1/ For the past few weeks you might have noticed a shift in perspective in the traders you follow.

Yes they are still TA traders and as such, will always use TA to some degree in every trade.

Yes they are still TA traders and as such, will always use TA to some degree in every trade.

2/ However when we are in alt season (as we are now) and a lot of coins, especially post 2017/2018 ones, aren’t just 95% down from ATH but are actually in price discovery, how do we determine what is a good project and what isn’t?

This is where fundamental analysis comes in.

This is where fundamental analysis comes in.

3/ What is Fundamental Analysis?

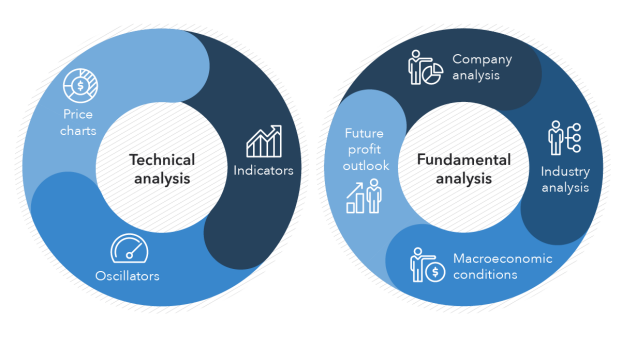

We are mostly quite familiar with Technical Analysis - the study of historical price action, analyzing it and creating predictions for future price action.

Fundamental analysis on the other hand is the study of an asset’s intrinsic value.

We are mostly quite familiar with Technical Analysis - the study of historical price action, analyzing it and creating predictions for future price action.

Fundamental analysis on the other hand is the study of an asset’s intrinsic value.

4/ Why Does Tokenomics Matter?

In traditional finance a lot of information can be gathered through the use of studying Corporate Governance and financial statements.

In traditional finance a lot of information can be gathered through the use of studying Corporate Governance and financial statements.

5/ This is usually a huge checklist of items covering all of the ways in which the company balances the interests of all stakeholders including; owners, investors, customers, employees and more.

6/ We can also check the financial statements, including; balance sheet, income statement, cash flow statement and list of shareholder’s equity.

In crypto we generally don’t have any of that.

In crypto we generally don’t have any of that.

7/ We can study the idea, the white paper, the team, the strategic investors, the partnerships.

This can give us some idea of the Governance of the project.

However when it comes down to financials, all we really have is Tokenomics.

This can give us some idea of the Governance of the project.

However when it comes down to financials, all we really have is Tokenomics.

8/ What are Tokenomics

Tokenomics is the study of the token economy; focusing on the creation, management or removal of a token from the network.

Tokenomics is the study of the token economy; focusing on the creation, management or removal of a token from the network.

9/ In various definitions it will also include everything to do with the project. Founding team, product, partners etc, or it will focus on the form by which the project raises money.

10/ However for now we want to just focus on the token economy itself through the distribution and function of the coin/token.

11/ Tokenomics Basics

A token is a programmable unit that is issued on a specific blockchain protocol. Unless a project has a main net, these are mostly on Ethereum (ERC20 tokens) and sometimes on Stellar or other newer blockchains.

A token is a programmable unit that is issued on a specific blockchain protocol. Unless a project has a main net, these are mostly on Ethereum (ERC20 tokens) and sometimes on Stellar or other newer blockchains.

12/ This is where they differ from traditional shares. A share in a company is a claim on the underlying company itself.

A token on a project is a piece of the ecosystem.

A token on a project is a piece of the ecosystem.

13/ Token Distribution

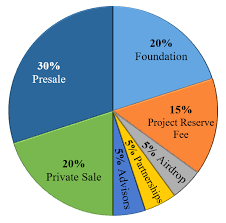

This described the specifics of how a token is distributed through the project.

In this way it is the “terms of governance” of the project.

In terms of distributing the tokens - it’s who gets what, and when, and how.

This described the specifics of how a token is distributed through the project.

In this way it is the “terms of governance” of the project.

In terms of distributing the tokens - it’s who gets what, and when, and how.

14/ Understanding this part is extremely important in knowing what you’re really buying.

You should check:

You should check:

15/ - What is the total supply (are these premined or being mined continually? Is there a soft cap or a hard cap? Is the coin deflationary or is the supply locked?)

- What is the circulating supply?

- What is the circulating supply?

16/ - How are coins allocated (usually between community, marketing, development, owners, legal and other “pots”)?

- Do any of the allocations have a lock in period? Is that lock in period verifiable on the blockchain?

- Do any of the allocations have a lock in period? Is that lock in period verifiable on the blockchain?

17/ These questions will help you to avoid traps such as a “Creator” shilling their price to a high level and disappearing into the sunset with nothing but the word “penis” left behind (yes, that really happened).

18/ Token Use Cases

You should find out what the use case of a token is.

For some coins (sorry Ripple Army) a use case was poorly defined or has yet to be found, which means the coin itself is essentially backed only by speculation.

You should find out what the use case of a token is.

For some coins (sorry Ripple Army) a use case was poorly defined or has yet to be found, which means the coin itself is essentially backed only by speculation.

19/ In other cases the coin is an essential part of the ecosystem. For example Ethereum where the tokens are used to maintain, govern and take actions on the network.

20/ Tokens have been pitched as being used in many very innovative ways, many of which are yet to have any proven traction in the real world.

While these projects have a risk of failure because they didn’t catch on, far many more fail because the token is literally useless.

While these projects have a risk of failure because they didn’t catch on, far many more fail because the token is literally useless.

21/ Conclusion

Tokenomics are important not because they can tell us which crypto projects will be successful. The industry is in the early stages still (even if you already feel like an OG!) and there is no reasonable way for us to know what will be successful in the future yet

Tokenomics are important not because they can tell us which crypto projects will be successful. The industry is in the early stages still (even if you already feel like an OG!) and there is no reasonable way for us to know what will be successful in the future yet

22/ So if we aren’t able to reliably predict success, we should at least be able to reliably identify projects that are doomed to failure.

23/ A project with poorly thought out, unclear or downright scammy tokenomics is starting out on very poor footing, and as such should be avoided.

24/ When trading in a purely technical sense on an established asset, this is unlikely to be a consideration however when looking at coins that are new, or yet to gain real traction, and have the ability to go 5, 10, 100 or 1,000x in price you ignore the tokenomics at your peril.

Read on Twitter

Read on Twitter