Recently @fintechfrank at @TheBlock__ uncovered a dispute between @gnosisPM & @arca. Here is our official response:

https://www.ar.ca/blog/understanding-arcas-request-for-change-at-gnosis

Add’l thread including an overview of our concerns w/ $GNO & answers to many questions from the Gnosis community

https://www.ar.ca/blog/understanding-arcas-request-for-change-at-gnosis

Add’l thread including an overview of our concerns w/ $GNO & answers to many questions from the Gnosis community

1/ We are long $GNO. We believe that @koeppelmann, @StefanDGeorge, and the rest of the @gnosisPM team are strong builders.

However, GNO trades well below its book value. This is something that should never happen in a high growth industry such as digital assets.

However, GNO trades well below its book value. This is something that should never happen in a high growth industry such as digital assets.

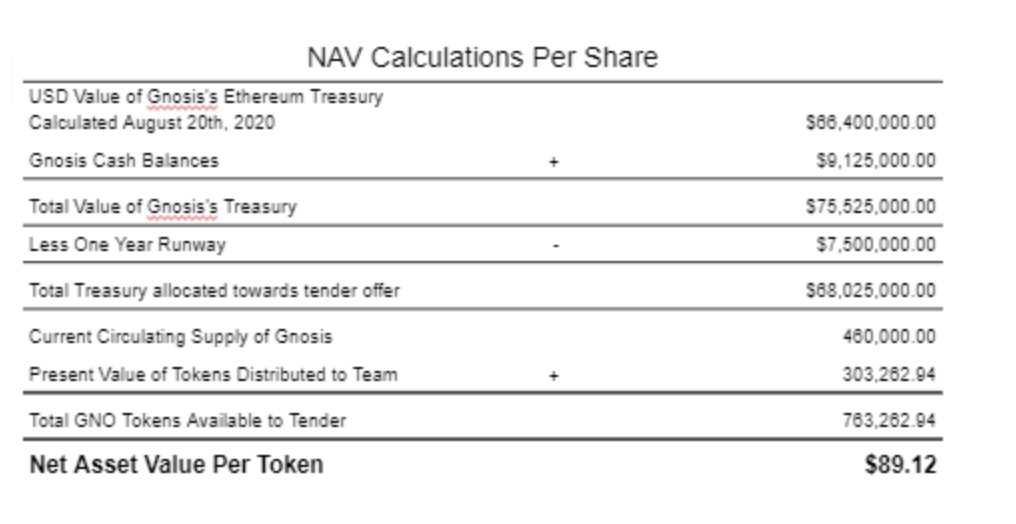

2/ The NAV of Gnosis’ treasury, currently worth $139 per $GNO token, is the absolute minimum GNO should ever trades. The floor has been set! Every $0.01 below this value is a direct message from token holders to Gnosis that they don't believe you can generate an ROI on that cash

3/ Per our deck, we believe this mispricing is due to a series of missteps by Gnosis.

First, the ICO: ~95% of tokens are held by the Gnosis team. This disenfranchises their community (the MOST important part of any digital asset project) and carries constant risk of dilution.

First, the ICO: ~95% of tokens are held by the Gnosis team. This disenfranchises their community (the MOST important part of any digital asset project) and carries constant risk of dilution.

4/ Second, a failure to drive real volumes to their products. Almost all volumes on Gnosis Protocol have come through IDOs, not daily trading volumes.

5/ The most glaring misstep is their finances. With ~$0 in revenue & 65 employees, Gnosis has an egregiously high $7.5mm yearly cash burn, partially due to investments in other tokens, & participation in ICOs. Gnosis has also been yield farming $COMP, $BAL, $CRV, and $SUSHI.

6/ None of these ICO investments or yield farming hobbies have been made public by Gnosis. When the community loaned Gnosis money 3+ years ago to build their prediction market, this is not what they expected.

These additional risks should not be borne by token holders.

These additional risks should not be borne by token holders.

7/ This is why $GNO trades so far below book value:

- lack of governance

- lack of transparency

- constant risk of dilution

- no value flow or accrual to token holders (only to equity holders - Gnosis & Consensys)

- And no detailed plan moving forward

- lack of governance

- lack of transparency

- constant risk of dilution

- no value flow or accrual to token holders (only to equity holders - Gnosis & Consensys)

- And no detailed plan moving forward

8/ In June, we proposed to Gnosis that they tender for outstanding tokens at slightly less than NAV, reserving 1 year of runway to run their business uninterrupted, and a very generous distribution of cash proceeds to team members. This price was $89.12 per token at the time.

9/ We believe that Gnosis has a fiduciary responsibility to token holders, and that a tender offer would be the highest ROI made available for token holders since the team has not created value for $GNO, and has released no details for creating a better plan.

10/ This also offers flexibility for Gnosis. Those who do not tender should receive a 10-for-1 token split allowing Gnosis to finally distribute more of their tokens w/out dilution. This would allow Gnosis to begin rebuilding their lost community, & may save Gnosis some money.

11/ This also un-tethers Gnosis from the current $GNO/$OWL tokenomics, which needs to be revised in order for value to flow to $GNO token holders.

12/ If Gnosis chooses not to tender for $GNO, they need to immediately outline a plan that will deliver a higher return than token holders would receive through returning balance sheet assets via the tender. If they can do this, the token would likely trade much higher than NAV.

13/ This plan should be immediately made public and allow for participation and revision by $GNO token holders.

If this is done, Arca will immediately pull our tender offer proposal. We look forward to participating in these discussions should they ever happen.

If this is done, Arca will immediately pull our tender offer proposal. We look forward to participating in these discussions should they ever happen.

14/ We are not anti-Gnosis -- we are long $GNO. Our interactions w/ @koeppelmann have been courteous and professional. These are good people trying to do good work, & we applaud their recent efforts to engage their community.

This was not an attack; it was a wake-up call.

This was not an attack; it was a wake-up call.

15/ However, we believe in fiduciary responsibility and transparency for token holders, not just from Gnosis, but from all projects that have issued tokens in this emerging asset class.

16/ We must all hold each other accountable and to the highest standards for digital assets to succeed.

The rest of this thread will be responses to questions and comments we have seen since The Block article was released

The rest of this thread will be responses to questions and comments we have seen since The Block article was released

17/ We have no interest in shutting Gnosis down. Our plan includes a VERY generous payout package to employees, while keeping management, their equity, & a long financial runway in place.

Run your business, but please don't ignore token holders https://twitter.com/StefanDGeorge/status/1301590135033692161

Run your business, but please don't ignore token holders https://twitter.com/StefanDGeorge/status/1301590135033692161

18/ “We are builders" does not excuse lack of transparency and lack of fiduciary responsibility.

Building, creating value, and providing transparency are not mutually exclusive. https://twitter.com/StefanDGeorge/status/1301590132995371009

Building, creating value, and providing transparency are not mutually exclusive. https://twitter.com/StefanDGeorge/status/1301590132995371009

19/ Straw man argument @koeppelmann. Instead of focusing on the rationale for why we approached Gnosis, we (and other $GNO token holders) would like you to focus on the facts and address the actual problem.

We have outlined our proposal - it is time for Gnosis to do the same.

We have outlined our proposal - it is time for Gnosis to do the same.

20/ Per the above, the key to running a hedge fund is providing transparency to our investors and passing through returns directly to them.

Gnosis, instead, haphazardly and secretly traded its Treasury for profit and none of this flowed back to GNO holders.

Gnosis, instead, haphazardly and secretly traded its Treasury for profit and none of this flowed back to GNO holders.

21/ It’s been 3 months since we engaged Gnosis, recommending change. Yet the first time we're hearing about redoing the tokenomics is in a public forum? Out of 65 employees, who is assigned to Investor/Token Relations? https://twitter.com/koeppelmann/status/1301835969008668672?s=20

22/ We agree @cryptoanuran. Gnosis has made contributions to the ecosystem, but they should also acknowledge that their token provides no utility -- pay $GNO token holders back, or work with your token holders to develop a plan to fix the token model. https://twitter.com/cryptoanuran/status/1301566614387568641?s=20

23/ Dissolving & repaying the $GNO token would offer Gnosis flexibility to improve.

https://twitter.com/papa_raw/status/1301582210651361280

@koeppelmann has acknowledged Gnosis products are "more of a contribution to the ecosystem" rather than contributions to $GNO token holders: https://twitter.com/koeppelmann/status/1060931961039020033?s=20

https://twitter.com/papa_raw/status/1301582210651361280

@koeppelmann has acknowledged Gnosis products are "more of a contribution to the ecosystem" rather than contributions to $GNO token holders: https://twitter.com/koeppelmann/status/1060931961039020033?s=20

Continued here: https://twitter.com/jdorman81/status/1303417560327569408

Read on Twitter

Read on Twitter