Let’s be clear: We need to provide relief to families and small- and medium-sized businesses hit hard by the closures caused by the pandemic. We must ensure relief goes to communities of color hit so hard by this crisis. The way to do this is to borrow at today's low rates 1/18

Unemployment remains in double-digits. & the official rate a likely under-estimate. “True” unemp rate for July closer to 13.8% than the reported 10.2% b/c of misclassification due to pandemic, while rates remain very high for Black & Latino workers https://twitter.com/hshierholz/status/1291724146918006784 2/18

Yet, the Administration is asleep at the wheel. Enhanced unemployment benefits expired in late July. The amount of benefits workers are receiving have fallen off a cliff: https://twitter.com/LookingGdLouis/status/1295869898984263680 3/18

(For more on the cliff, see this terrific post by @hshierholz https://www.epi.org/blog/ui-claims-remain-historically-high-and-the-presidents-sham-executive-memorandum-is-doing-next-to-nothing-congress-must-reinstate-the-600/ 4/18)

(And, let’s remember that the weight of the evidence is that the high UI replacement WAS NOT discouraging people from going back to work. Here’s one data point: https://twitter.com/ernietedeschi/status/1295829253569863685 5/18)

We have high unemployment **b/c the Administration has failed to do its job.** The USA has over 170K dead and over 5M cases – an outbreak that’s far worse than other countries in terms of total numbers (& still bad per capita) 6/18

The recent “fixes” aren’t a fix. So far, only one state has been able to put the new benefits in Trump’s Executive Orders in place – and it’s AUGUST 22! https://www.washingtonpost.com/us-policy/2020/08/21/trump-unemployment/?hpid=hp_hp-top-table-main_bailouttrump-720pm%3Ahomepage%2Fstory-ans 7/18

And, oof, there’s more crises to come. Families in serious mortgage distress (more than 90 days late on payments) are at highs not seen since the Great Recession, which, pls recall, was caused by the collapses of a housing bubble. https://www.washingtonpost.com/business/2020/08/21/serious-mortgage-delinquencies-soared-10-year-high-last-month/ 8/18

American business gets it: ~30 industry groups—incl the Chamber of Commerce—told the WH that they WON’T implement Trump’s payroll tax cut b/c it’s “UNWORKABLE” https://www.cnn.com/2020/08/19/politics/businesses-say-payroll-tax-executive-action-unworkable/index.html 9/18

(And, don't forget: Trump’s payroll tax cut is a cut to revenue for SOCIAL SECURITY with no plan for how to refund it. AND: He said he’ll make those cuts permanent if he can. Yikes. Super bad idea! 10/18)

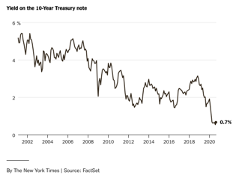

America needs relief. Now. We can (& should) borrow to make this happen. That’s the right economic plan. Interest rates are at historic lows, which means that it’s cheap to borrow. 11/18

Not only is it cost-effective to borrow now to save lives, family homes, family farms, family businesses, and our economy, but there’s plenty of people with $$ who are ready and willing to finance necessary public investment (i.e, they're still buying t-bills!) 12/18

Low interest rates mean that there’s lots of $$ chasing too few opportunities. Textbook would say we should worry about gov't investment “crowding out” private as the gov’t competes with private firms for capital. But low interest rates mean that’s so NOT the case now. 13/18

A big part of the problem is that we have too many rich people w/ too much $$ --> saving glut. Check out @profsufi thread on this: https://twitter.com/profsufi/status/1280165094761156609 14/18

(And, while you’re reading @profsufi, check out his thread on how low interest rates can be bad for market competition, productivity, and growth: https://twitter.com/profsufi/status/1295791405768544256 15/18)

Not acting isn’t an option. As EG grantee @thesugar says, “The few green shoots of improved economic data belie the fact that the health and economic crises are far from over. In fact, we are in danger of sleepwalking into economic depression.” https://equitablegrowth.org/sleepwalking-into-depression-the-economic-response-to-covid-19-in-the-united-states/ 16/18

While we’re at it taking action, let’s make these recession policies trigger on and off as the economy falls in and out of recession. @JayCShambaugh @RyanDNunn and I put together a whole book on this: https://twitter.com/equitablegrowth/status/1296503286758088709 17/18

Finally, when the time comes to do big things to get us out of this mess, low interest rates not only mean we can borrow, they also mean that it’s time to tax the rich. A topic for a future Saturday morning thread ... 18/18

Read on Twitter

Read on Twitter