. Ferrari is 80 years old and sells 10,000 cars a year.

4. Tesla sells 38x Ferrari's volumes today at 1/6 the unit price. In this view of reality, Tesla would have to double unit prices by 2x and volumes by 2.5x over the next decade. All while extracting Ferrari-like unit economics. Tough ask? Or achievable? Pay-off boils down to this

5. Tesla as a Tech company.

In this narrative, Tesla evolves as a CAAS (Car As A Service) model. The business resembles SAAS business with high ARR; at Big Tech-like unit economics. $TSLA sells a tech/energy co 'software' license, packaged in the form factor of an automobile.

In this narrative, Tesla evolves as a CAAS (Car As A Service) model. The business resembles SAAS business with high ARR; at Big Tech-like unit economics. $TSLA sells a tech/energy co 'software' license, packaged in the form factor of an automobile.

6. In this view of reality, $TSLA would resemble a monopolistic BigTech co in terms of economics. At a basic level, TSLA would hold unit prices at current levels, with gradual increases. Essentially selling a 'car' as a multi-year license. It would need to sell this to >1M users.

7. In this reality, the 'automobile', or 'energy solution', may be sold as a $1,000/month, multi-year license. The CAASization of the business would render customer stickiness and a permanent shift in narrative ("Tesla is about as much a car co, as Apple is a phone co").

8. The CAASization shift could open up-sell opportunities (sell car software/energy solutions as follow-on purchase; and other use cases not visible today). Not dissimilar to how 'phone co' Apple extracts super-normal economics selling stuff that is embedded on top of the product

9. Assume that Tesla manages to deliver all of the above. This would still put the onus on Tesla's ability to extract BigTech like unit economics.

Tough ask? Or achievable?

Tough ask? Or achievable?

10. Prices imply the latter view (Tesla-as-a-tech-co-with-a-hazy-future-path) as the dominant narrative.

But the thing about narratives is that collective belief also has an obligation to be right; in order to realize an acceptable rate of return.

But the thing about narratives is that collective belief also has an obligation to be right; in order to realize an acceptable rate of return.

11. The best investment outcomes are realized when business reality closely resembles expectational realities. When the range of collective belief is wide, the onus is on sizing up the odds smartly.

Will the Tesla Bears win, or will Tesla Bulls have the last laugh?

Will the Tesla Bears win, or will Tesla Bulls have the last laugh?

Read on Twitter

Read on Twitter