I count 10 announced SPACs that are relevant to the energy transition:

- Five EV OEMs (Nikola, Canoo, Hyliion, Lordstown, Fisker)

- Two LIDAR companies (Luminar, Velodyne)

- Two battery tech companies (Quantumscape, EOS)

- One additive mfg company (Desktop Metal)

- Five EV OEMs (Nikola, Canoo, Hyliion, Lordstown, Fisker)

- Two LIDAR companies (Luminar, Velodyne)

- Two battery tech companies (Quantumscape, EOS)

- One additive mfg company (Desktop Metal)

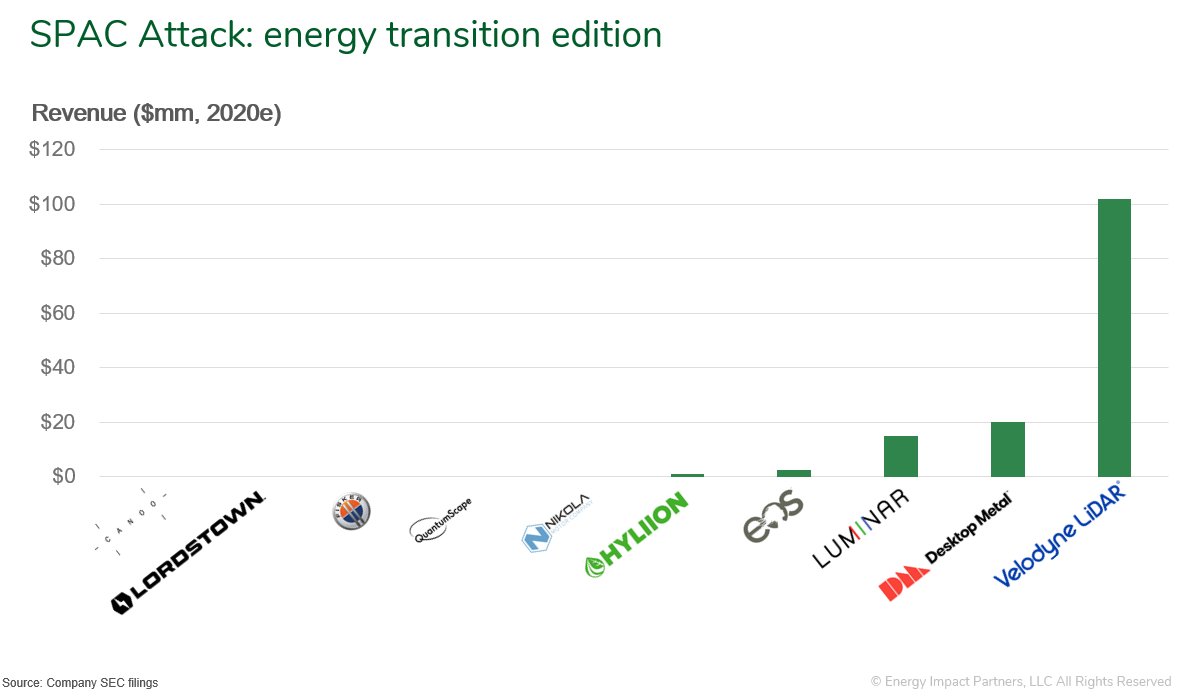

Five of the ten are pre-revenue. Of the rest, only one (Velodyne) has meaningful revenue expectations this year.

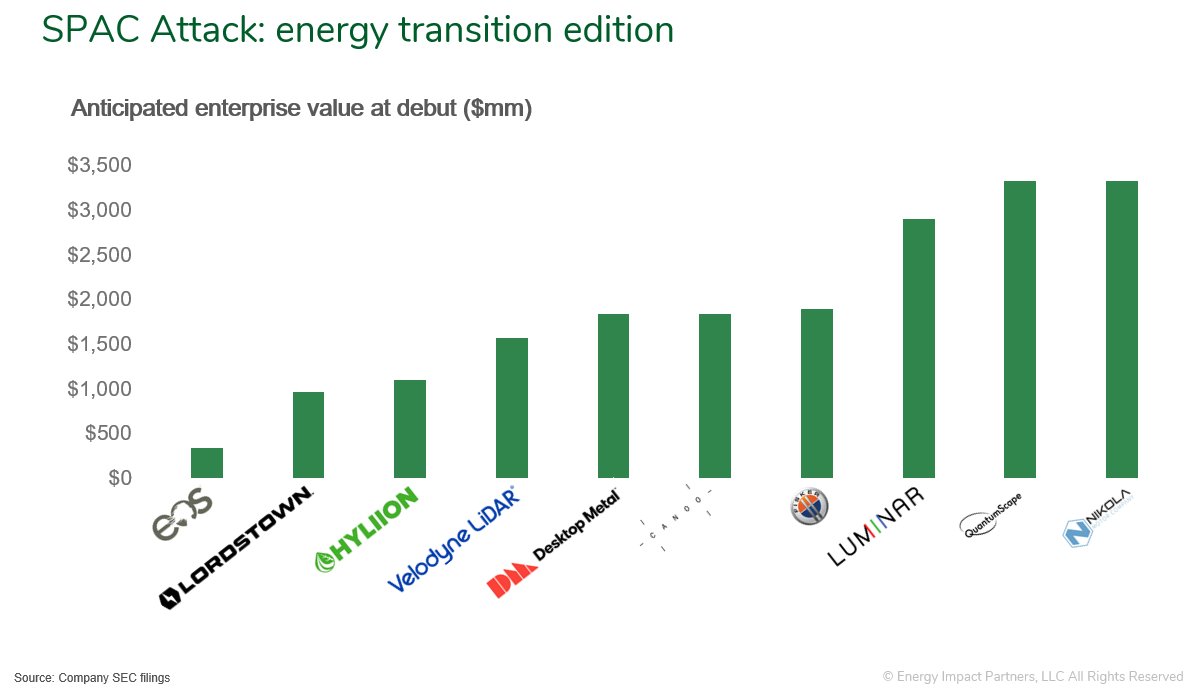

And yet, expected enterprise value upon closing ranges from $346m-$3.3bn, with a median of $1.8bn. All of them are selling investors on on a growth story.

And yet, expected enterprise value upon closing ranges from $346m-$3.3bn, with a median of $1.8bn. All of them are selling investors on on a growth story.

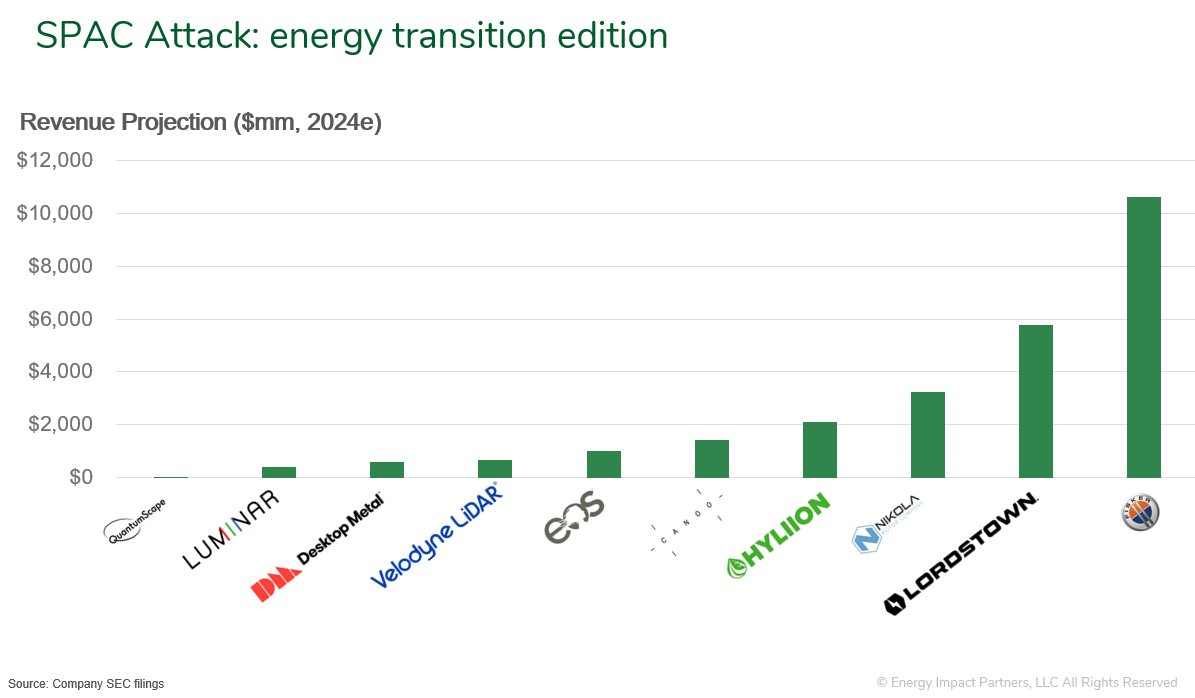

They're universally projecting a lot of growth. Apart from Quantumscape (which really hits the market in 2025), revenue projections for 2024 range from $418m (Luminar) to $10.6bn(!) (Fisker).

Here are the median stats for a SPAC-able company in this group:

- Has raised $250m in private markets.

- Last post-money valuation was $1.65bn.

- Will earn $1m in revenue in 2020 and lose $64m in EBITDA

- but expects to reach $1.2bn revenue and $149m EBITDA by 2024.

- Has raised $250m in private markets.

- Last post-money valuation was $1.65bn.

- Will earn $1m in revenue in 2020 and lose $64m in EBITDA

- but expects to reach $1.2bn revenue and $149m EBITDA by 2024.

Important to note: only one of these SPACs has been completed (Nikola). The rest are scheduled for sometime in 2020, so expect a Q4 #SPACattack.

Also important to note: each SPAC has a different lockup period for investors, generally in the range of 180-360 days post-debut, or earlier based on price triggers. So, depending on the market, the real test will come sometime in 2021.

Future SPACs may look different (and there are many more coming, to be sure). But takeaways based on this crop:

On paper they share many characteristics - compelling vision, big market, technology-heavy. Lots of capital raised, now claiming to be on the verge (i.e. next 1-4 years) of a commercial breakthrough and massive growth. But virtually all unproven

2 ways to look at this: 1) Struggling to raise more private capital, and w/ fatigued investors, Company X finds an escape hatch in the SPAC frenzy & prays the market holds up, or 2) Revolutionary, world-changing company finds better path to public markets than traditional IPO.

So it's left to public market investors (institutional or Robinhood) to pick and choose. There may well be another $TSLA in the group (e.g. Nikola is trading at >400% of its debut price). And there may well be another http://pets.com .

But for what it's worth, I'm excited for at least a few of these companies to get a big shock of cash on their balance sheets and, as a result, the runway to validate or disprove the non-believers. The world needs audacious climate solutions.

Read on Twitter

Read on Twitter