Fountaine Pajot ($ALFPC.PA)

French microcap selling catamarans worldwide (sails+motors)

High growth, high ROE, but very low multiples?

It seems the market does not like the combination cyclical+seasonal & covid19. Could be a chance..

Quick overview

French microcap selling catamarans worldwide (sails+motors)

High growth, high ROE, but very low multiples?

It seems the market does not like the combination cyclical+seasonal & covid19. Could be a chance..

Quick overview

$ALFPC

Price 66E

MCap 110M

PB 2.45

PCF 3.87

PS 0.49

PE 7.22

Cash 57M

Debt 43.5M (+other and deposits)

TTM

Rev 223M

NI 13M

ROE 29%

H1 NI 3.7M

H2 NI ???

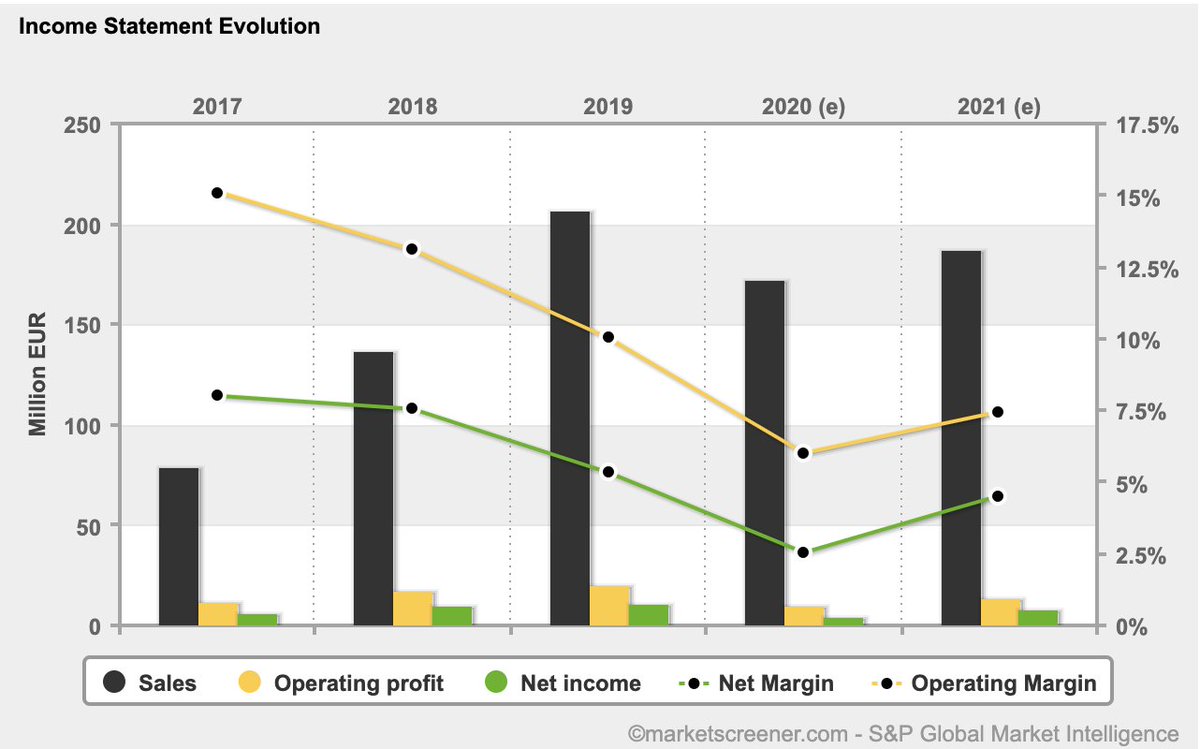

Highly profitable H2 is in danger. Forecasts for FY2020 is around 2.65 EPS (=4.4M). 2021 back to 5.13 EPS.

Price 66E

MCap 110M

PB 2.45

PCF 3.87

PS 0.49

PE 7.22

Cash 57M

Debt 43.5M (+other and deposits)

TTM

Rev 223M

NI 13M

ROE 29%

H1 NI 3.7M

H2 NI ???

Highly profitable H2 is in danger. Forecasts for FY2020 is around 2.65 EPS (=4.4M). 2021 back to 5.13 EPS.

Competitors Beneteau ($BEN) and Catana ($CATG).

CATG: 70M MCap, PB 2.13, PCF 8.72, PS0.81, PE 7.40

BEN: 565M MCap, PB 0.92, PCF 6.80, PS 0.42, PE 14.64

CATG had to close their factories longer, until May. They publish quarterly news: only netted 5M in revenues in that period.

CATG: 70M MCap, PB 2.13, PCF 8.72, PS0.81, PE 7.40

BEN: 565M MCap, PB 0.92, PCF 6.80, PS 0.42, PE 14.64

CATG had to close their factories longer, until May. They publish quarterly news: only netted 5M in revenues in that period.

There are two forces fighting in my opinion:

Travel, boat vacations are down during covid19.

Individual leisure (also see pool sales of $ALPDX and google trends) is up sharply, also home improvement, media.

In the US boat sales are up 30% YoY, see: https://eu.usatoday.com/story/news/nation/2020/08/29/coronavirus-boat-sales-making-waves-pandemic/5639610002/

Travel, boat vacations are down during covid19.

Individual leisure (also see pool sales of $ALPDX and google trends) is up sharply, also home improvement, media.

In the US boat sales are up 30% YoY, see: https://eu.usatoday.com/story/news/nation/2020/08/29/coronavirus-boat-sales-making-waves-pandemic/5639610002/

$ALFPC

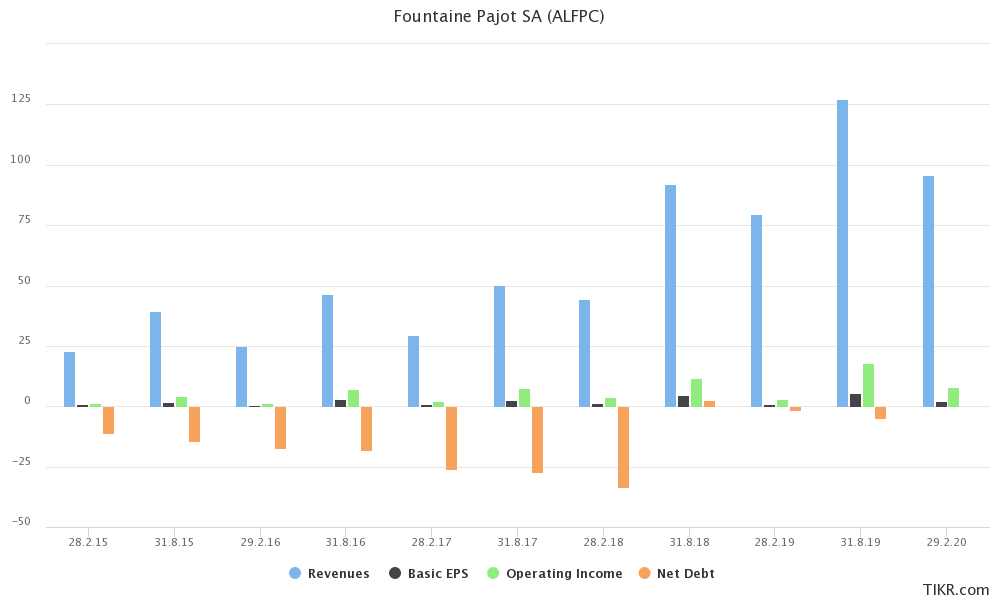

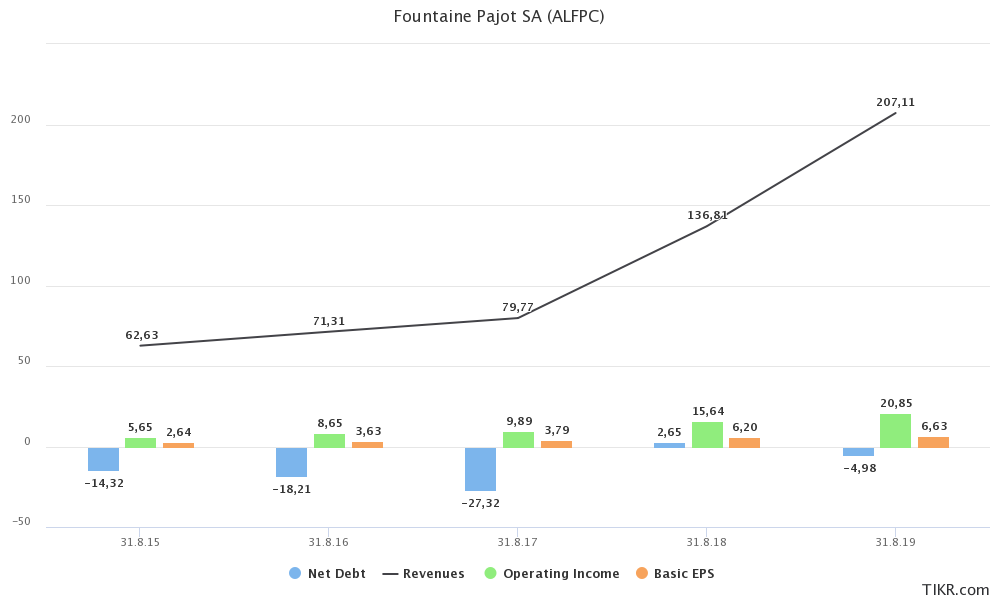

A graph from 2015 until today, generated with @theTIKR

1. seasonal character H1 and H2

2. Cash generation from 2015-2018

3. Acquisition, ramp up in revenues

4. rise in Net income, no loss year

"Net debt" = Net cash if negative

A graph from 2015 until today, generated with @theTIKR

1. seasonal character H1 and H2

2. Cash generation from 2015-2018

3. Acquisition, ramp up in revenues

4. rise in Net income, no loss year

"Net debt" = Net cash if negative

Comparison of the valuation (EV/EBITDA) between

Fountaine Pajot

Beneteau

Catana

1. Catana always at a premium

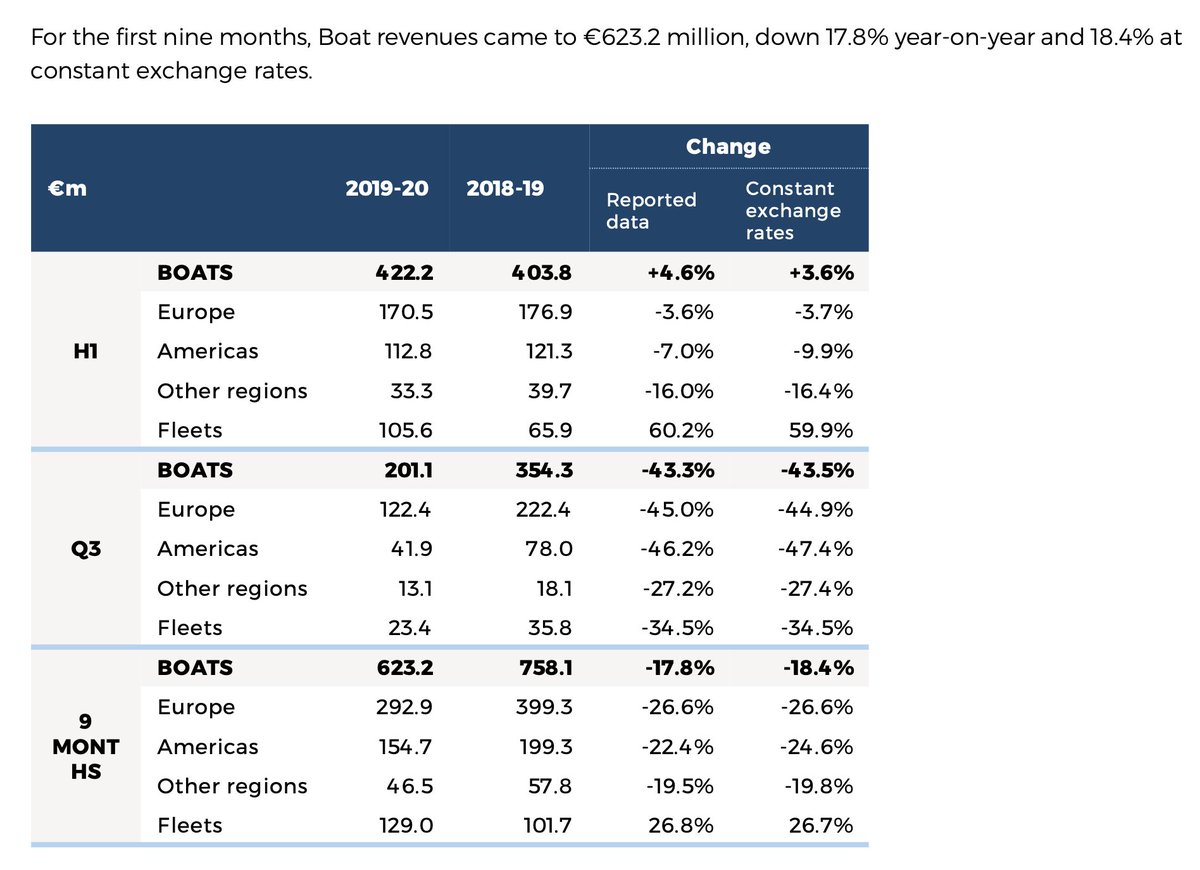

2. Beneteau with multiple expansion since March and now at highest valuation (already published Q3 data)

3. ALFPC from similar valuation to lowest (lower cash now)

Fountaine Pajot

Beneteau

Catana

1. Catana always at a premium

2. Beneteau with multiple expansion since March and now at highest valuation (already published Q3 data)

3. ALFPC from similar valuation to lowest (lower cash now)

Beneteau has a negative outlook for the sector: They are closing sites and laying off workers.

"... closure, sale or shutdown of 5 sites out of 24 and a reduction in the workforce of between 710 and 1,390 people out of the 8,361 employees as of August 31, 2019."

Bad news ALFPC

"... closure, sale or shutdown of 5 sites out of 24 and a reduction in the workforce of between 710 and 1,390 people out of the 8,361 employees as of August 31, 2019."

Bad news ALFPC

Read on Twitter

Read on Twitter