Last week, Ant Group (the company behind Alipay) filed for potentially the largest IPO ever.

If that doesn't make you listen, consider that in 2019, Alipay's payment volume was $16 trillion -- that's 12% more than China's GDP.

What's the deal with Alipay?

A (long) thread

If that doesn't make you listen, consider that in 2019, Alipay's payment volume was $16 trillion -- that's 12% more than China's GDP.

What's the deal with Alipay?

A (long) thread

Let's start with a timeline of events.

Until 2011, Ant Group (or back then, simply Alipay) was part of Alibaba, China's largest e-commerce company.

Alibaba created the Alipay in 2003 to build trust between sellers and buyers, similar to how PayPal was key to Ebay's growth.

Until 2011, Ant Group (or back then, simply Alipay) was part of Alibaba, China's largest e-commerce company.

Alibaba created the Alipay in 2003 to build trust between sellers and buyers, similar to how PayPal was key to Ebay's growth.

For the years to come, Alipay primarily was online payment service, holding payments in escrow until a buyer received his or her purchase.

In 2009, Alipay launched its first mobile payments app.

In 2010, Alibaba started to use Alipay to facilitate loans for Alibaba merchants.

In 2009, Alipay launched its first mobile payments app.

In 2010, Alibaba started to use Alipay to facilitate loans for Alibaba merchants.

In 2011, Alibaba spun off Alipay.

Why?

In 2010, the Chinese central bank (PBOC) issued new regulations requiring non-bank payment companies to obtain a license in order to operate in China and said it would clarify rules for foreign companies later.

Why?

In 2010, the Chinese central bank (PBOC) issued new regulations requiring non-bank payment companies to obtain a license in order to operate in China and said it would clarify rules for foreign companies later.

Alibaba (including Alipay) incorporated itself offshore and therefore was a forge in company. According to Alibaba, it was therefore necessary to spin off Alipay in order to apply for and receive the new payments license for Alipay as a Chinese non-bank payments company.

Yahoo (owning 43% of Alibaba at the time) said it was not informed of the spin off and was not very pleased by it. The spin off was structured so that Alibaba owned 37.5% of Alipay, received 49.9% of pretax income. Alipay remained controlled by Jack Ma.

It's interesting to note that Tencent (the parent company of Tenpay/WeChat Pay) also was registered as a foreign company but did not spin off Tenpay, still Tenpay was able to continue operations in 2011.

Bottom line, Alibaba and Ma were very aware of the asset they had in Alipay.

Bottom line, Alibaba and Ma were very aware of the asset they had in Alipay.

In 2011, received the electronic payment license from China’s central bank. It allowed Alipay to handle foreign exchange transactions, mobile payments, debit card services and other financial services. https://www.reuters.com/article/us-alipay/alipay-gets-licence-to-set-up-e-payment-system-idUSTRE74P26120110526

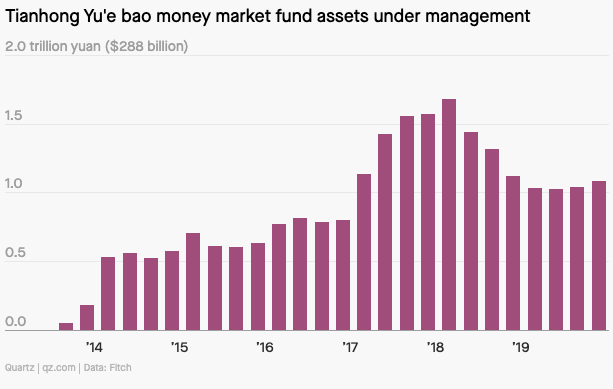

Fast forward to 2013. Alipay started its foray into what Ant today calls 'InvestmentTech'. Alipay acquired 51% of Tianhong Asset Management and launched Yu e Bao later.

Alipay payed $193 million for the stake. In 2019, Alipay's InvestmentTech revenues were close to $2 billion.

Alipay payed $193 million for the stake. In 2019, Alipay's InvestmentTech revenues were close to $2 billion.

The Yu E Bao fund enabled Alipay users to invest small sums, as little as 1 yuan ($0.15). Kind of like the original fraction share trading now offered by Cash App, Robinhood, Public and others. Yu E Bao attracted 2.5 million customers and raised $1 billion in the first 18 days.

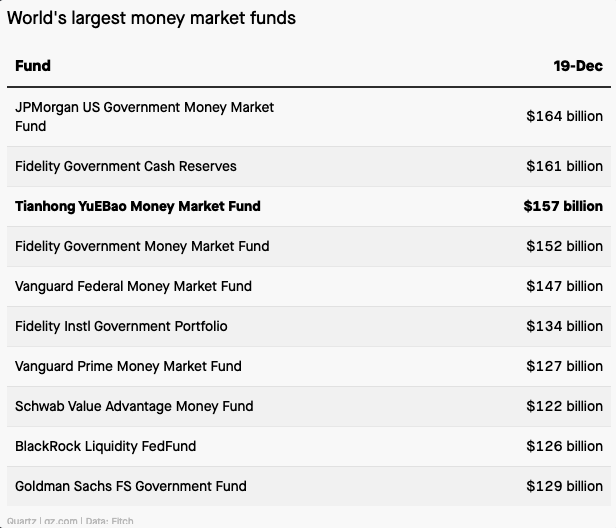

In 2017, Yu E Bao became the largest money market fund in the world with $165b under management, overtaking JPMorgan’s US government money market fund with $150b. In 2018, the fund climbed to $268b. In 2017 though, regulators started to tighten regulations given the funds' size.

Users daily and total subscriptions got capped, limits on lower quality assets and requirements to hold more liquid assets got put into place, resulting in the AUM to drop. Yu’e Bao was reportedly called a “blood-sucking vampire” by a commentator on state-run television.

As of 2019, Yu E Bao still was in the top three largest money market funds globally. This Quartz article offers more insight: https://qz.com/1791778/ant-financials-yue-bao-is-no-longer-the-worlds-biggest-money-market-fund/

In 2014, Alipay changed its name to Ant Financial, symbolizing the shift from the payment service tied to Alibaba to a financial services platform. The name Ant was chosen to 'symbolize the strength of a number of smaller brands working together' -the marketplace Alipay is today.

"Ant Financial executives outlined a vision of turning its mobile payment app into a full-fledged, data-driven commercial platform".

That's the Digital Wallet Alipay is today. https://www.reuters.com/article/us-china-alibaba/alibaba-affiliate-alipay-rebranded-ant-in-new-financial-services-push-idUSKCN0I50KJ20141016

That's the Digital Wallet Alipay is today. https://www.reuters.com/article/us-china-alibaba/alibaba-affiliate-alipay-rebranded-ant-in-new-financial-services-push-idUSKCN0I50KJ20141016

In 2018, Ant went even further and said that “The idea is people are living their lives through this platform".

As we'll see further down below, that's actually somewhat true.

Back to 2014. Alipay associated MYBank (Ant owns 30% of) received approval from Chinese regulators.

As we'll see further down below, that's actually somewhat true.

Back to 2014. Alipay associated MYBank (Ant owns 30% of) received approval from Chinese regulators.

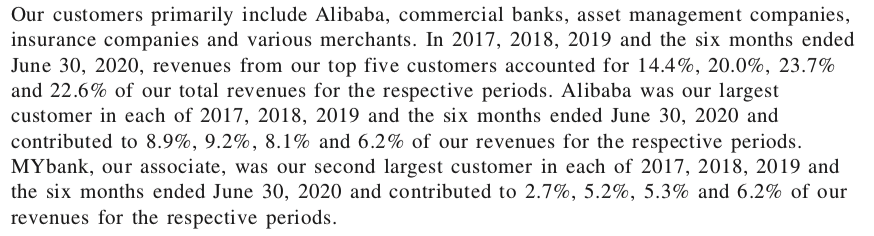

Much of Alipay's lending today is facilitated by MYBank. According to Ant's IPO prospectus, MYBank is Alipay's second largest customer and contributed 6.2% of total revenues in the first six months of 2020. Unsurprisingly, Alibaba is Ant's largest customer.

In 2015, Ant launched Sesame Credit, a credit scoring system vital to the coming success of its lending products.

"Sesame Credit will collect data from 300m individual users and 37m small businesses that buy and sell on Alibaba platforms" https://www.ft.com/content/34e77fe8-a6a3-11e4-9bd3-00144feab7de

"Sesame Credit will collect data from 300m individual users and 37m small businesses that buy and sell on Alibaba platforms" https://www.ft.com/content/34e77fe8-a6a3-11e4-9bd3-00144feab7de

In 2016, Alipay entered the red envelope game, virtual items containing cash or coupons users can send each other via the Alipay app. Virtual Red envelopes kickstarted WeChat Pay's growth in 2014, adding ten of millions of users to WeChat Pay in weeks.

https://www.chinadaily.com.cn/business/2016-01/08/content_22988494.htm

https://www.chinadaily.com.cn/business/2016-01/08/content_22988494.htm

In 2018, both Alipay and WeChat Pay took a small hit as regulators restricted them from earning interest on stored user balances. Tencent earned 2% of its total revenues in 2017 from interest. https://www.ft.com/content/b472f73c-859e-11e8-96dd-fa565ec55929

In 2020, Ant Financial changed its name to Ant Technology but wants to be referred to as Ant Group, as it looks to be viewed as "an innovative global technology provider", according to an Ant spokesperson.

https://www.spglobal.com/marketintelligence/en/news-insights/podcasts/street-talk-episode-65

https://www.spglobal.com/marketintelligence/en/news-insights/podcasts/street-talk-episode-65

Where does Ant stand today?

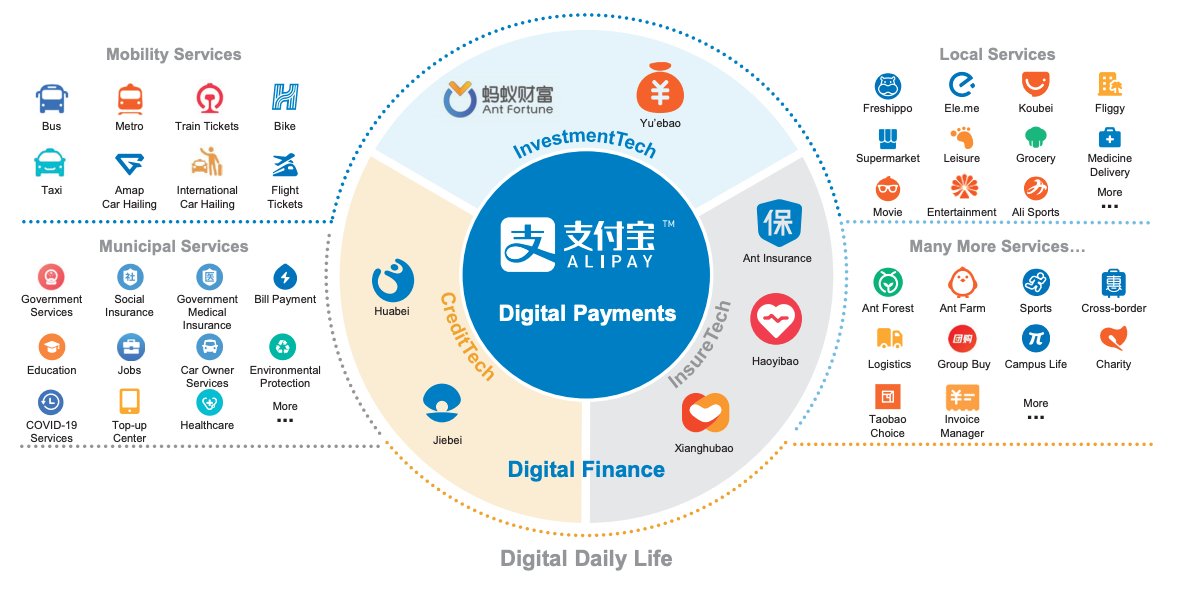

As laid out above, Alipay transformed from a escrow payment service to a full-fledged Digital Wallet, offering 5 core services:

- Payments

- Wealth Management

- Micro Financing

- Insurance

- Credit Service

As laid out above, Alipay transformed from a escrow payment service to a full-fledged Digital Wallet, offering 5 core services:

- Payments

- Wealth Management

- Micro Financing

- Insurance

- Credit Service

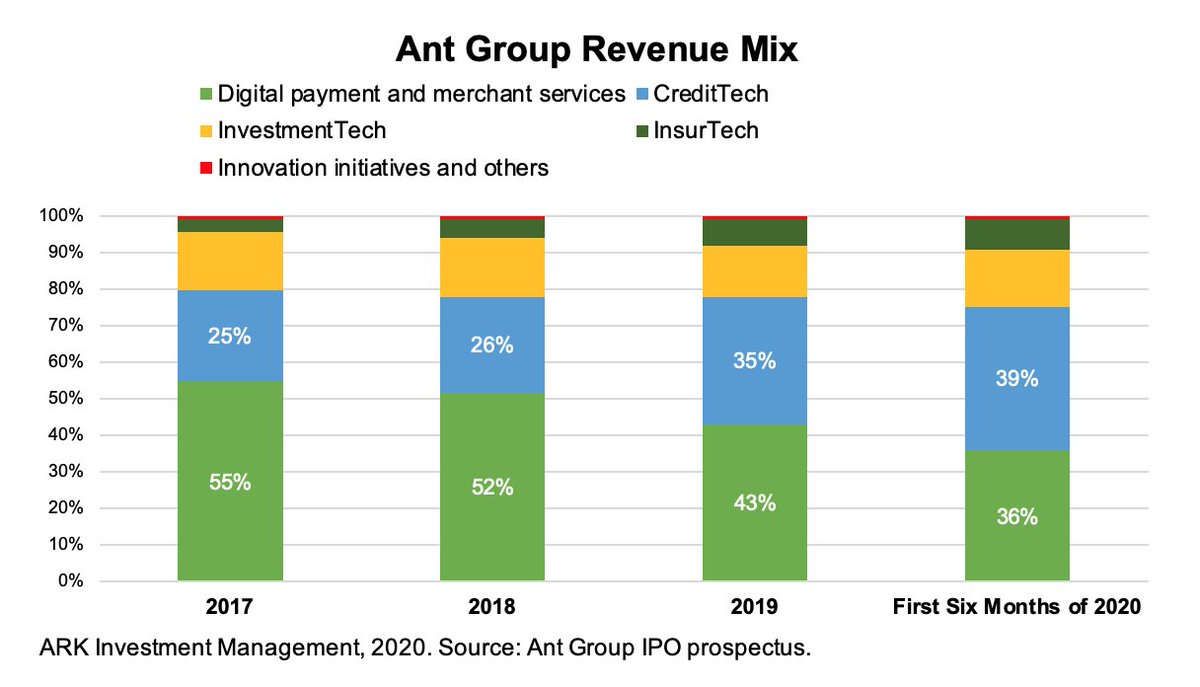

Ant breaks down the five segments into four revenue streams:

- Digital payment and merchant services

- CreditTech

- InvestmentTech

- InsurTech

Plus bundles other initiatives in

- Innovation initiatives and others

The graphic below does a good job of showing Alipay's scale:

- Digital payment and merchant services

- CreditTech

- InvestmentTech

- InsurTech

Plus bundles other initiatives in

- Innovation initiatives and others

The graphic below does a good job of showing Alipay's scale:

A testament to Alipay being a diversified Digital Wallet, payment revenue only represented 36% of revenues in the first 6 months of 2020, down from 55% in 2017. Meanwhile, lending grew from 25% to 39%. Likely part of the reason why Ant grew GM from 50% in 2019 to 59% in 2020.

Stichting together threads. Please continue reading here: https://twitter.com/mfriedrichARK/status/1300791632678334465

Read on Twitter

Read on Twitter