I see the old topic of savers "losing £xxxx" by saving into cash instead of investing is doing the rounds today. A few thoughts.....

1. These articles tend to use big numbers...."savers missing out on £billions". The reality for individual savers is very different. Latest HMRC ISA figures show 44% of ISA savers save between £1 & £2499....

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/894771/ISA_Statistics_Release_June_2020.pdf

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/894771/ISA_Statistics_Release_June_2020.pdf

2. Why is this? The recent Advice Gap research from @OpenMoneyUK asked this very question....

3. The first 2 of these reasons are hugely relevant. If you don't have any money spare, and/or you are in debt, you cant/shouldn't be investing.

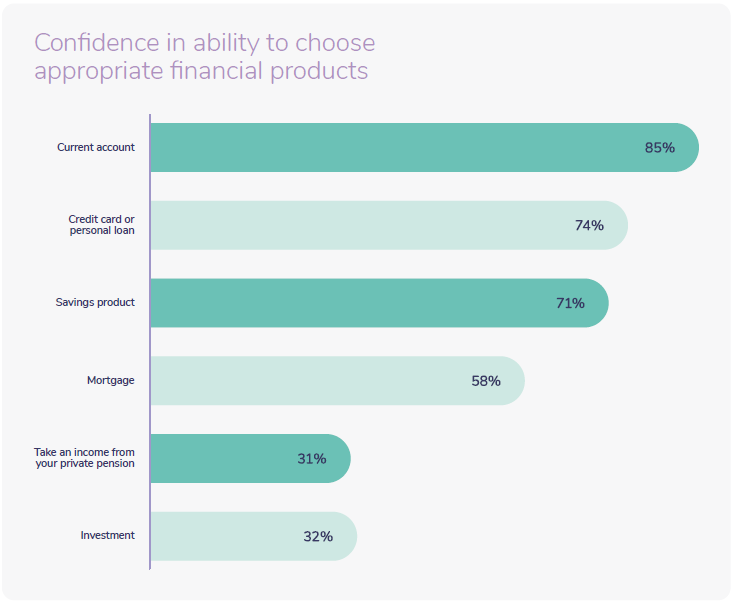

4. The other reasons point to a lack of confidence. And confidence was a question that @OpenMoneyUK also explored in their research. People are relatively confident with saving, but not investing.

Bottom line - these cash vs investing comparisons almost always miss two crucial points.

1 - The majority of the population find investing intimidating and confusing. They need help to understand their options, not articles that say "you are missing out"

1 - The majority of the population find investing intimidating and confusing. They need help to understand their options, not articles that say "you are missing out"

.....and 2..... Savings and investing should go side by side. You shouldn't be investing unless you have adequate savings. If you are saving you are not "missing out", you are making a big step to a more secure financial future, a step that could be complemented by investing

Thank you for reading my Ted Talk on saving. Sorry, my TxD talk.....

Read on Twitter

Read on Twitter