This week, I’m adding $BAC to my 2021 Best “PH”List at $26.30 (PH is permanent hold).

Last week I started the list with $LSXMK which was up this week. That’s great, but I don’t care - these are stocks I’m holding through at least 2021.

Here’s why I like $BAC :

Last week I started the list with $LSXMK which was up this week. That’s great, but I don’t care - these are stocks I’m holding through at least 2021.

Here’s why I like $BAC :

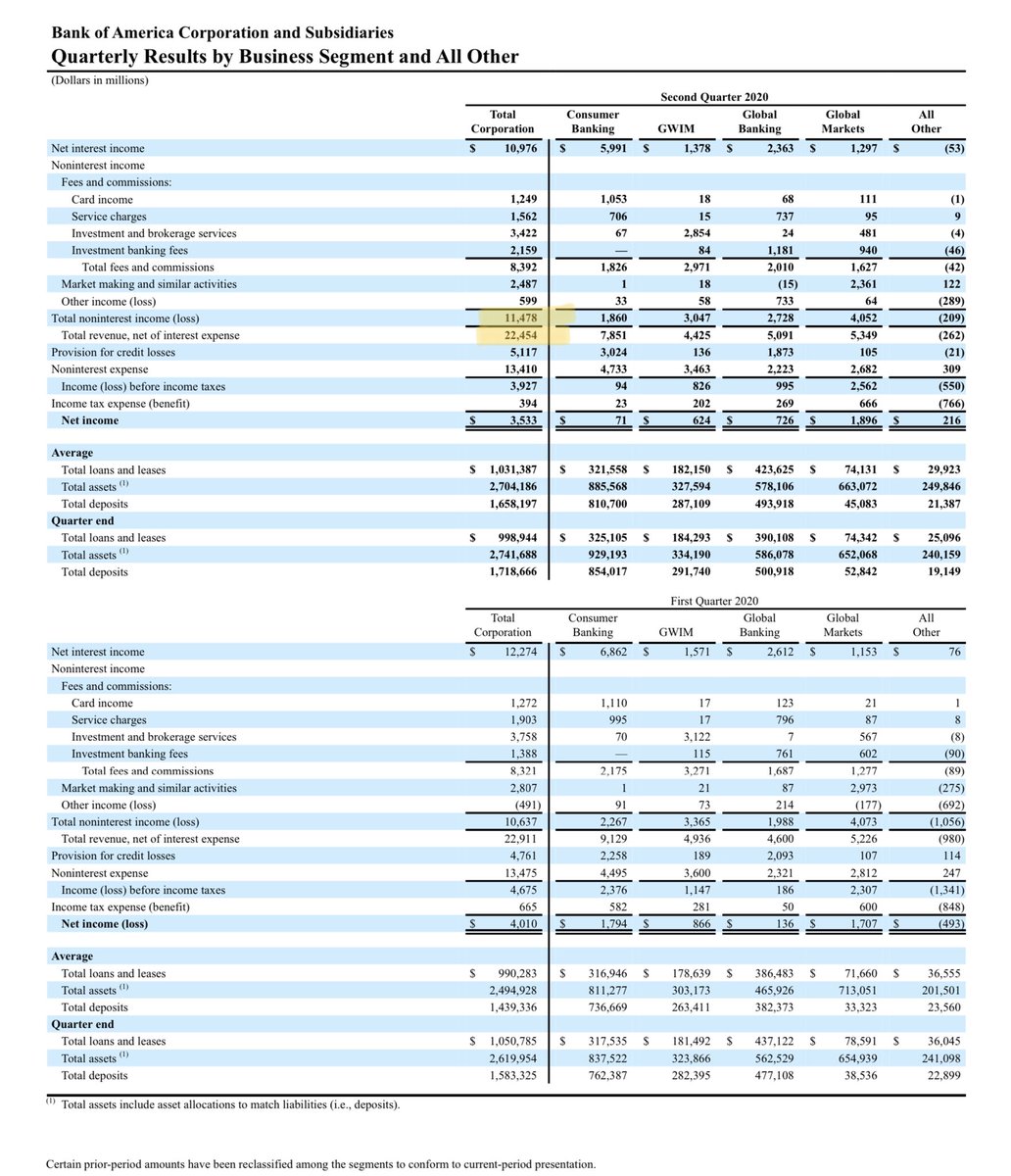

Current summary of the “Big 4”

$JPM is the best bank extant, and it’s not even close. It’s also priced that way. I like $JPM but like $BAC more.

$WFC is cheap but can’t seem to make any money until after the government leaves them alone (yes, a potential catalyst).

$JPM is the best bank extant, and it’s not even close. It’s also priced that way. I like $JPM but like $BAC more.

$WFC is cheap but can’t seem to make any money until after the government leaves them alone (yes, a potential catalyst).

That leaves:

$C is as cheap as $WFC and is the most internationally diversified (good and bad IMO). I like $C a lot (it may find it’s own place on this list in the future).

$BAC is today’s pick. Why?

It’s an inexpensive, well run, profitable bank.

$C is as cheap as $WFC and is the most internationally diversified (good and bad IMO). I like $C a lot (it may find it’s own place on this list in the future).

$BAC is today’s pick. Why?

It’s an inexpensive, well run, profitable bank.

$1.7 Trillion in deposits for which they pay 9 basis points! That is incredible earnings power today and in the future (if interest rates ever go up again).

However, I don’t believe interest rates are going up anytime soon.

Half of $BAC income doesn’t come from interest.

However, I don’t believe interest rates are going up anytime soon.

Half of $BAC income doesn’t come from interest.

On the loan side I believe the asset book is improving in credit quality:

Increasing exposure to residential mortgages where collateral is improving;

And reduced exposure in unsecured consumer.

Increasing exposure to residential mortgages where collateral is improving;

And reduced exposure in unsecured consumer.

Conclusion: I’m getting a well run bank (5% ROE after $4 Billion in reserve add last quarter) that generates half its income from fees for less than book value.

Read on Twitter

Read on Twitter