The business model for a blockchain might seem magical. Why should the cryptocurrencies that drive them be worth anything at all? How do they capture value? And, how are they defensible? There is a hint of an answer in what I like to call the Network Flywheel. A thread

Traditionally, defensibility in business has almost always depended on privileged access to some resource that confers an advantage—be it a new technology, private user data, relationships with key partners, capital assets, distribution channels, or even raw materials.

But one of the defining aspects of blockchains is that everything about them is both open source and permissionless. The code that they are made from is freely available for anyone to read, and their functionality is accessible to anyone with an internet connection.

By definition, a blockchain that is designed correctly cannot benefit from any kind of cornered resource. The very notion that a blockchain is decentralized means that there exists no small group of people that has unilateral control or outsized power over it.

In other words, for a blockchain to be a blockchain, there can be no privileged actors.

So, it is almost a paradox that it is possible for you, as a founder, to go forth and give away every last line of code that makes up your product—that you could opt for ceding control of the movement that you begin—and still capture some of the value that you create.

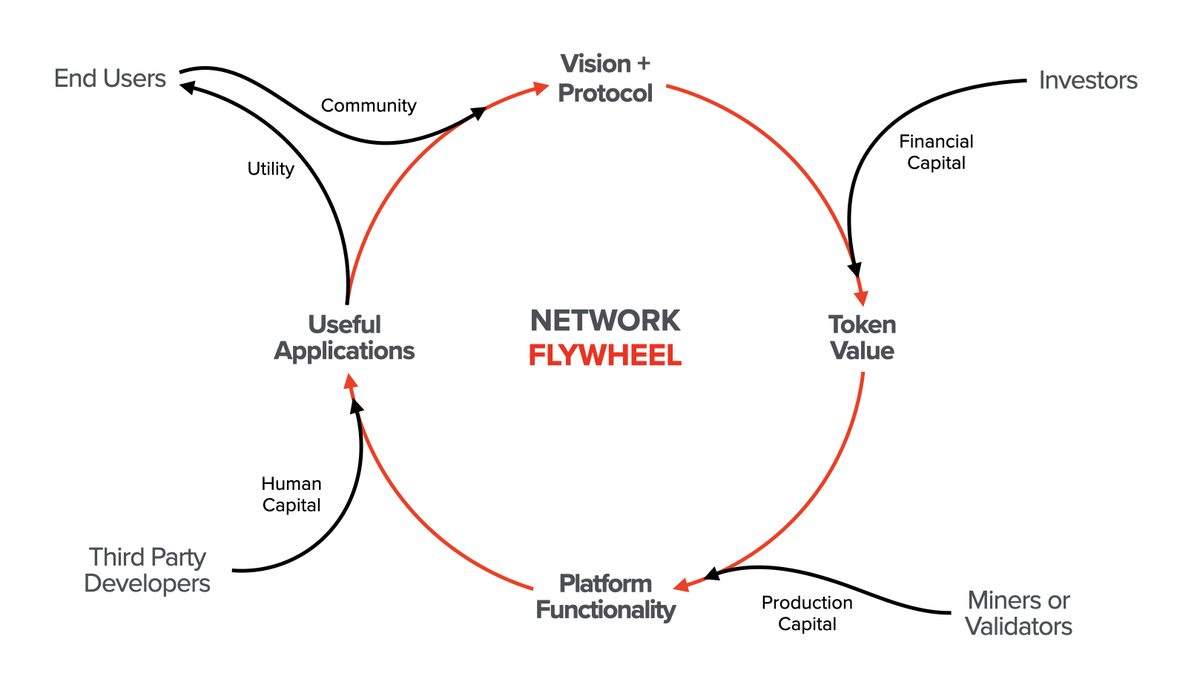

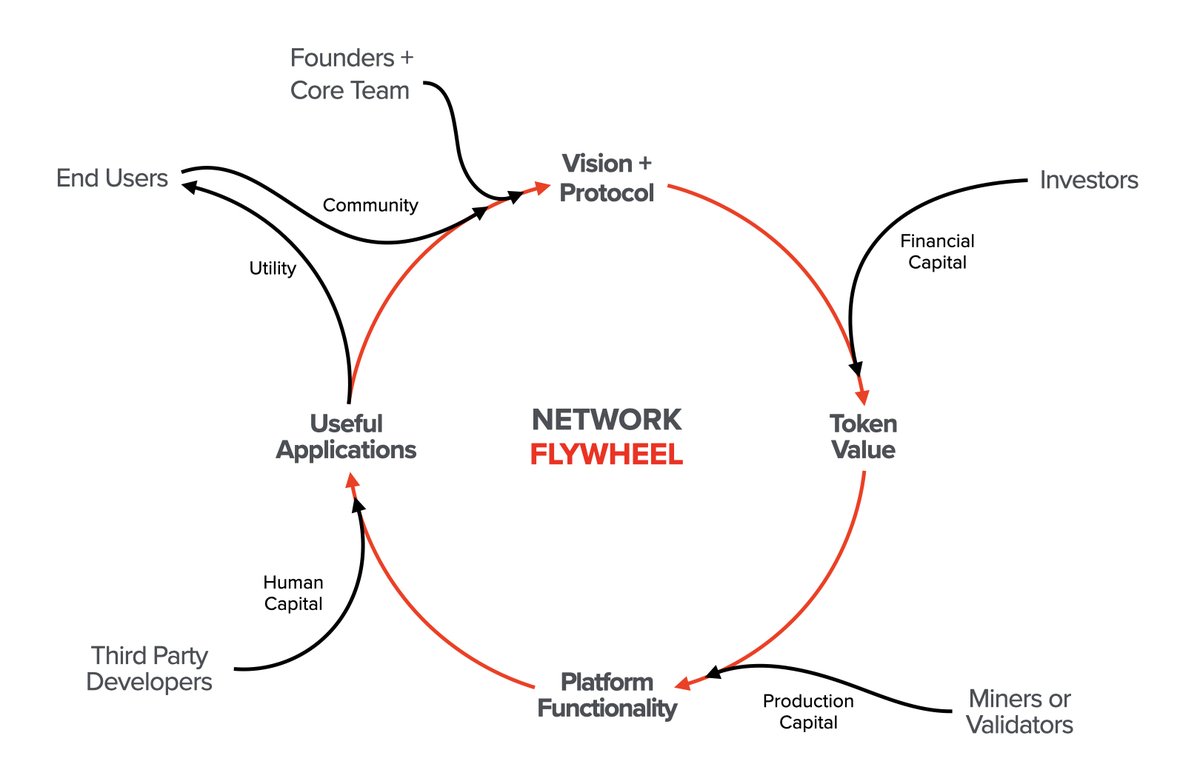

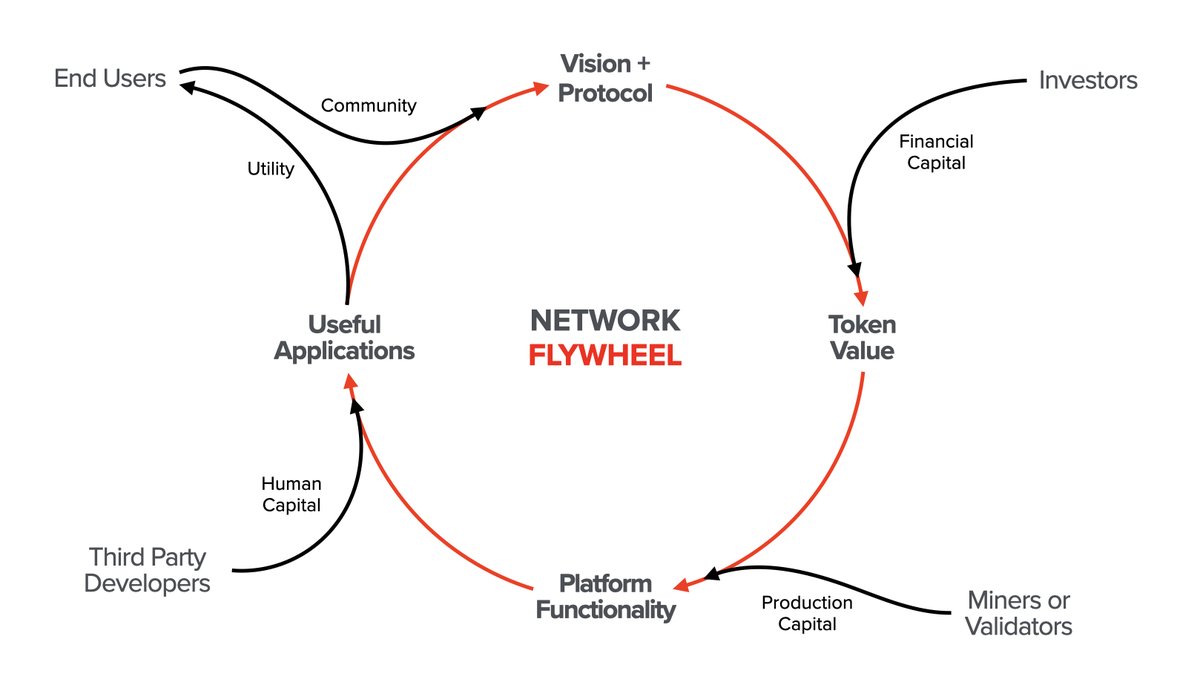

The solution to the paradox lies in the fact that a well-designed blockchain has a built-in incentive structure that creates a multi-sided market with strong network effects. Its defensibility doesn’t come from the code itself; it comes from the network that the code creates.

How does it work?

(Keep reading this thread here or, for more depth, check out the lecture I gave at our @a16z Crypto Startup School: )

(Keep reading this thread here or, for more depth, check out the lecture I gave at our @a16z Crypto Startup School: )

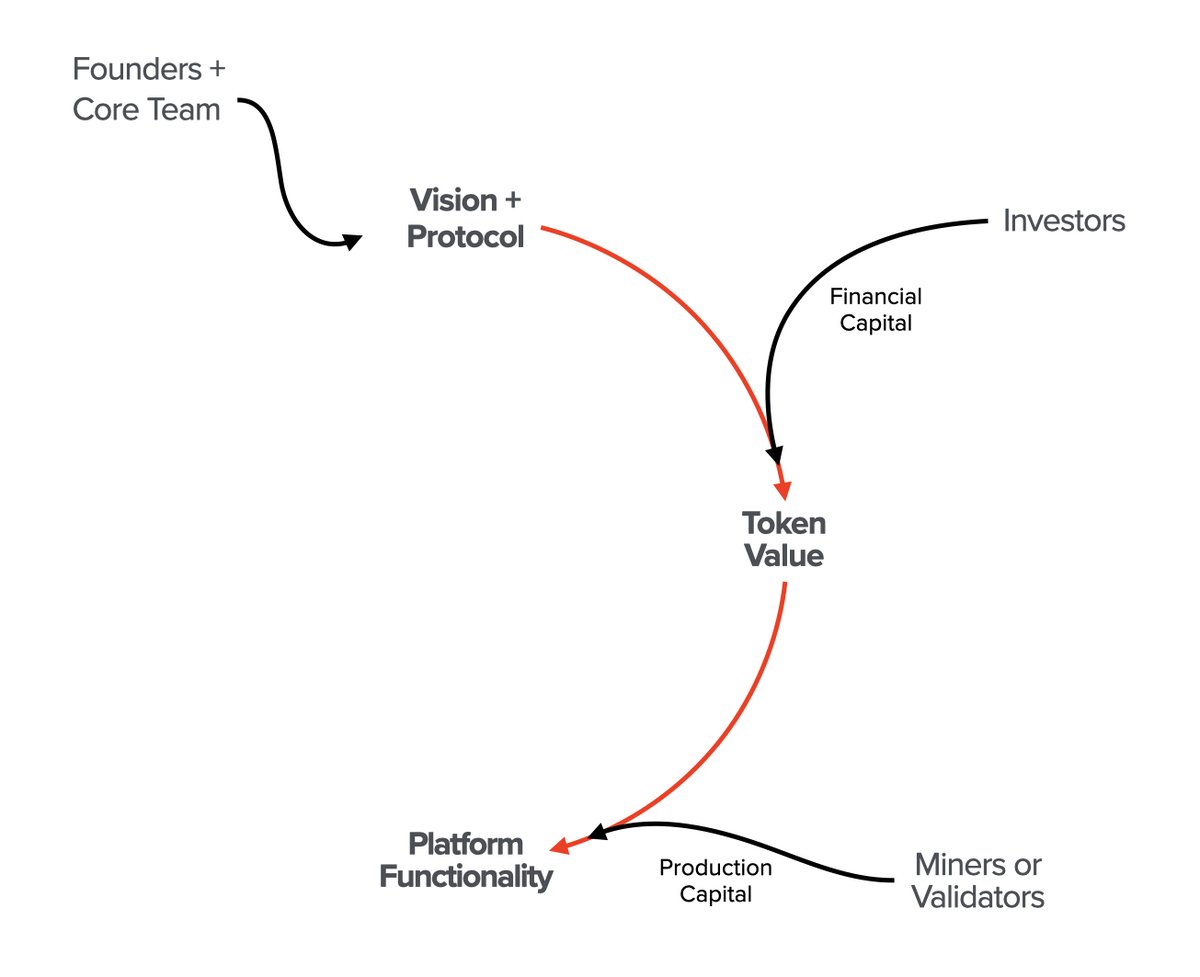

It all starts with the founding team. They are the ones who spark the flywheel into motion by communicating to the world a new vision for a decentralized network.

If the vision is compelling enough, a community begins to form around it. The project becomes a movement and, in the process, a core team of developers join and begin to build the protocol.

At this point, there may be enough momentum behind the project to bootstrap an initial monetary value for the network’s token. This can be true even if the protocol’s development isn’t yet complete, which allows the community to enlist outside financial capital in the effort.

But there is a second reason that the token’s initial value matters. Once the protocol is complete, it helps bootstrap the supply-side of the network by acting as an incentive for a different kind of participant—miners (or validators, as they’re known in proof-of-stake networks).

Miners and validators are the ones who, in exchange for a reward from the protocol, contribute the production capital—i.e. computational resources—that give the network its functionality and security.

Thereafter, a network that is both functional and secure can begin to act as a platform for third-party developers who leverage that functionality to build useful applications on top.

And finally, this is where the rubber meets the road. Those applications create real-world value for end-users who drive demand for the token and, by becoming part of the community, reinforce the vision at the heart of the protocol. And, with that, we’ve gone full circle.

A larger community leads to greater demand for the token, which creates stronger incentives for miners to support the network’s functionality, which further encourages developers to build useful applications, which creates utility for users, who then feed back into the community.

The beauty of all of this is that once the flywheel has been set into motion and has reached a critical threshold of energy, the founding team can begin to step back. The protocol takes a life of its own as it becomes fully decentralized.

If the network is well designed, control and ownership over it will then be in the hands of the users, third-party developers, miners/validators, and investors who make up the protocol’s community.

{fin}

{fin}

Thanks to @jessewldn for conversations/feedback about these ideas.

Read on Twitter

Read on Twitter