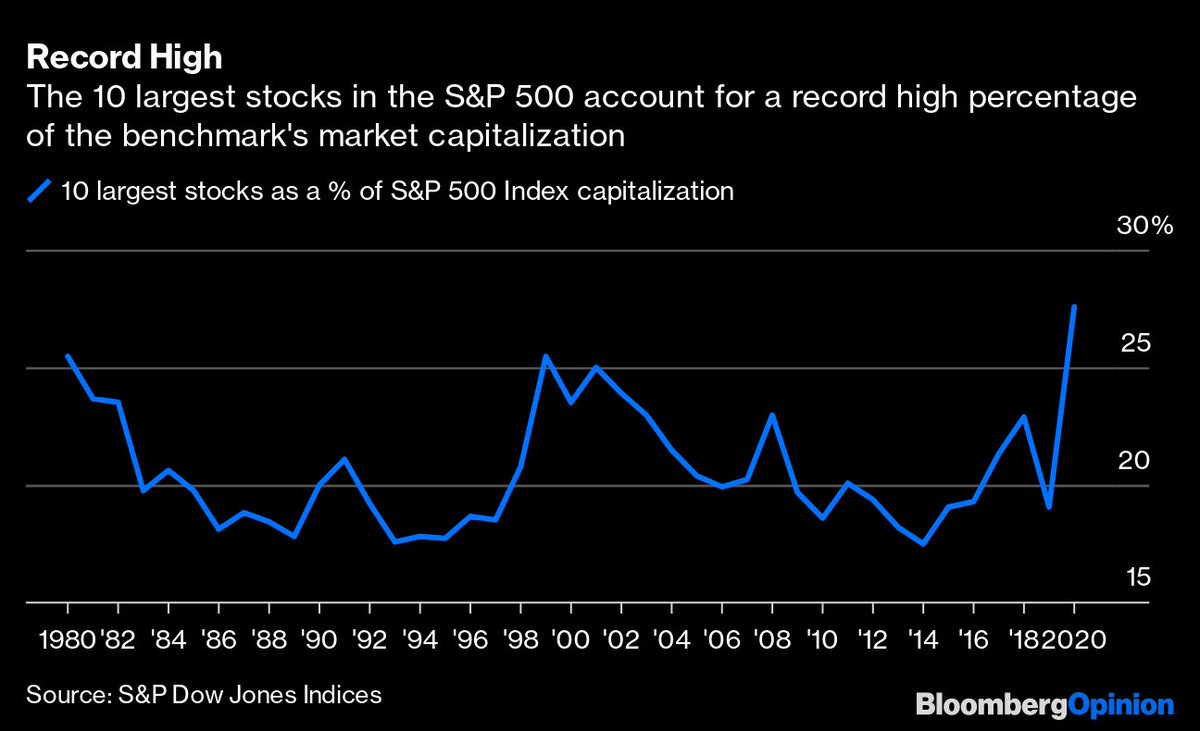

Market cap ratio between 10 biggest SPX stocks + next 490 firms ranges from 17.5% in 2014 to 25.5% in 1980.

A recent high of 27.6% was pandemic/lockdown induced, collapsing small & mid cap companies.

https://ritholtz.com/2020/08/criticism-of-concentrated-index-risk-are-off-base/

1/

A recent high of 27.6% was pandemic/lockdown induced, collapsing small & mid cap companies.

https://ritholtz.com/2020/08/criticism-of-concentrated-index-risk-are-off-base/

1/

Some of this is clearly caused by the strength of the $FAANMG firms in the face of stronger overseas economies that are managing their lockdown better than USA.

Average SPX firm sees 43% of their sales from overseas; FAANMG is half or more.

https://ritholtz.com/2020/07/faanmg/

2/

Average SPX firm sees 43% of their sales from overseas; FAANMG is half or more.

https://ritholtz.com/2020/07/faanmg/

2/

Sometimes investors fail to see that -- they assume their local or regional economy is what is driving the stock market.

It is not.

Looking at one number out of context -- the numerator alone -- is called "Denominator Blindness"

https://ritholtz.com/2015/10/dont-suffer-from-denominator-blindness/

3/

It is not.

Looking at one number out of context -- the numerator alone -- is called "Denominator Blindness"

https://ritholtz.com/2015/10/dont-suffer-from-denominator-blindness/

3/

Dozens of commentaries have decried this concentrated risk for the top 5 or 10 stocks in the index.

All declared it as risky, excessive, or dangerous — Yet they never explain what the historical levels were, why they are elevated now, or why today's concentration is risky.

4/

All declared it as risky, excessive, or dangerous — Yet they never explain what the historical levels were, why they are elevated now, or why today's concentration is risky.

4/

Back to the S&P500 Index:

Many visible sectors have been crushed in 2020:

Dept stores -63%

Airlines -55%

Travel services -51%

Oil + gas -51%

Resorts + casinos -45%

Hotel + motel REIT -42%

https://ritholtz.com/2020/08/market-rational-after-all/

5/

Many visible sectors have been crushed in 2020:

Dept stores -63%

Airlines -55%

Travel services -51%

Oil + gas -51%

Resorts + casinos -45%

Hotel + motel REIT -42%

https://ritholtz.com/2020/08/market-rational-after-all/

5/

Next 15 industry sectors in index are down between 30.5% and 41.7%.

Lose the 30 most damaged sectors + it shaves 2% off the S&P 500; The 50 worst performing industry sectors are under 6% of the index’ size.

Market capitalization is the reason why.

6/

Lose the 30 most damaged sectors + it shaves 2% off the S&P 500; The 50 worst performing industry sectors are under 6% of the index’ size.

Market capitalization is the reason why.

6/

These beaten-up sectors are big in our local economy, but tiny in indexes:

Department stores are a mere 0.01% of the S&P 500.

Airlines are 0.18% of the index. The story is the same for travel services, hotel and motel REITs, and resorts and casinos.

7/

Department stores are a mere 0.01% of the S&P 500.

Airlines are 0.18% of the index. The story is the same for travel services, hotel and motel REITs, and resorts and casinos.

7/

Given how much these sectors have fallen, and how much the big international firms have profited from global work from home, is it any surprise that the top 10 stocks is slightly elevated above its historical range?

https://ritholtz.com/2020/08/more-thoughts-on-concentrated-index-risk/

8/

https://ritholtz.com/2020/08/more-thoughts-on-concentrated-index-risk/

8/

Some of the gains are Absolute: Big cap tech stocks have seen huge increases in revenue and profits as their business models benefit from WFH environments.

Over time, capital flows benefit biggest stocks most + these holdings become larger as a percentage of the index.

9/

Over time, capital flows benefit biggest stocks most + these holdings become larger as a percentage of the index.

9/

Relative performance occurs when those stocks do compared to others, and because of that, become even larger within the index. Their success attracts more capital, and quarterly index rebalancing works to their advantage.

10/

10/

2020 has seen Absolute + Relative Performance: Not only have top 10 stocks done well, most of next 490 have done poorly. This is unusual.

Most economies work through various market caps. The uniqueness of the pandemic and lock down has created a very unusual situation.

11/

Most economies work through various market caps. The uniqueness of the pandemic and lock down has created a very unusual situation.

11/

Now add in none more issue: Externalities.

When the usual cycle of a system is suddenly impacted by a nontraditional element.

Think of the Asteroid that ended Dinosaurs, giving an advantage to mammals as an externality impacting evolution's cycle.

https://ritholtz.com/2020/08/how-externalities-affect-systems/

12/

When the usual cycle of a system is suddenly impacted by a nontraditional element.

Think of the Asteroid that ended Dinosaurs, giving an advantage to mammals as an externality impacting evolution's cycle.

https://ritholtz.com/2020/08/how-externalities-affect-systems/

12/

In most financial circumstances when externalities hit, markets wobble. We see a spike in fear that leads to a fast + hard sell off.

But then, markets normalize, and simply resume their prior trend.

That may be what is taking place currently, with a caveat.

13/

But then, markets normalize, and simply resume their prior trend.

That may be what is taking place currently, with a caveat.

13/

When all this is over, will the FAANMG advantages stick?

Or, will mean reversion occur, as the prior economic structures reassert themselves?

Will the economic dinosaurs soon find themselves replaced by smarter, more adaptable mammals?

14/

Or, will mean reversion occur, as the prior economic structures reassert themselves?

Will the economic dinosaurs soon find themselves replaced by smarter, more adaptable mammals?

14/

I don't pretend to know the answer to these questions.

It might be a little of both, as some of the future gets accelerated forward to deal with the lockdown, benefiting big tech. But things might normalize somewhat once we have a Covid-19 vaccine and treatment.

/END

It might be a little of both, as some of the future gets accelerated forward to deal with the lockdown, benefiting big tech. But things might normalize somewhat once we have a Covid-19 vaccine and treatment.

/END

Read on Twitter

Read on Twitter