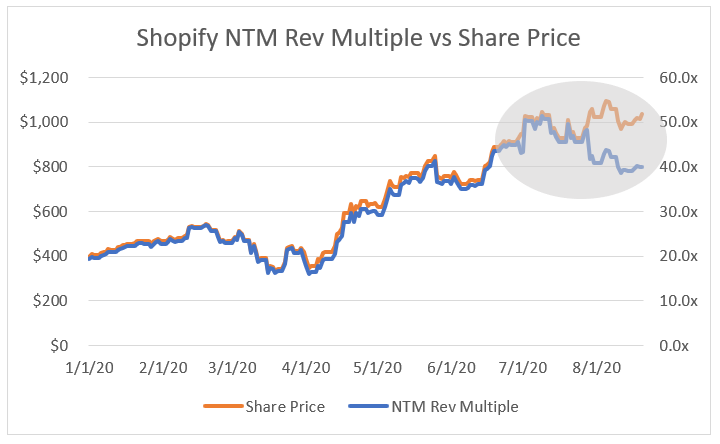

Growing into a Multiple: Graphing Shopify's NTM revenue multiple alongside share price going back to Jan 1 illustrates this concept. Normally the two are tightly correlated. However, during extreme growth the multiple can compress 25% with no effect to share price $SHOP

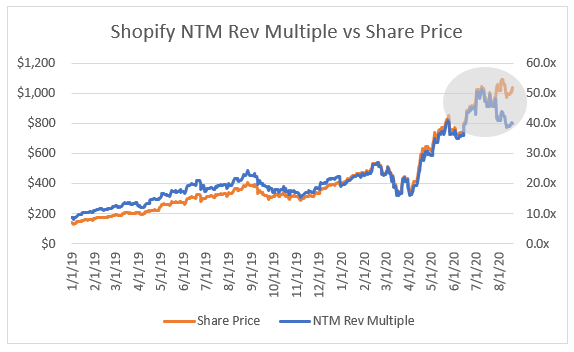

Same chart but going back to 1/1/19. This should also put into perspective just how high multiples are today... Shopify will need at least 3 more quarters of extreme growth (like last quarter) to withstand the inevitable multiple compression (I think they can!)

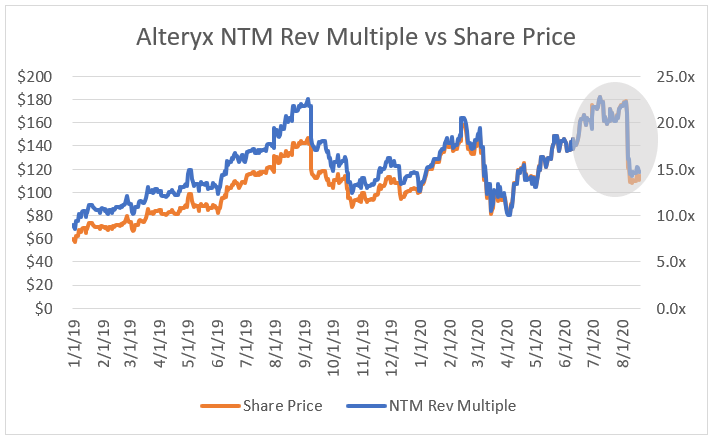

Other businesses, like Alteryx, won't grow fast enough to survive multiple compression. In these instances share price and multiple will both fall in harmony. Unfortunately (depending on the timing of multiple compression) i think more charts will look like Alteryx than Shopify

However, multiples are an output, not an input, to valuation. Things like growth, margins, unit economics, TAM all play into what multiple a company trades at. Said another way, the different operational metrics of a business determine how much every dollar of revenue is "worth"

With that being said, in equilibrium SaaS companies generally trade in the 5-10x range, with high growth businesses trading ~15x. It seems inevitable we'll return to those levels. The big question for SaaS businesses - what will happen to their share price when multiples fall?

I think we'll really see a separation between the top tier SaaS names (small bucket) and the rest of the universe. IMO the most likely scenario from today on is the top tier names end up seeing their share price trade horizontally/ slightly up / down as multiples compress

But then again, no one really knows :) For all I know SaaS multiples could permanently reset higher. Or we could be due for an extreme rotation out of SaaS plummeting multiples. Right now "SaaS is safe" but when we return to "normal" (whatever that normal may be) all bets are off

Read on Twitter

Read on Twitter