A short thread of the non-recovery of the global #economy.

Let's start on the PMI -fallacy.

With the PMI:s all figures above 50 signal overall increase, compared to previous month, while figures below 50 signal a decrease. 1/10

@GnSEconomics https://gnseconomics.com/2020/09/08/there-is-no-recovery/

Let's start on the PMI -fallacy.

With the PMI:s all figures above 50 signal overall increase, compared to previous month, while figures below 50 signal a decrease. 1/10

@GnSEconomics https://gnseconomics.com/2020/09/08/there-is-no-recovery/

During the lockdowns, PMIs crashed to range of 20 to 40, signalling a massive decrease in expectations and production.

Now, the PMIs are mostly in a range from 50 to 60. What does this imply?

The easiest way is to consider PMIs in terms of percentage changes. 2/

Now, the PMIs are mostly in a range from 50 to 60. What does this imply?

The easiest way is to consider PMIs in terms of percentage changes. 2/

So, when index dives to 30, it signals a decrease of (roughly) 40 percent.

How long does it take for the underlying series (production, sales, new orders, etc.) to recover to the level it was at before the decline?

Note: All percent changes are relative. 3/

How long does it take for the underlying series (production, sales, new orders, etc.) to recover to the level it was at before the decline?

Note: All percent changes are relative. 3/

Let’s assume that there’s a decline of 40% in some monthly index from a level of 100 (to 60).

With a monthly growth rate of 10 percent, it takes 6 months for the index to regain the 100 level. With a growth rate of five percent, it takes 11 months. With a growth rate... 4/

With a monthly growth rate of 10 percent, it takes 6 months for the index to regain the 100 level. With a growth rate of five percent, it takes 11 months. With a growth rate... 4/

...of three percent, it takes 18 months. With a growth rate of two percent, it takes 26 months.

The PMIs that are increasing are implying growth rates of 3 to 10 percent. Thus, even in the best-case we would be around six months away from a recovery, but a slowdown looms. 5/

The PMIs that are increasing are implying growth rates of 3 to 10 percent. Thus, even in the best-case we would be around six months away from a recovery, but a slowdown looms. 5/

The so-called high-frequency indicators indicate that we have reached only just around 60% to 80% of pre-Covid economic activity.

Most importantly, they have stabilized or even turned back down recently. 6/ https://twitter.com/GnSEconomics/status/1301083029369245696

Most importantly, they have stabilized or even turned back down recently. 6/ https://twitter.com/GnSEconomics/status/1301083029369245696

This indicates that PMIs are likely to first stabilize around 50, and then turn back below 50 in the coming months.

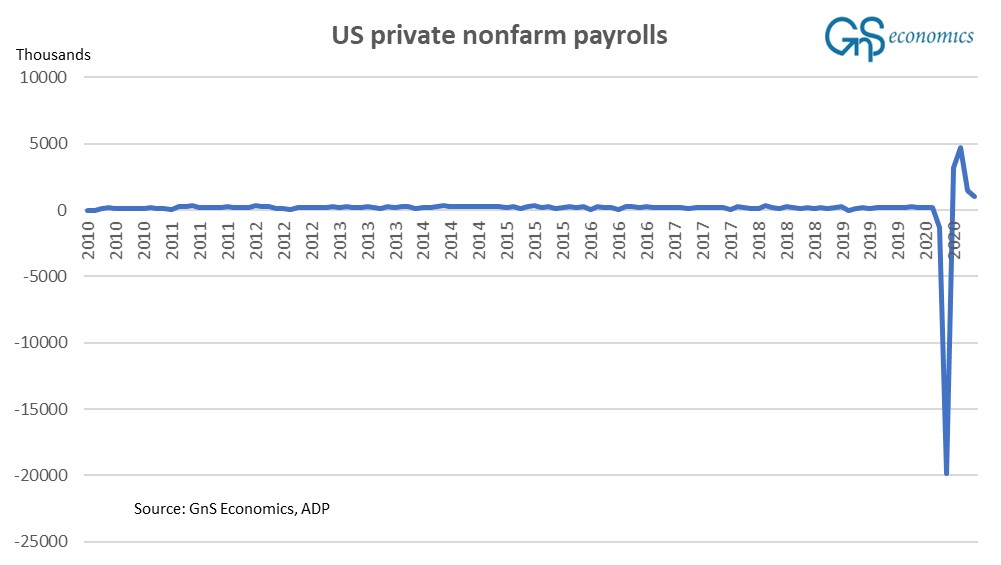

The situation is not much better in monthly indicators.

The improvement in employment is stalling in the US. 7/

The situation is not much better in monthly indicators.

The improvement in employment is stalling in the US. 7/

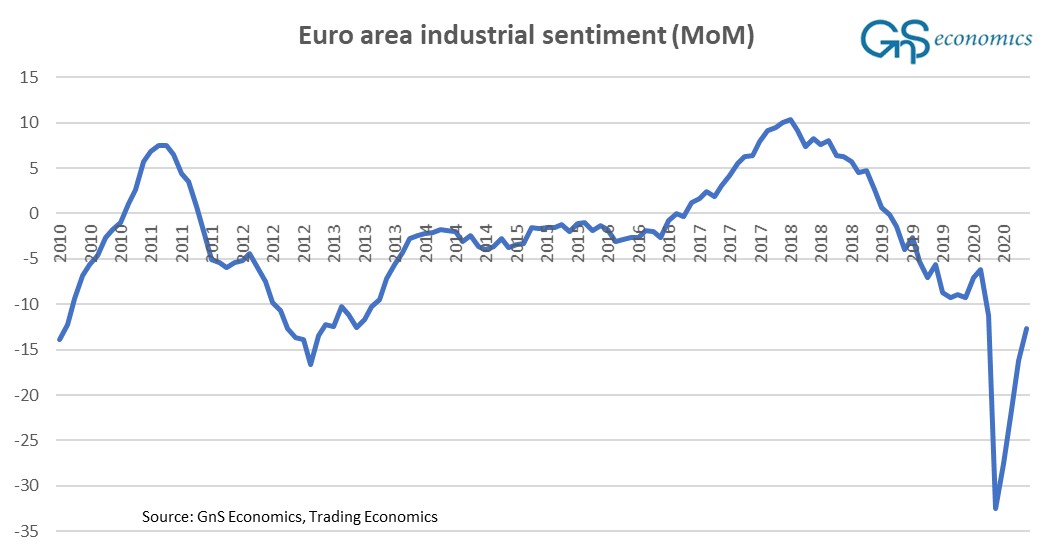

The industrial sentiment has collapsed in the Eurozone, and there's not quick recovery insight. This is no surprise, as the EZ fell into recession in Q4 2019.

This is very unwelcome for the banking sector of Europe teetering on the edge of collapse: https://gnseconomics.com/2020/05/22/the-approaching-european-global-banking-crisis/

8/

This is very unwelcome for the banking sector of Europe teetering on the edge of collapse: https://gnseconomics.com/2020/05/22/the-approaching-european-global-banking-crisis/

8/

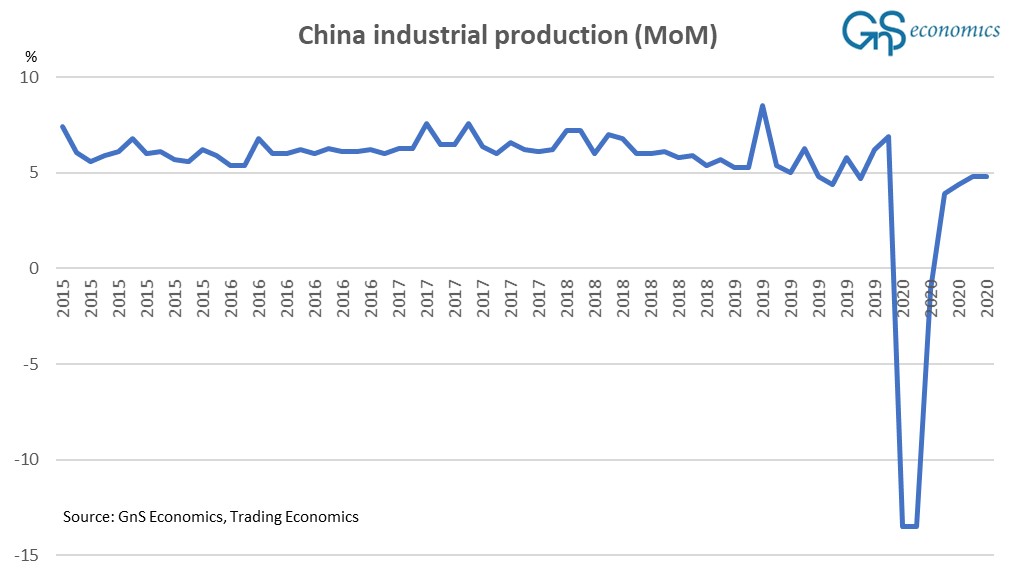

While the industrial production has returned to growth in #China , there has been no "bounce", and troubles in the banking sector are growing: https://twitter.com/GnSEconomics/status/1301432492138921986

China's economic recovery is fragile, at best. 9/

China's economic recovery is fragile, at best. 9/

So, there simply is no global economic recovery coming.

This does not bode well with the fragile European banking sector nor the over-levered and over-valued financial markets of the US.

We are bound to collapse.

/End

#brace #recession #stockmarkets https://gnseconomics.com/2020/08/28/the-fed-and-the-looming-capital-market-meltdown/

This does not bode well with the fragile European banking sector nor the over-levered and over-valued financial markets of the US.

We are bound to collapse.

/End

#brace #recession #stockmarkets https://gnseconomics.com/2020/08/28/the-fed-and-the-looming-capital-market-meltdown/

Read on Twitter

Read on Twitter