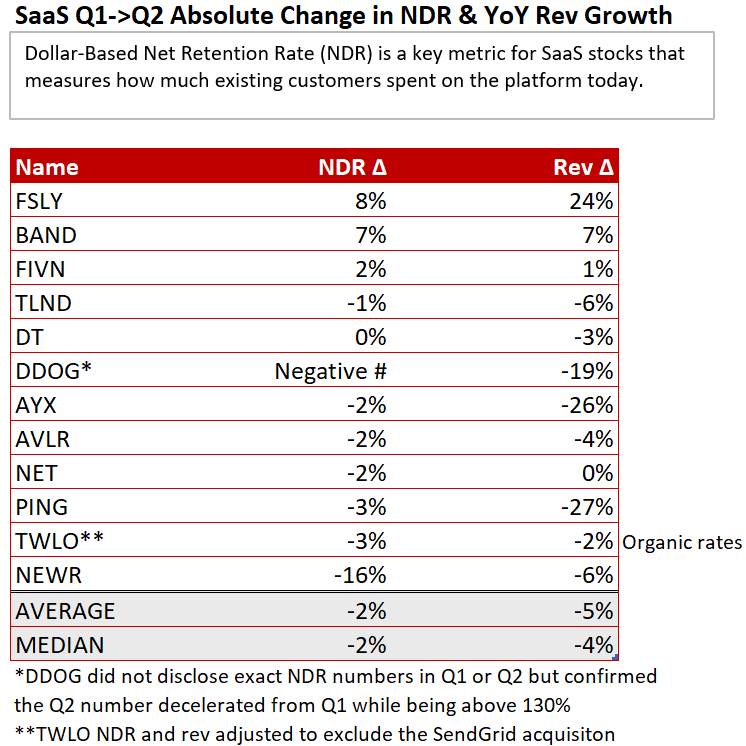

Enterprises spent $35B on cloud software & services in Q2, up nearly 30% YoY. However, many SaaS companies reported a Q1->Q2 deceleration in NDR and YoY revenue growth, indicating that SaaS customers started to cut back on spending  ...

...

$TWLO $NET $FSLY $PING $FIVN $AVLR

...

...$TWLO $NET $FSLY $PING $FIVN $AVLR

This is consistent with what some SaaS management teams noted. $DDOG said they saw their larger customers look to conserve cash. $AYX said they observed higher levels of scrutiny on spending and that they do not anticipate an improvement in 2020...

A common narrative has been that the digital transformation accelerated SaaS growth across the board. The digital transformation is unquestionably an industry tailwind, but most SaaS companies are facing COVID headwinds too as their customers look to cut spending...

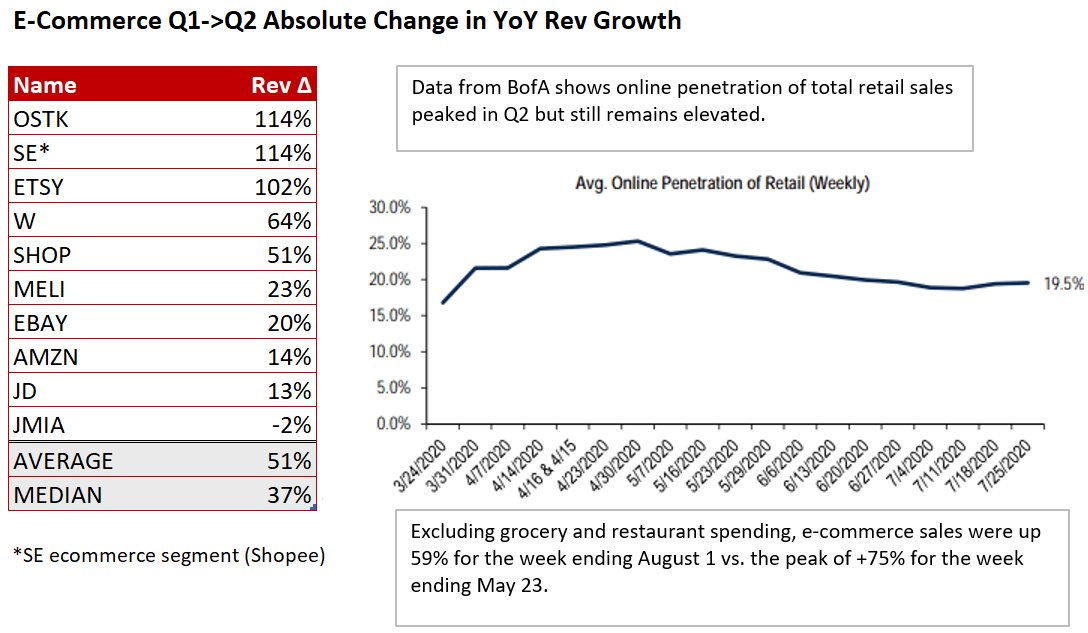

Q2 showed the pandemic provided the biggest boon to e-commerce. Looking to Q3, data points to continued strength in online shopping. E-commerce growth for the week ending Aug 1 rose 71% YoY. That # is consistent with the Q3 growth recorded in the prior few weeks...

$SHOP $AMZN

$SHOP $AMZN

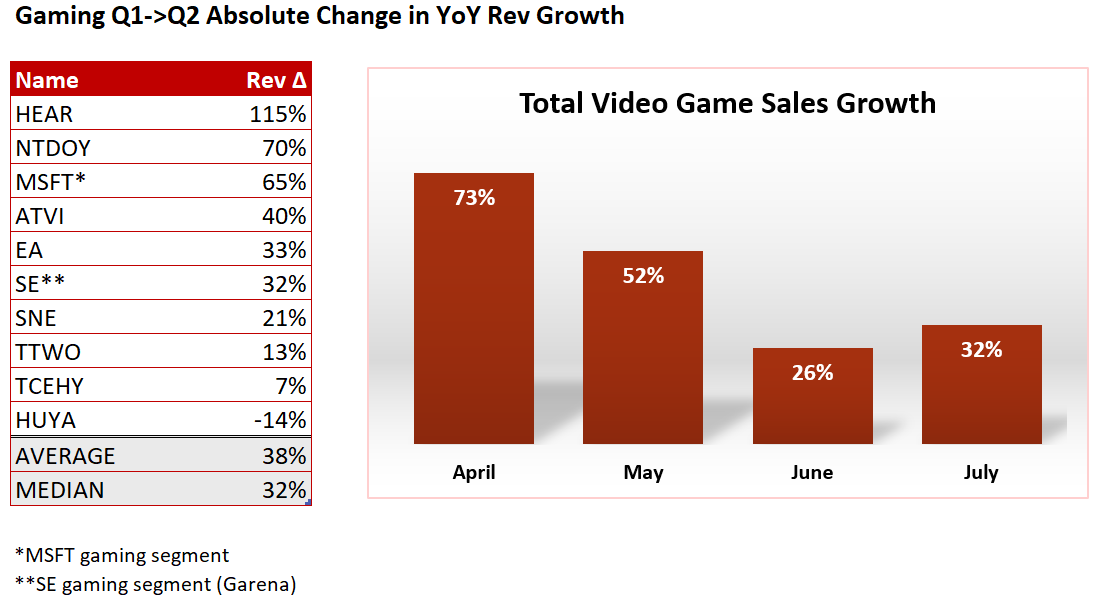

Not far behind e-commerce in Q2 was gaming. Video game sales hit a record in Q2, rising 30% YoY. Growth re-accelerated in July to 32% YoY, bringing YTD sales growth to 21%. COVID provided a predictable tailwind for gaming, and data points to continued strength in Q3.

$ATVI $TTWO

$ATVI $TTWO

Read on Twitter

Read on Twitter