1) Market Structures are an Important Aspect to understand if you perform 'bottom-up' analysis

Typically there are 4 widely-known structures

- Perfect

- Monopolistic

- Oligopoly

- Monopoly https://investmenttalk.substack.com/p/the-four-market-structures?r=66q6l&utm_campaign=post&utm_medium=web&utm_source=copy

Typically there are 4 widely-known structures

- Perfect

- Monopolistic

- Oligopoly

- Monopoly https://investmenttalk.substack.com/p/the-four-market-structures?r=66q6l&utm_campaign=post&utm_medium=web&utm_source=copy

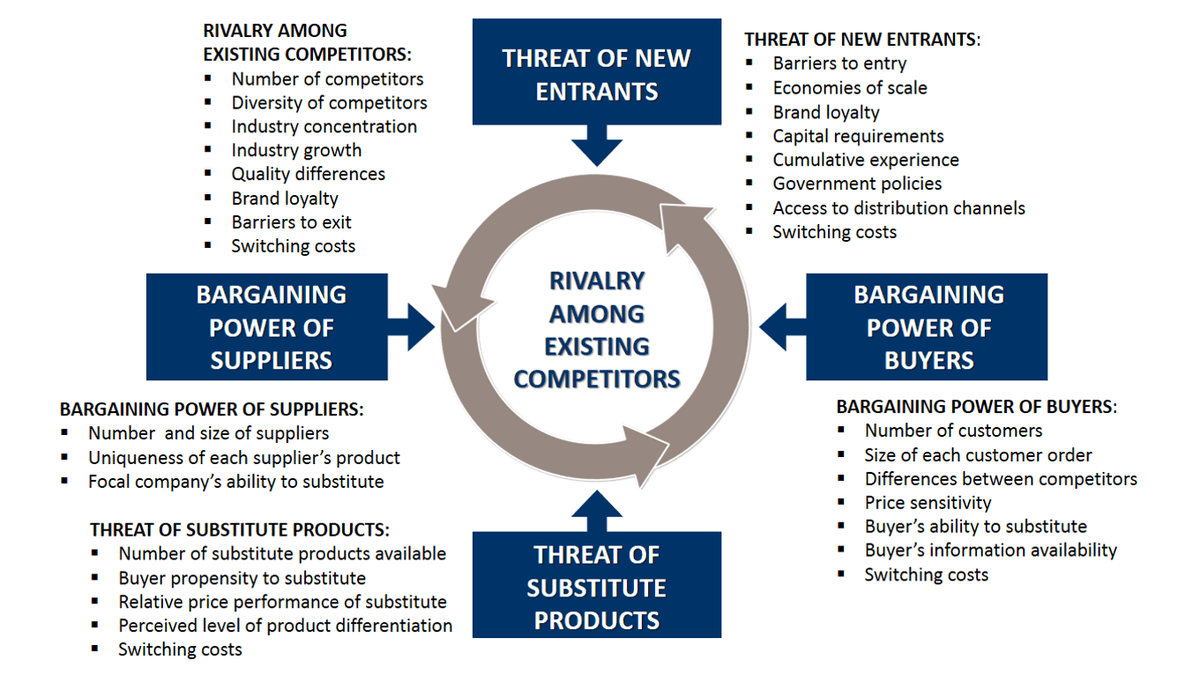

2) Understanding the nature of the market your firm operates in is crucial if you are to understand the firm.

Firms are at the mercy of Porter's Five Forces

However, each firm faces different intensity's of those forces

This all boils down to market structure

Firms are at the mercy of Porter's Five Forces

However, each firm faces different intensity's of those forces

This all boils down to market structure

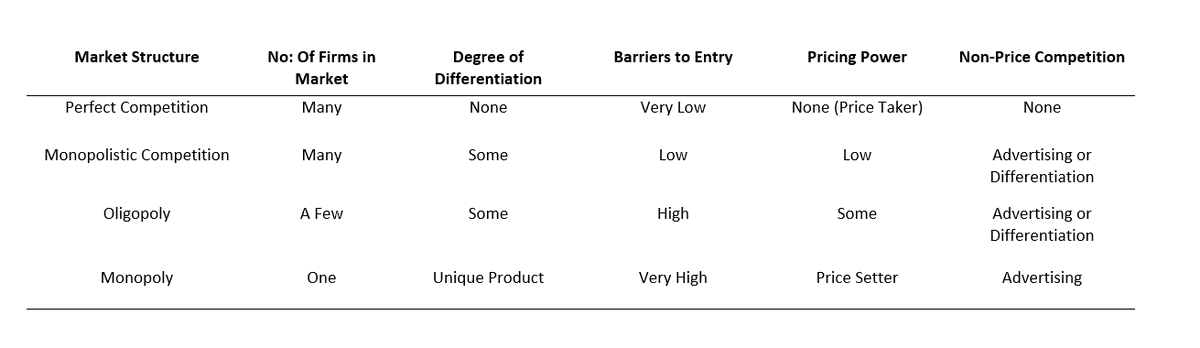

3) Markets can be distinguished between some factors such as;

- Number of firms

- Degree of Differentiation

- Barriers to Entry

- Pricing Power

- Non-Price Competition

Knowing this, will help you understand a firm's current and future behaviors

- Number of firms

- Degree of Differentiation

- Barriers to Entry

- Pricing Power

- Non-Price Competition

Knowing this, will help you understand a firm's current and future behaviors

4) Perfect Competition

In truth, a theoretical concept, but useful for understanding behaviors.

The highest concentration of competition, firms are price takers, there are homogeneous product offering, complete freedom of entry, and assumed perfect knowledge.

In truth, a theoretical concept, but useful for understanding behaviors.

The highest concentration of competition, firms are price takers, there are homogeneous product offering, complete freedom of entry, and assumed perfect knowledge.

5) Monopolistic Competition

Still a high number of firms, but now with differentiation, and a little price control.

Freedom to entry is still low and firms engage in some non-price competition.

Think hairdressers.

Still a high number of firms, but now with differentiation, and a little price control.

Freedom to entry is still low and firms engage in some non-price competition.

Think hairdressers.

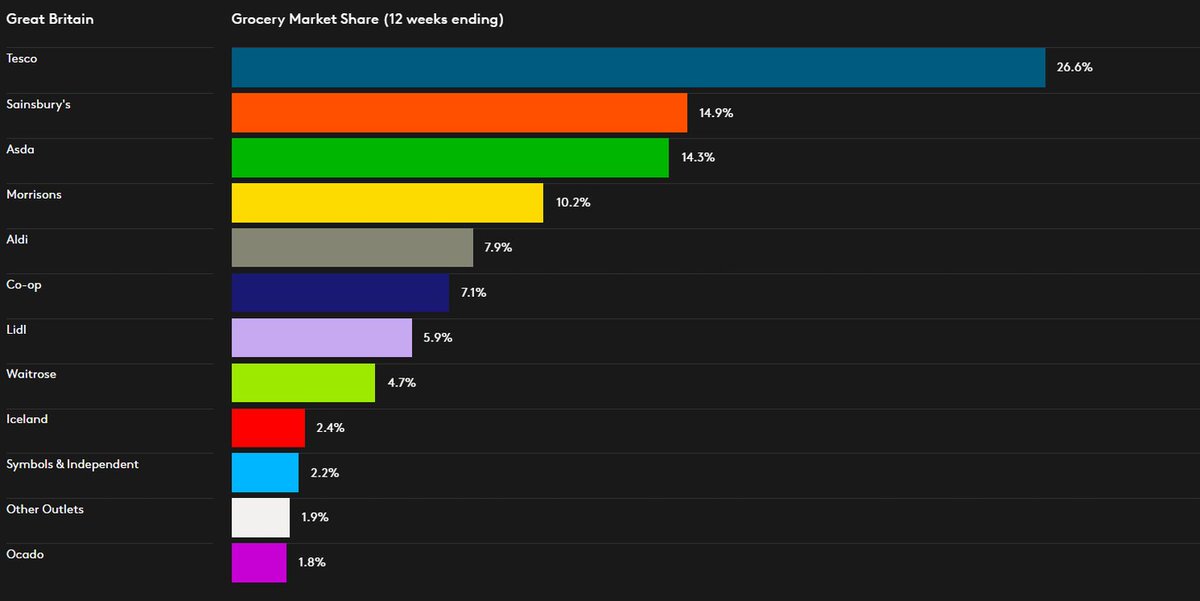

6) Oligopoly

Few firms controlling one market. Pricing power is considerable, for the most part and barriers to entry are high.

Firms will be interdependent, in that their actions directly impact competitors.

The UK Supermarket industry is a classic example.

Few firms controlling one market. Pricing power is considerable, for the most part and barriers to entry are high.

Firms will be interdependent, in that their actions directly impact competitors.

The UK Supermarket industry is a classic example.

7) Monopoly

Typically one (or two) firms completely owning a market with full price discretion. Competition is the lowest.

Can take various forms, such as pure, legal, or natural monopoly.

Typically one (or two) firms completely owning a market with full price discretion. Competition is the lowest.

Can take various forms, such as pure, legal, or natural monopoly.

8) I wrote at length about these four structures as well as each of the factors we use to differentiate them this morning.

I think a firm understanding of the economics of competition really aids your analysis from the bottom-up.

Have a great day

IT

I think a firm understanding of the economics of competition really aids your analysis from the bottom-up.

Have a great day

IT

Read on Twitter

Read on Twitter