1/x

Turkey is having a tough year with Covid-19 leaving less room for policy mistakes.

Turkey is having a tough year with Covid-19 leaving less room for policy mistakes.

Here's a quick X-ray in context.

1) Growth: Less hit on the economy; 2Q20 was better than major emerging & developed peers.

But % growth is usually not a problem for Turkey.

Turkey is having a tough year with Covid-19 leaving less room for policy mistakes.

Turkey is having a tough year with Covid-19 leaving less room for policy mistakes.Here's a quick X-ray in context.

1) Growth: Less hit on the economy; 2Q20 was better than major emerging & developed peers.

But % growth is usually not a problem for Turkey.

2/x

Problem is usually how Turkey grows. Is it productivity gains, value added, capital investments; fat or muscle?

Well, a long discussion. But the big push for credit (ie. sugar rush) that accelerated credit growth momentum up to 50-80% levels definitely helped.

Problem is usually how Turkey grows. Is it productivity gains, value added, capital investments; fat or muscle?

Well, a long discussion. But the big push for credit (ie. sugar rush) that accelerated credit growth momentum up to 50-80% levels definitely helped.

3/x

But sugar rush is never good. The credit push once again led to an increase (or prevented a decline) in imports - will elaborate shortly.

2) Government finances: The momentum is definitely no good, but remains as one of stronger aspects of the Turkish economy +++

But sugar rush is never good. The credit push once again led to an increase (or prevented a decline) in imports - will elaborate shortly.

2) Government finances: The momentum is definitely no good, but remains as one of stronger aspects of the Turkish economy +++

4/x

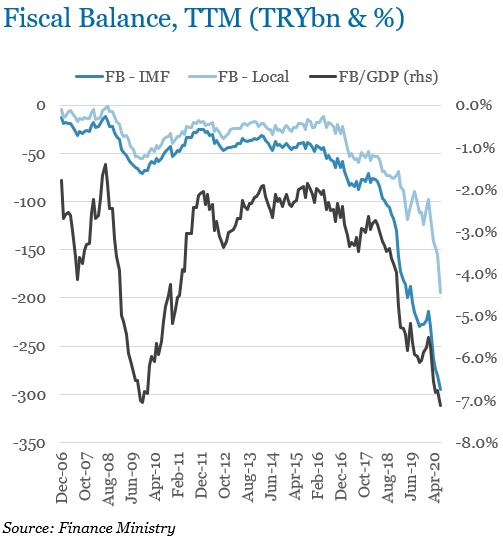

One hand, budget deficit is skyrocketing especially assuming IMF definition (ie. removing some one-off rev's).

Another hand, debt/GDP still lower than majority of emerging peers, reaching only to 40% even assuming a 5% deficit in 20. Many EM peers will see a 5-15% deficit.

One hand, budget deficit is skyrocketing especially assuming IMF definition (ie. removing some one-off rev's).

Another hand, debt/GDP still lower than majority of emerging peers, reaching only to 40% even assuming a 5% deficit in 20. Many EM peers will see a 5-15% deficit.

5/x

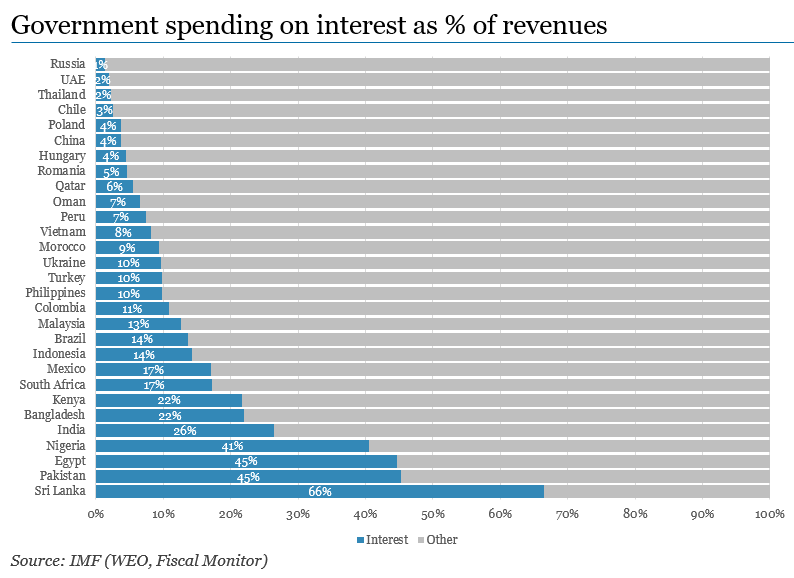

In context, government spending on interest as % of revenues still lower than peers despite significantly higher interest Turkey pays.

In context, government spending on interest as % of revenues still lower than peers despite significantly higher interest Turkey pays.

6/x

3) Currency: This is where trouble starts.

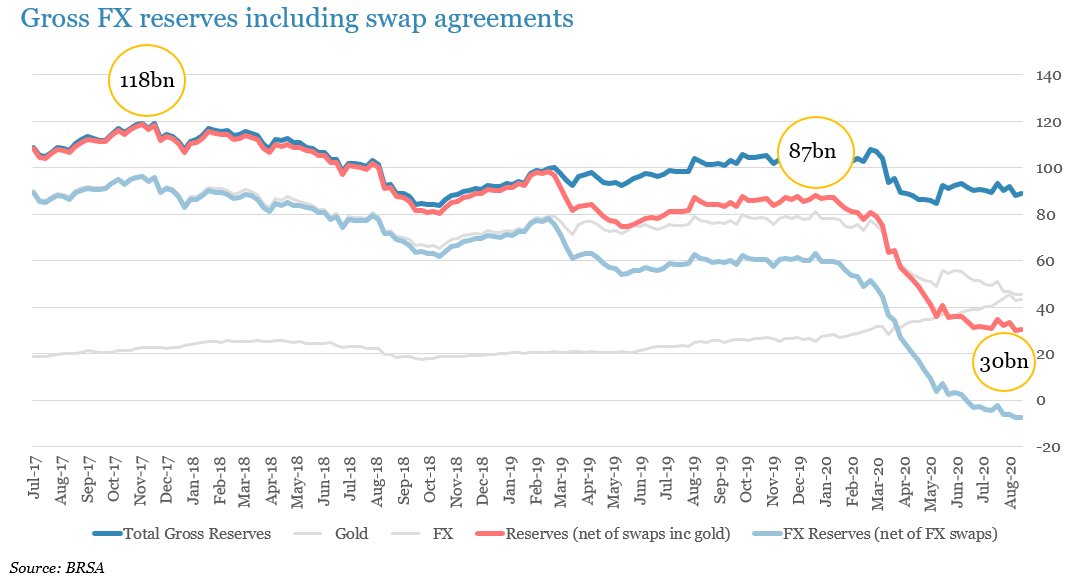

Four major sources of demand for Dollars in Turkey this year led to the CB losing some USD 60-65bn FX reserves, net of swaps, so far this year.

3) Currency: This is where trouble starts.

Four major sources of demand for Dollars in Turkey this year led to the CB losing some USD 60-65bn FX reserves, net of swaps, so far this year.

7/x

This demand for FX was driven primarily by

1. Demand for imports: Turks buying raw materials, importing energy, renewing mobile phones and driving German cars.

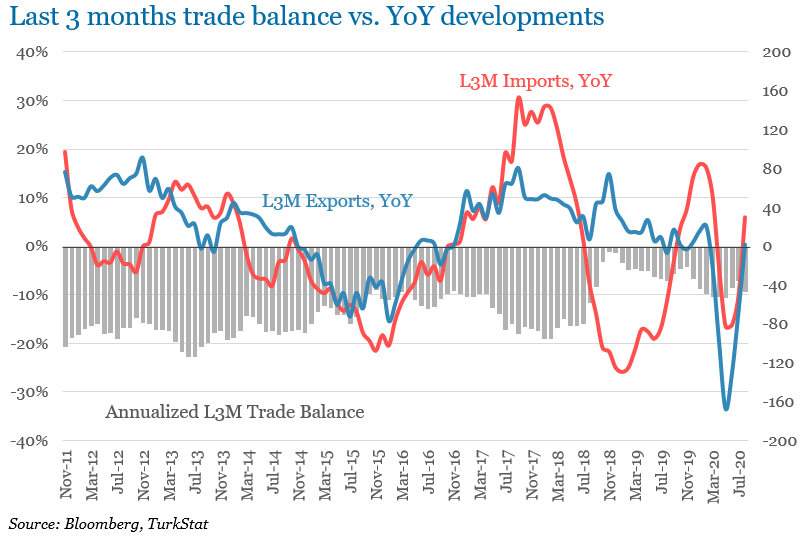

Triggered by a significant credit expansion, trade deficit began to increase already during early 2020.

This demand for FX was driven primarily by

1. Demand for imports: Turks buying raw materials, importing energy, renewing mobile phones and driving German cars.

Triggered by a significant credit expansion, trade deficit began to increase already during early 2020.

8/x

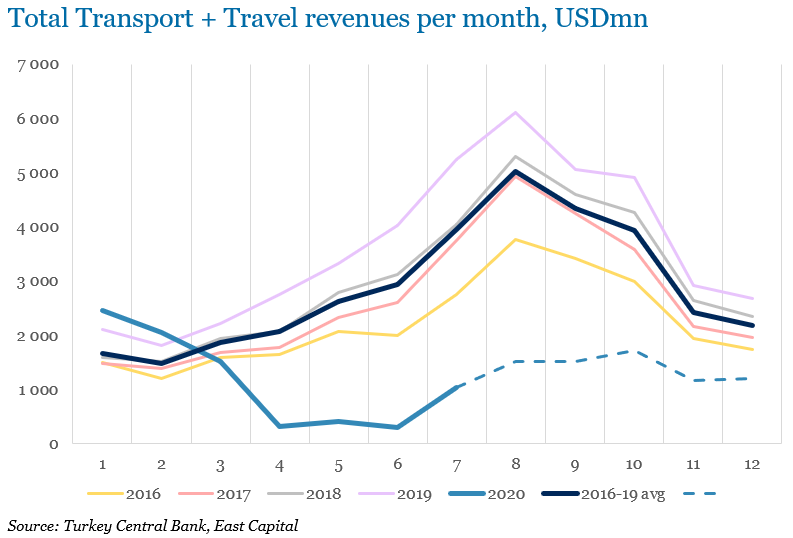

But lack of tourism revenues for a summer tourism country such as Turkey made things much, much worse.

Turkey has so far lost out on some USD 19bn of FX inflows from travel + transport due to Covid-19.

Full year, the unrealized FX revs might reach USD 28bn, combined T&T.

But lack of tourism revenues for a summer tourism country such as Turkey made things much, much worse.

Turkey has so far lost out on some USD 19bn of FX inflows from travel + transport due to Covid-19.

Full year, the unrealized FX revs might reach USD 28bn, combined T&T.

9/x

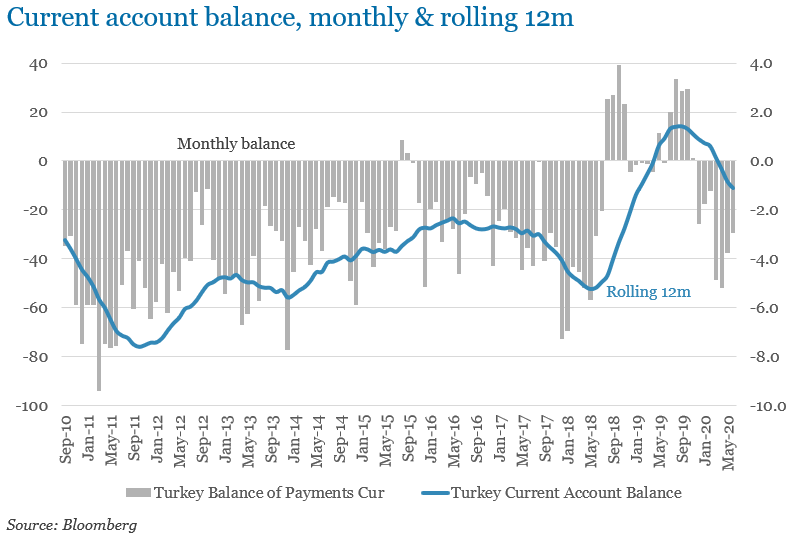

The outcome is that current account deficit will be much higher than it'd otherwise be: partially due to aggressive credit expansion (could've been controlled), partially on tourism (simply unlucky).

YtD current account deficit implied some USD 20-22bn demand for Dollars.

The outcome is that current account deficit will be much higher than it'd otherwise be: partially due to aggressive credit expansion (could've been controlled), partially on tourism (simply unlucky).

YtD current account deficit implied some USD 20-22bn demand for Dollars.

10/x

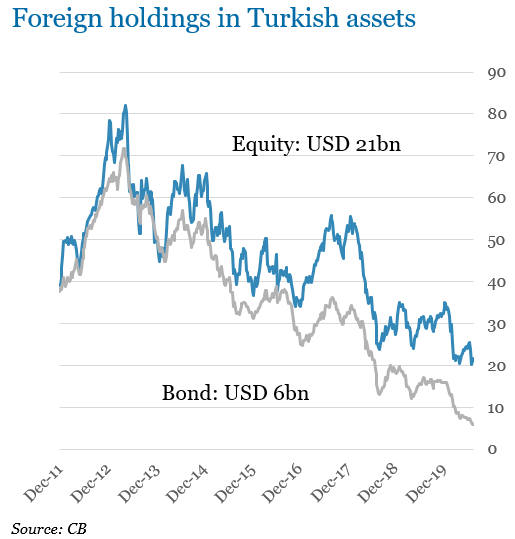

2. Foreign repatriation: another large source of demand for Dollars, foreigners pulled USD 13.5bn out of the market so far this year.

Foreign holdings in Turkish assets now down from ~ USD 150bn in 2013 to only USD 27bn. Foreign investors now practically out.

2. Foreign repatriation: another large source of demand for Dollars, foreigners pulled USD 13.5bn out of the market so far this year.

Foreign holdings in Turkish assets now down from ~ USD 150bn in 2013 to only USD 27bn. Foreign investors now practically out.

11/x

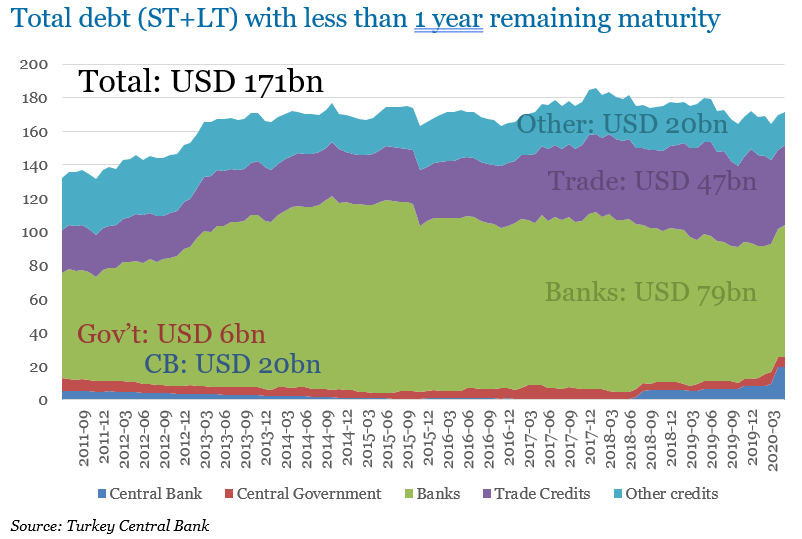

3. Debt repayments: Total ST debt been ~USD 170bn . Even though lots of details, one can assume a high rollover of 80-90%.

USD 14bn/month to rollover at a high rate, debt repayments would make some USD 1.5-2bn a month, or USD 12-14bn demand for Dollars ytd.

3. Debt repayments: Total ST debt been ~USD 170bn . Even though lots of details, one can assume a high rollover of 80-90%.

USD 14bn/month to rollover at a high rate, debt repayments would make some USD 1.5-2bn a month, or USD 12-14bn demand for Dollars ytd.

12/x

4. Finally, locals... : Locals rushed to gold, adding USD 21bn to their bank deposits. This demand was probably the most unexpected and strongest of all.

As a result, Lira is the second weakest EM currency, losing 20.5% vs. USD so far this year.

4. Finally, locals... : Locals rushed to gold, adding USD 21bn to their bank deposits. This demand was probably the most unexpected and strongest of all.

As a result, Lira is the second weakest EM currency, losing 20.5% vs. USD so far this year.

13/x

Reversing this trend will not be easy in an environment where market participants show zero tolerance to policy mistakes due to Covid-19 stress (EM-context) and given lack of tourism $$$ (Turkish context).

Reversing this trend will not be easy in an environment where market participants show zero tolerance to policy mistakes due to Covid-19 stress (EM-context) and given lack of tourism $$$ (Turkish context).

14/14

Going forward,

1) Imports/CA: less imports on weaker Lira and increasing taxes

2) Foreign outflows: likely ease bcs foreigners have simply no money left

3) Debt repayments: continue, but foreseeable & rolling over

4) Local demand: KEY to determine what happens to Lira

Going forward,

1) Imports/CA: less imports on weaker Lira and increasing taxes

2) Foreign outflows: likely ease bcs foreigners have simply no money left

3) Debt repayments: continue, but foreseeable & rolling over

4) Local demand: KEY to determine what happens to Lira

Read on Twitter

Read on Twitter