I started Trading in 2017 and in two years I blown 75% of my capital.

Mostly due to Option buying and Future trading -

I will mention my biggest loss trades just for learning.

Follow this thread -

Trollers are welcome

Mostly due to Option buying and Future trading -

I will mention my biggest loss trades just for learning.

Follow this thread -

Trollers are welcome

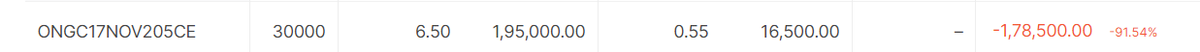

In 2018 Crude oil prices were increasing fast . so i thought ONGC should go up , So i bought ONGC CE . My assumption went right and i made 80K profit. I squared off my position and booked 80 K profit.

But on the same day crude oil again increased by more than 8% , so i thought i exited very early , so i should enter again tomorrow . Next Day ONGC was 3% Gap-up .

So i bought 30000 QTY at 6.5 Rs . I thought i will make big profit . but this was top in ONGC .

So i bought 30000 QTY at 6.5 Rs . I thought i will make big profit . but this was top in ONGC .

Slowly option is eroded to 0.5 Rs .

Big Joke is I averaged the Option when it was going down.

Lesson - 1. Don't be greedy , once profit booked see other opportunities.

2. Risk management not followed. 20% capital gone.

3. Avoid news based trading

Big Joke is I averaged the Option when it was going down.

Lesson - 1. Don't be greedy , once profit booked see other opportunities.

2. Risk management not followed. 20% capital gone.

3. Avoid news based trading

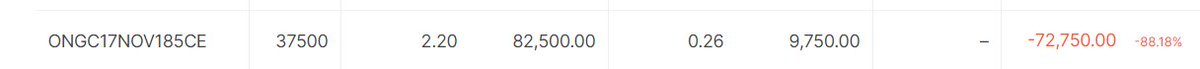

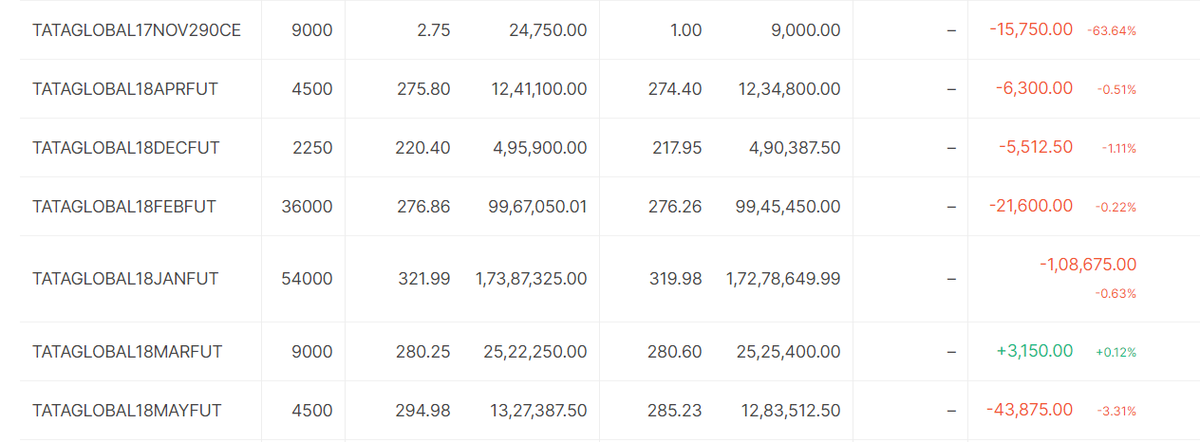

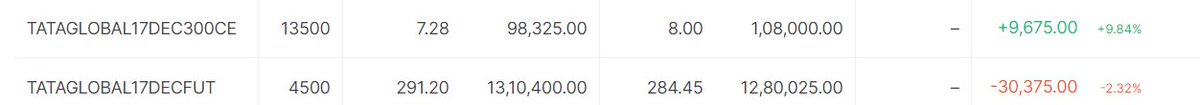

NEXT STORY - TATA GLOBAL -

I was just learned basics of TA . I started applying on my trading . I applied it on Tata global and i made decent profit. it was purely my luck as stock was in good uptrend -

I was just learned basics of TA . I started applying on my trading . I applied it on Tata global and i made decent profit. it was purely my luck as stock was in good uptrend -

but my overconfidence killed me , i thought i will increase my profit many times if i trades it in futures , so i started taking trades in futures with huge quantities . But losses increased fast and i also did revenge trading which further increased the losses.

NEXT STORY - SRT FINNACE

I was watching CNBC , Analyst given buy call on SRTFIN . So i bought ATM CE .

At that time i didnt know about options. it was only two days left for monthly expiry when i bought the option.

I was watching CNBC , Analyst given buy call on SRTFIN . So i bought ATM CE .

At that time i didnt know about options. it was only two days left for monthly expiry when i bought the option.

Next day when market opened i saw 14 K loss where as spot was same unchanged , finally next day this option expired worthless without change in spot.

Lesson - Dont buy Option in last week of the expiry , if ur not sure about direction. Dont follow news tips.

Lesson - Dont buy Option in last week of the expiry , if ur not sure about direction. Dont follow news tips.

Next story - PNB .

This loss was happened due to Tip from Paid advisor . He gave buy call on PNB his target was way above 200 . So i bought it and made big loss.

Dont follow paid advisory.

This loss was happened due to Tip from Paid advisor . He gave buy call on PNB his target was way above 200 . So i bought it and made big loss.

Dont follow paid advisory.

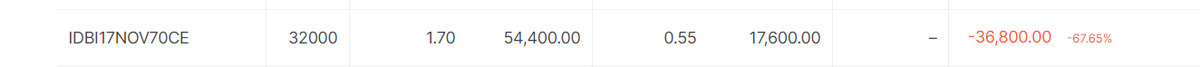

Next Story - IDBI & SBIN

This was very interesting , so i remembered it . My paid advisor taken extra 10 K Rs for this Tip as this tip was very special as per him. so as per his advice i taken the position & I had booked heavy losses.

This was very interesting , so i remembered it . My paid advisor taken extra 10 K Rs for this Tip as this tip was very special as per him. so as per his advice i taken the position & I had booked heavy losses.

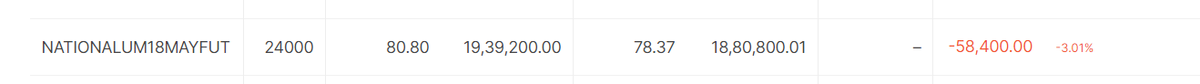

Next Story - NALCO

Alumina prices was increasing fast that days , so the prices of Nalco was sky rocketing . Anticipating good gains i take trade . Same night US lifted ban on one big alumina producing company and prices of alumina crashed 20-30% . Next day Nalco crashed 10%.

Alumina prices was increasing fast that days , so the prices of Nalco was sky rocketing . Anticipating good gains i take trade . Same night US lifted ban on one big alumina producing company and prices of alumina crashed 20-30% . Next day Nalco crashed 10%.

Learning - if ur 100% sure about direction , then also go with hedge if ur carrying overnight positions.

You will be not lucky always. hedge will always protect you against the odds.

You will be not lucky always. hedge will always protect you against the odds.

Next story - GSFC -

This was also due to my paid advisor , he given by call on GSFC just before results and again i booked huge loss.

Learning - 1. Dont fall in trap with Paid advisors , they dont care about ur money . 2. Dont buy options near qtrly results announcement .

This was also due to my paid advisor , he given by call on GSFC just before results and again i booked huge loss.

Learning - 1. Dont fall in trap with Paid advisors , they dont care about ur money . 2. Dont buy options near qtrly results announcement .

Read on Twitter

Read on Twitter