In 2014, the ECB started an unprecedented monetary experiments with catastrophic side effects. Time to sum up what happened & the impact on various aspects of the economy, especially in my home country Germany.

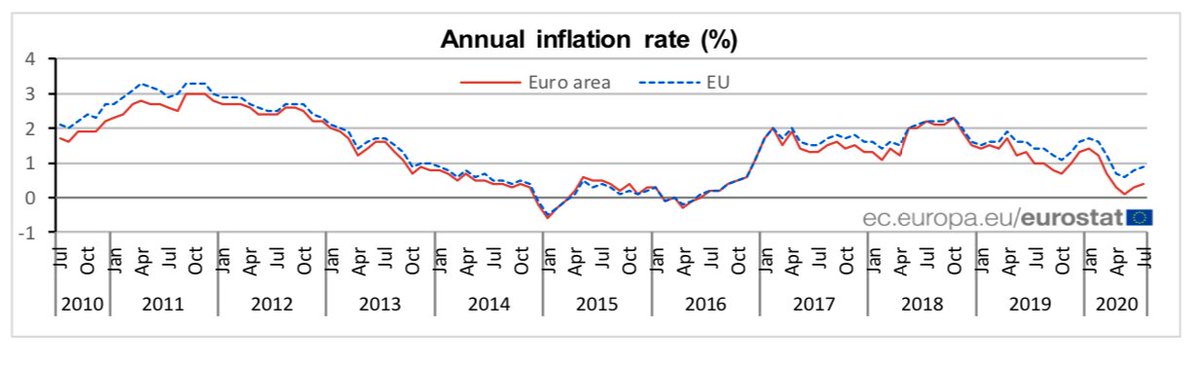

1/From mid-2014, banks had to pay 0.1% interest for any excess reserves deposited with the ECB. The target was to boost price levels and stimulate the sluggish economy by making banks lend more money to consumers and businesses.

2/With Germany at the brink of a recession and disappointing inflation, the ECB doubled down five years later forcing banks to pay 0.5% interest on their idle cash, although a tiered system allows them to avoid the charge for a portion of their deposits.

3/Negative deposit rates erode bank profitability by narrowing their net interest margin. So banks began to charge their customers negative interest rates as well. In Germany 260 out of 1300 banks have introduced negative interests of 0.4% to 0.5% for deposits over €100k.

4/An interest of -0.5% coupled with an inflation of 2% reduces purchasing power by 22% after 10 years and 39% after 20 years. 40% of German wealth is stored in cash & deposits, causing an annual purchasing power loss of €40 bn.

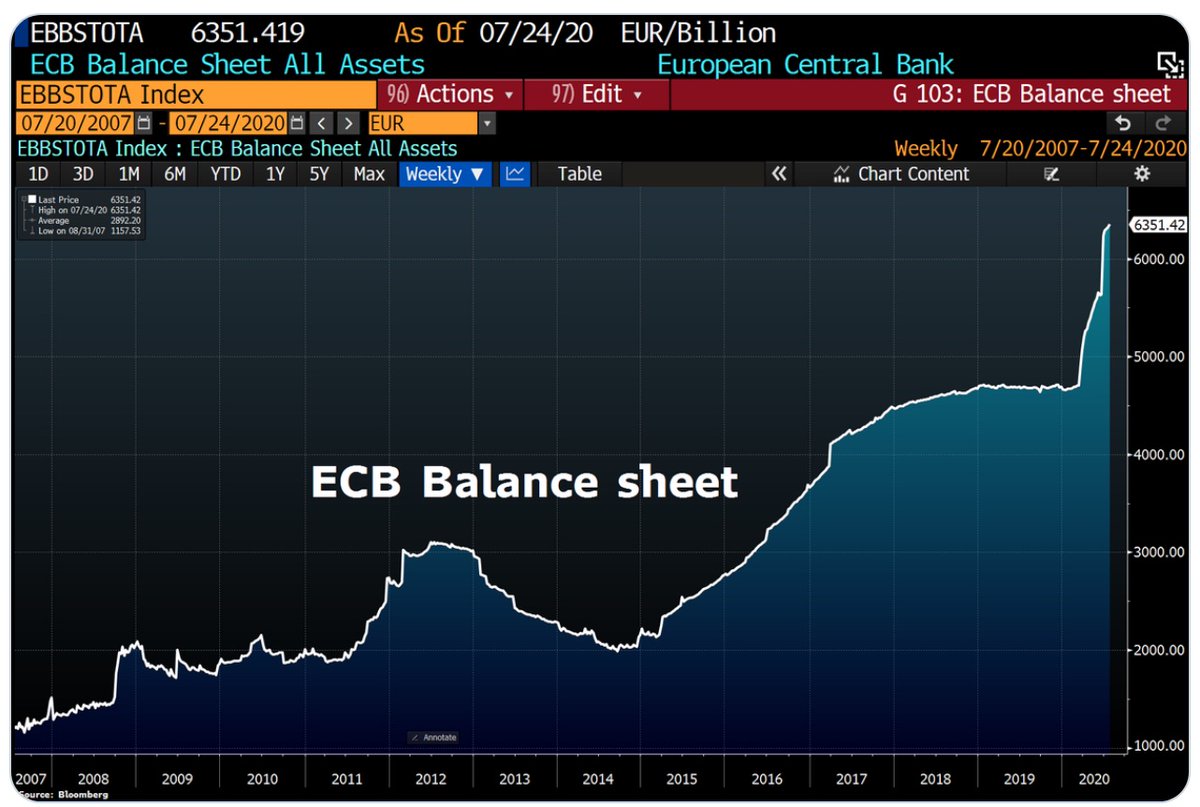

5/On top of low rates, the ECB launched QE in Mar 2015, injecting liquidity into financial markets and the broader economy. Until the end of its first QE program in Dec 2018, the ECB printed €2.6 tn to purchase government and corporate debt.

6/But inflation remained stubbornly below the 2% target, so the ECB started a new round of QE in November 2019 with monthly asset purchases worth €20 bn Euro for “as long as it takes for the Eurozone’s economic growth and inflation rate to return to satisfactory levels”.

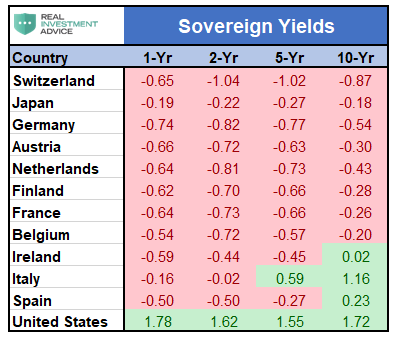

7/While QE turned out to be a wasted effort to drive up inflation, government borrowing cost dropped to a record low: Bonds in several European countries traded at negative yields across the entire maturity spectrum in Aug 2019.

8/In February 2020, Greece’s 10-year bonds fell to 0.9% as investors were betting on indefinite cheap credit & negative rate policy. Less than a decade ago Greece had to pay a 45% interest for borrowing money & its Debt/GDP ratio is one of the worldwide highest.

9/Negative bond yields disincentivize governments to reform & cut spending. They also distort the traditional business model of life insurances who guarantee an annual return for policyholders & are legally obliged to invest in low-risk products like bonds.

10/With yields diminishing, insurances are reducing returns for their customers. Germans hold much of their wealth in these retirement products but life insurers are expected to provide an average return of just 2.3% in 2020 - less than half the return as 10 years ago.

11/Although the ECB’s policy led to heavy criticism from, it did not prevent the German President Frank-Walter Steinmeier in January 2020 to award former ECB head Mario Draghi with the Federal Order of Merit - Germany’s highest honour.

12/In response to the economic destruction resulting from COVID19 lockdowns, the ECB launched a €1.3 tn asset purchase program to buy more government and corporate bonds without the prior constraints as to how much capital can be allocated to individual countries.

13/The ECB balance sheet increased from €4.7 tn in mid-April to €5.6 tn in June. In August, the ECB’s balance sheet hit a fresh record at €6.4 tn and accounts for 53% of the Eurozone GDP. In comparison, the FED’s balance sheet represents “only” 32% of the US GDP.

14/Financial history teaches that ECB-style credit expansion leads to excessive risk-seeking & creation of asset bubbles by making borrowing cheaper and saving less attractive. One area where steep price spikes become most visible is the real estate sector.

15/After the ECB introduced negative rates, several banks started to offer mortgage loans with an interest rate close to 0. Mortgage interest rates range between 0.5% and 2% in Western EU countries. In Germany, individuals with good creditworthiness can get a mortgage at 0.4%.

16/Prior to negative rates, average property prices in Germany stood at €2.1k/sqm & €3k/sqm at the end of 2019. Average price buyers need to pay per sqm is €9k in Munich (vs. €6k in 2015), €5.6k in Berlin (vs. €3.3k in 2015) & €6.7k in Frankfurt (vs. €3.8k in 2015).

17/Ironically, in July 2019, it was none other than ECB President Draghi warning of a growing bubble in the European housing sector and the fact that many households became heavily indebted by investing in expensive real estates.

18/Thanks to a continuation of negative interest rates & QE, there is no end in sight for the boom in the housing market. But as rents increased hand in hand with property prices, regulators are looking at radical measures to ensure housing stays affordable.

19/Berlin’s leftist state govt passed a rent control law in Jan 2020 to freeze the rents of 1.5 mio homes for 5 ys & introduce price ceilings. The law prevents landlords from charging higher rents when tenants change. Tenants can sue their landlord to have their rents reduced.

20/Also in other European cities there is growing animosity towards large real estate investors and landlords in general. More interventionist measures like Berlin are likely, but few seem to blame the money-creating wizards from the ECB for the tragedy on the housing market.

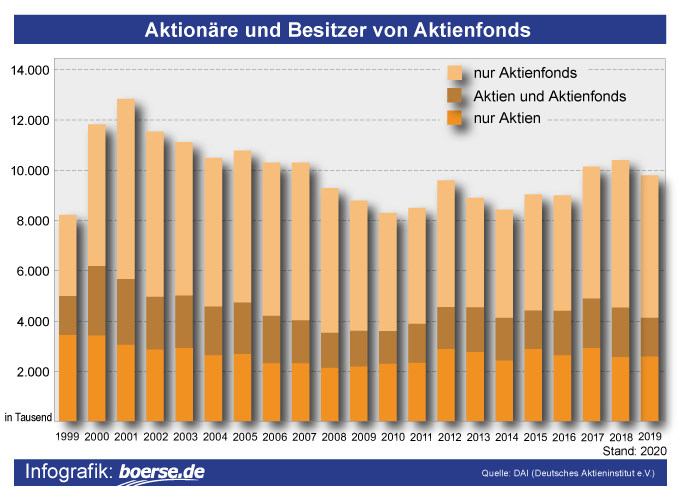

21/Also stock owners benefited from ECB measures. The German blue chip index DAX increased by roughly 40% since 2014. Less than 10 million Germans own stocks or equity funds, so the global bull market did not add to the wealth of most people.

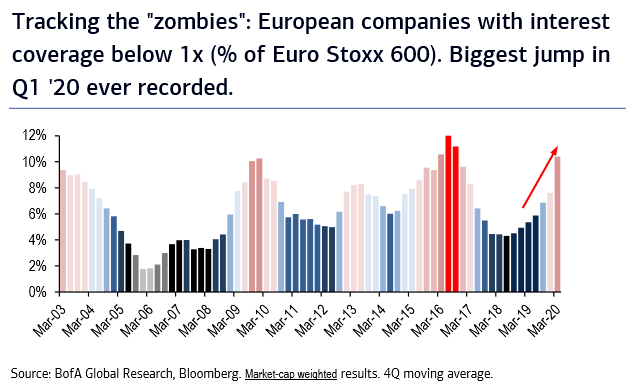

22/An additional effect of immense ECB liquidity is that it keeps companies alive that would have otherwise gone out of business. Zombie companies do not generate sufficient profit to service their debts, but can only carry on thanks to government & central bank support.

23/A high share of zombies in the economy prevents the optimal allocation of resources away from unproductive firms to more efficient companies. It prevents the creative destruction process, as termed by Schumpeter, and inhibits productivity, innovation and economic growth.

24/In March, the German govt introduced a waiver for companies to file for insolvency. The rule should be phased out by end of Sep but was extended until the end of the year to avoid an insolvency wave sweeping through the country before the important 2021 election year.

25/Back to the ECB who is currently reviewing its policy strategies of the past decades to figure out how they could persistently fail in achieving their inflation target which was the reason QE and negative rates got implemented in the first place.

26/According to a recent analysis by the Bank of Portugal, price levels are increasingly determined by technological forces outside the control of central banks as well as increased competition from global supply chains - with both having strong deflationary effects.

27/This assessment is in line with @JeffBooth fantastic book “the price of tomorrow” suggesting that deflationary effects of technology cannot be outpaced by central bank’s mandate to boost inflation which only drives wealth inequality and creates social conflicts.

27/In summary: The ECB printed gigantic amounts of money and drove interests into negative territory to fight a futile battle against the deflationary forces of technology and globalisation that their policies can’t influence.

28/Instead of reaching their goals to boost prices and growth the ECB policy eroded people’s life savings, distorted credit markets, outpriced people from housing & stock markets and bred zombie firms. Time to stop this insanity. Time for Plan ₿, Time for #bitcoin  .

.

.

.

Read on Twitter

Read on Twitter