Thread about liquidity mining, reusability of debt, and how it is all connected to inflated prices of defi tokens.

$YFI, $SNX, $UMA, $CRV

$YFI, $SNX, $UMA, $CRV

Historically when people explore new ways to exchange value, eg. creating equity and debt markets they began to exploit the system to make a profit while everything is going up. And the best way for markets to continue to go up is through debt.

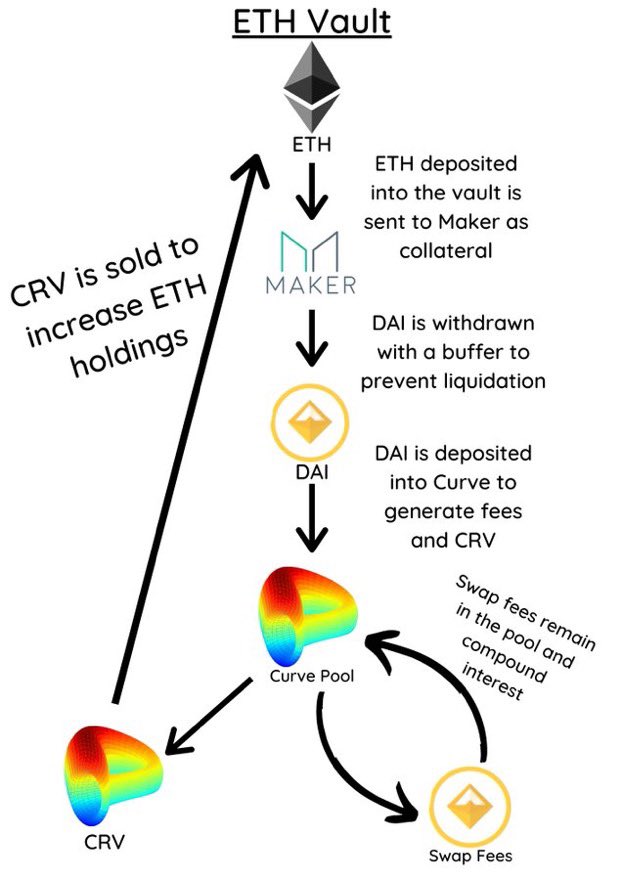

Let's look at the first simple example to farm $CRV with $ETH through @iearnfinance. A simplified visual scheme of what is happening under the hood was made by @DeFi_Dad

As you can see there on the first step liquidity mining creates buying pressure for ETH, then ETH leveraged up to mine CRV, which is sold to get more ETH, and mine more CRV. It’s close to what I described in December here. https://twitter.com/stangulchenko/status/1217861760079794179?s=21

Liquidity mining is happening not only with ETH, it is happening primarily with other assets and in the process inflates them as well. But, things become more interesting with liquidity provider tokens that you get in exchange for the asset you provided to the protocol.

Let’s see an example of providing sUSD to Curve. When you are providing sUSD you will get in exchange the LP token called sUSDv2. But what if I tell you that you can mine with sUSDv2 also $BASED or other awesome tokens?

Practically with the same amount of collateral miners can earn several different tokens. Such liquidity mining scheme with the reusability of collateral is happening all over the place, which leads to even more buying pressure for tokens which are used to get LP tokens as sUSDv2.

In the case of sUSD it leads to growth in price of $SNX token, because sUSD in itself is debt created for with SNX token as collateral. If the scheme above was complicated to grasp, from here things began to grow exponentially more complex.

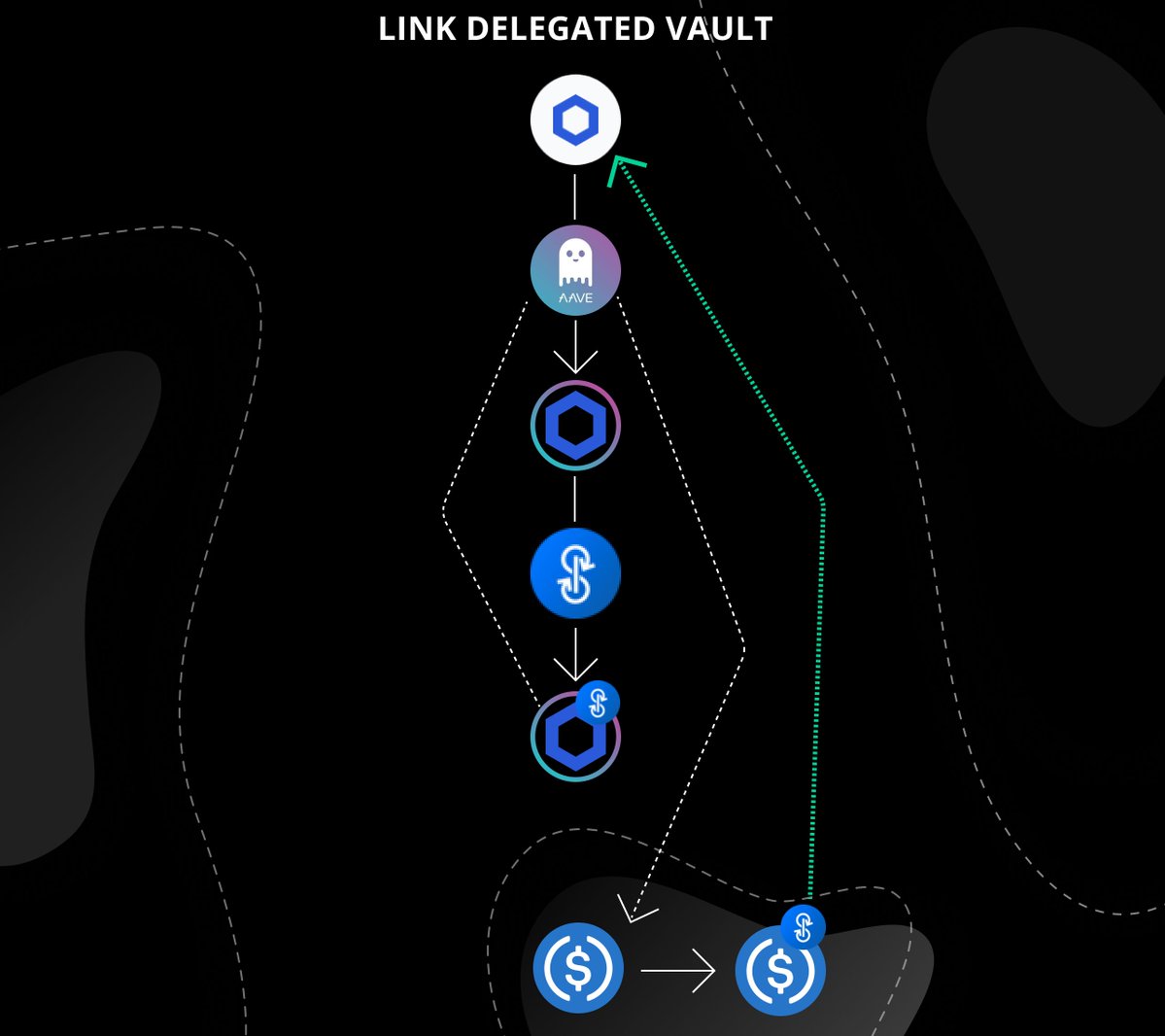

Because to get liquidity in the first place liquidity providers can use lending platforms as @AaveAave to take debt based on other LP tokens that they might have from providing liquidity to @UniswapProtocol pools. @shvandrew https://cointelegraph.com/news/crypto-users-could-soon-receive-interest-from-two-defi-protocols-at-once

I was looking at ways how the most lucrative liquidity mining schemes already generating profits and they are basically highly leveraged positions on bad collateral as LP tokens which are used in several places simultaneously.

So why all these protocols even do that? The answer is TVL, it’s the simplest metric to judge protocol success in Defi, as the higher TVL protocol has, the more fees protocol will be able to amass and share with token holders, therefore its market capitalization should go higher.

The prices of token rise, liquidity provider can get more debt for less collateral, mine more new tokens, and the cycle repeats.

The most dangerous thing now you don’t need to participate in liquidity mining to be exposed to underling risks, in just 2 months it’s already spread like fire everywhere in the Ethereum ecosystem.

It will take just a little before platforms will hook up to Yearn finance and make it incredibly easy for the average person to earn huge ROI with no understanding of any risks. Take for example aggregator as http://Zapper.fi and add a highly opportunistic team to it.

My worries here is that Ponzis as Bitconnect and OneCoin are what the average person can’t resist, the combination of crypto and high returns just clicks for retail investors. But if they are justified by the complexity that retail can’t understand you get an explosive Ponzi.

It was hard for outsiders to understand what is happening in 2017 crypto, it will be impossible for the average person to understand crypto 2020–2021.

How can we prevent this explosive growth through leveraged debt and following the bust of the bubble? I don’t think we can at this point, greed is too big, systems are too complex. The best thing we can do is to disclose as much as we can about risks and educate people.

The next frontier is to make insurance products work. Interestingly, insurance is usually playing a huge role in economic bubbles, I believe it will also have a sizable part in the growth of Defi. But the role of insurance and how it to do in a safe way will be in other thread.

If it was interesting to you, you can read full essay here. https://medium.com/@stangulchenko/how-the-new-crypto-cycle-begins-2b7df8996c44

Read on Twitter

Read on Twitter