1/ $NXM has done a monster run up, this past month alone but why? Is it really just because people are starting to realise the demand for an Insurance product in DeFi or is there another reason why?

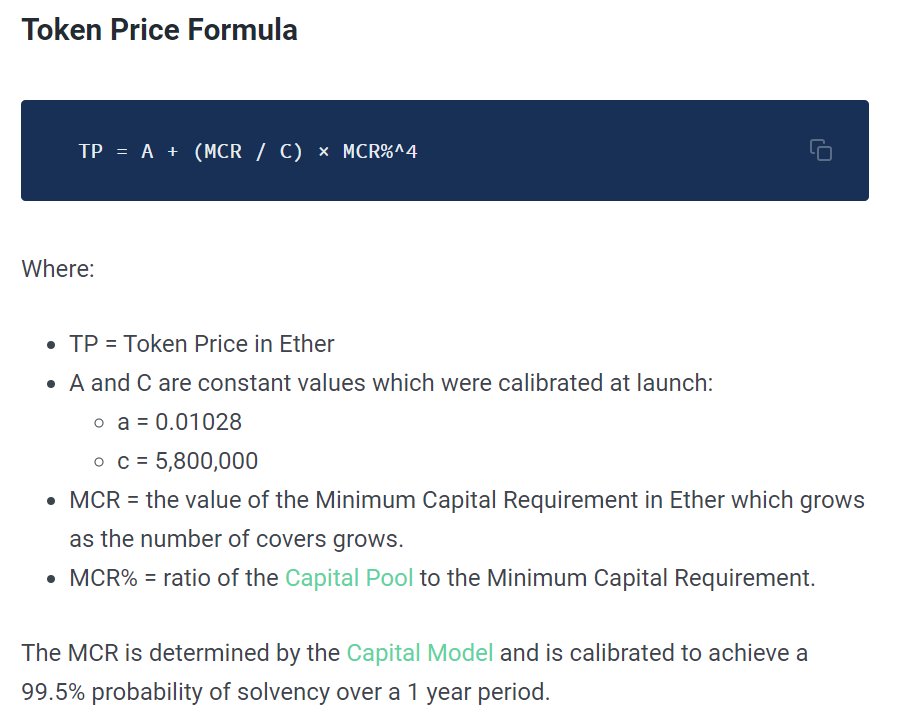

2/ Few understand this but, NXM’s token price doesn’t work like a normal coin, instead it works following a bonding curve:

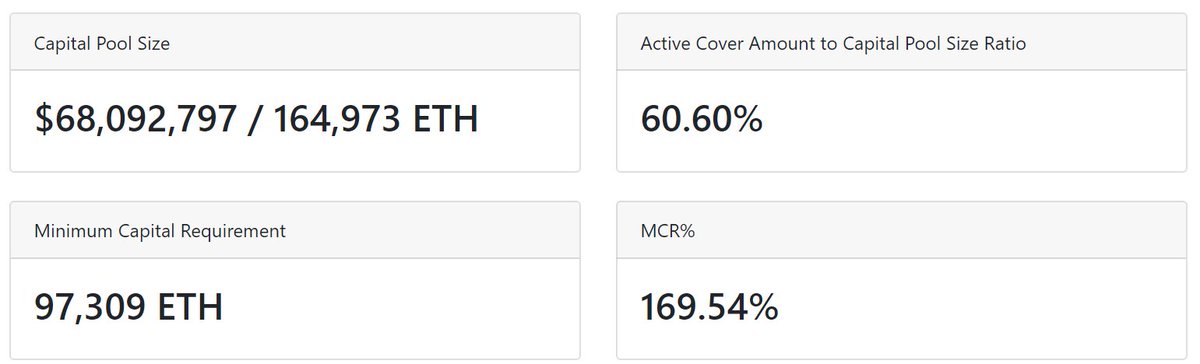

3/ So from this formula you see that we need the MCR and the MCR%.

Think of it as:

MCR - Minimum Amount Nexus Mutual needs to operate

MCR% - Capital Pool Size over Minimum Capital Requirement

Krugman does a good thread here : https://twitter.com/krugman25/status/1292500127047979014

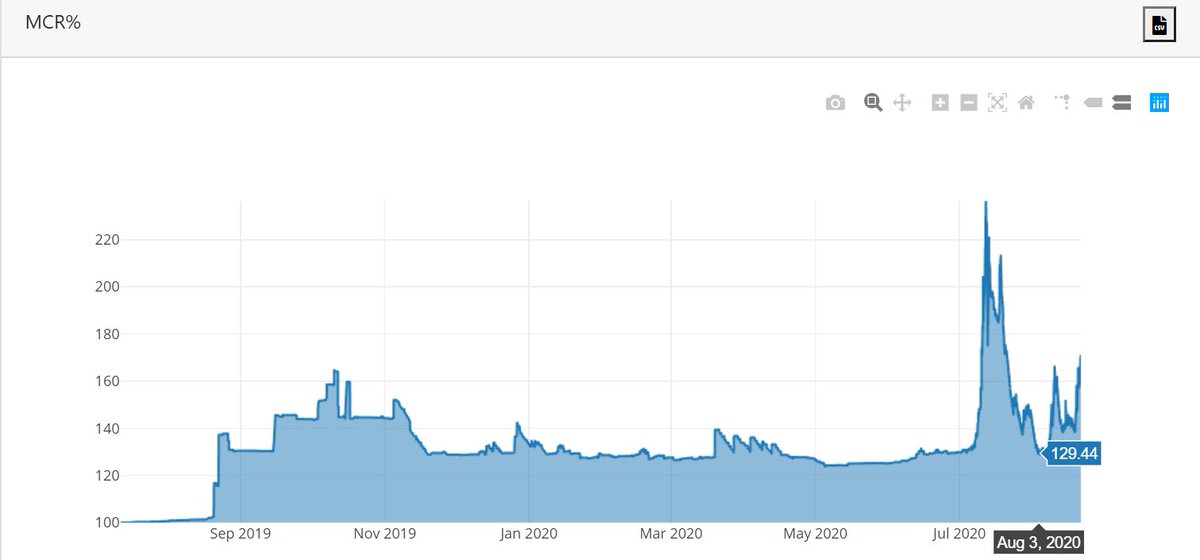

Think of it as:

MCR - Minimum Amount Nexus Mutual needs to operate

MCR% - Capital Pool Size over Minimum Capital Requirement

Krugman does a good thread here : https://twitter.com/krugman25/status/1292500127047979014

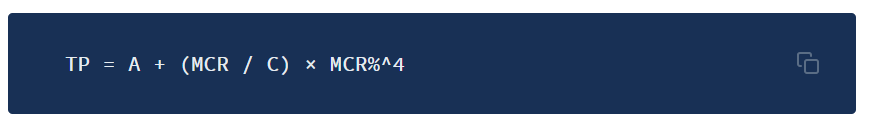

4/ On July 19th, this proposal took place https://forum.nexusmutual.io/t/capital-scaling/63, where MCR changed from increasing by 1% every 24 hours to increasing 1% every 4 hours until MCR hits 100k ETH. What does this to have to do with the price?

5/ If you look at the formula, MCR% has a big effect on the price because it is ^4, so when MCR increases, MCR% will decrease and the magnitude of this decrease will be bigger on the price

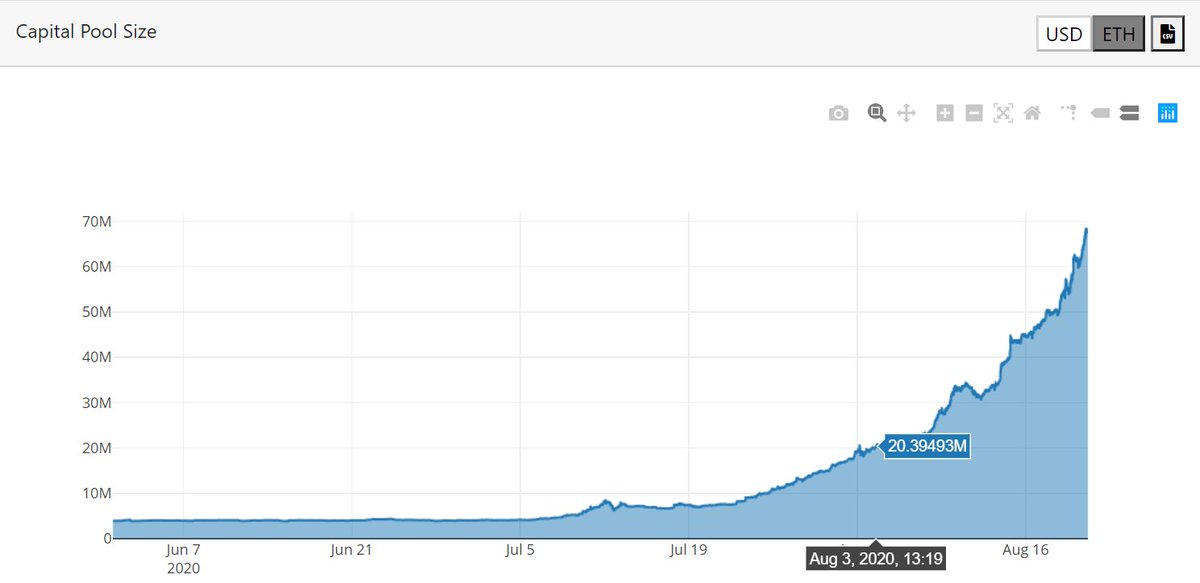

6/ The MCR stops increasing when the MCR% hits below 130% which it did in Aug 3 and actually hovered around there even till Aug 6. Because the MCR stops increasing then, this would have been a good time for entries because this would be the price floor (unless someone sells)

7/ And if we look at the Capital Pool Size (which is the amount of ETH) that is held by the Mutual which increases as buys come in, it was only around $20M in August 3, it has since tripled to $60M which a large amount of buys coming in this past 3 weeks

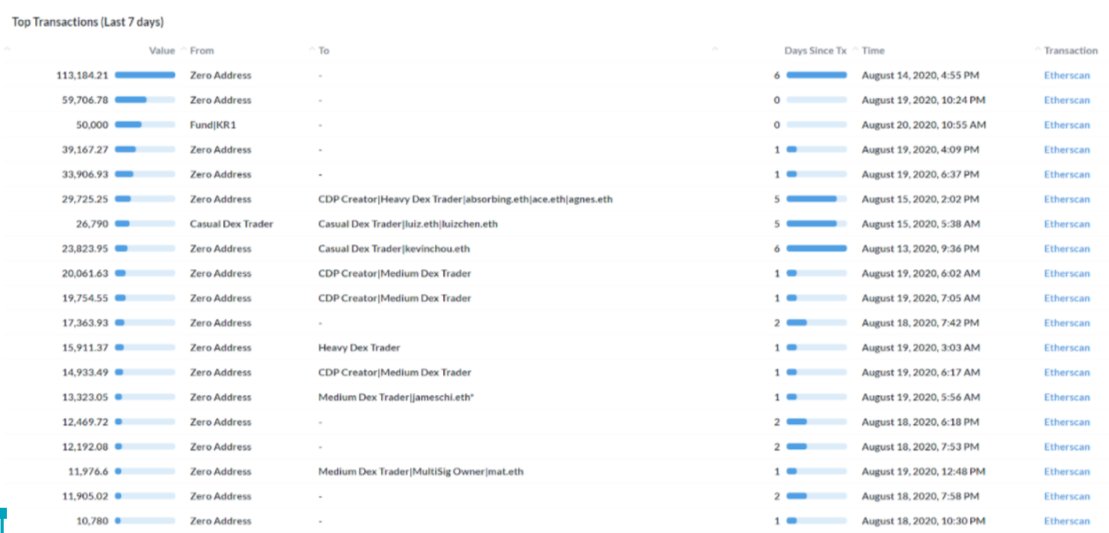

8/ If we’re just looking at the top 19 transactions this last 7 days alone, the average buy was 28,261.89 NXM which is about $140,000.

But this is heavily skewed by buys from this ETH whale:

https://etherscan.io/token/0xd7c49cee7e9188cca6ad8ff264c1da2e69d4cf3b?a=0xd1bda2c21d73ee31a0d3fdcd64b0d7c4bce6d021

Who has bought 259,379.89NXM for 21501.3494568 ETH

But this is heavily skewed by buys from this ETH whale:

https://etherscan.io/token/0xd7c49cee7e9188cca6ad8ff264c1da2e69d4cf3b?a=0xd1bda2c21d73ee31a0d3fdcd64b0d7c4bce6d021

Who has bought 259,379.89NXM for 21501.3494568 ETH

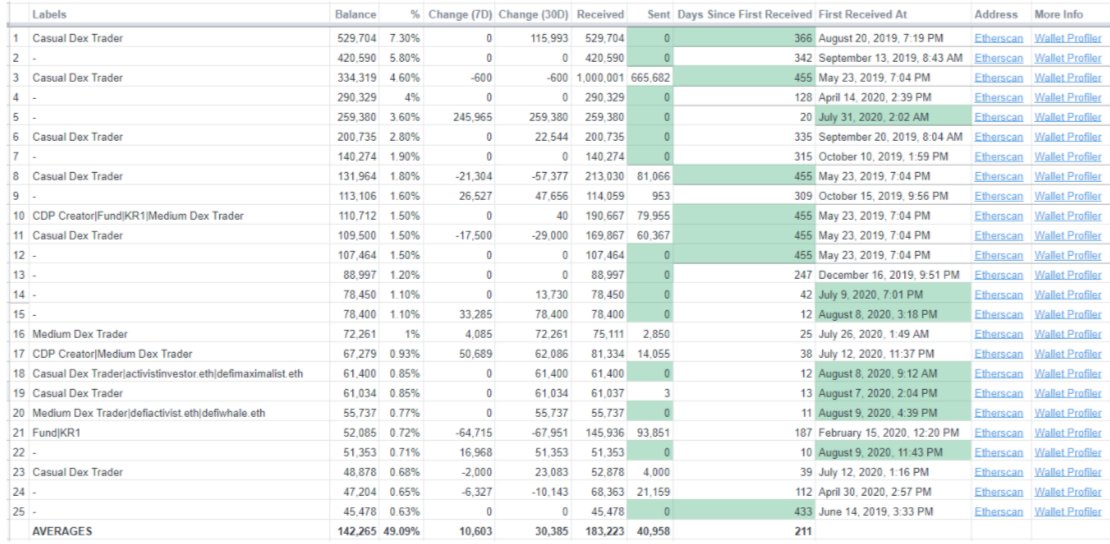

9/ If you look at the top 25 addresses that hold NXM (excluding contracts), they control 50% of ~supply, (3,556,633 NXM) and 21% of this was only bought this month alone.

On average these holders have 142,265 NXM which is 7M at current prices….

On average these holders have 142,265 NXM which is 7M at current prices….

10/ But 7 of which are early supporters of the project, receiving tokens more than a year ago while another 7 of them first bought their tokens this month, which shows a healthy mix of both old and new supporters.

11/ If you look at the overall distribution, 50% of the addresses that hold $NXM bought in the last 30 days and now control 23.5% of supply. This shows a ramping increase in excitement over $NXM this past month

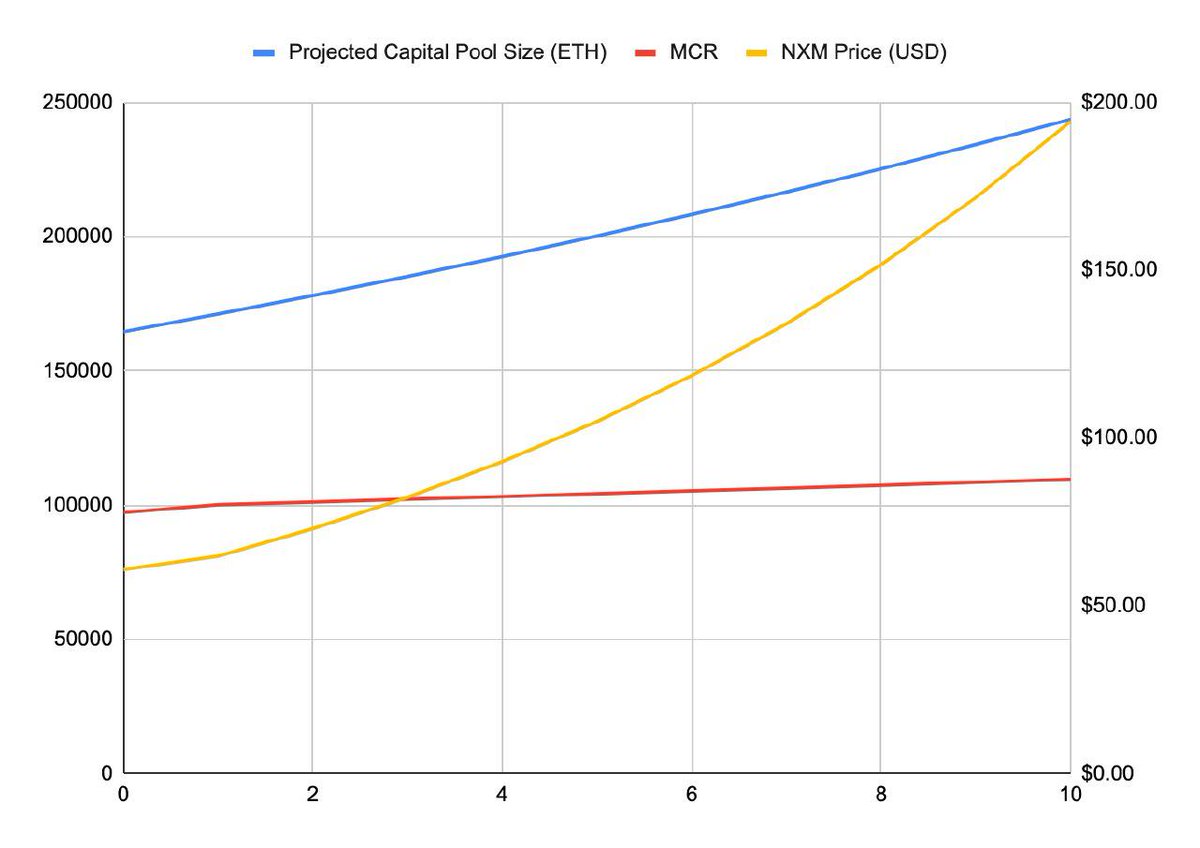

12/ With all these buys, the Capital Pool Size has skyrocketed to 164,973 ETH and the MCR is now at 97,309 ETH. This will increase by 1% every 4 hours.

So that means at 2PM UTC the MCR will stop increasing by 1% every 4 hours and only increase by 1% every 24 hours instead

So that means at 2PM UTC the MCR will stop increasing by 1% every 4 hours and only increase by 1% every 24 hours instead

13/ And this is the moment that everyone’s been waiting for.

Why? Because the heaviest limiter on the price would be lifted. Looking at the previous run in July 9 to July 12, the Capital Pool Size increased by 60% but the price increased by nearly 4x, back when MCR increased 1%

Why? Because the heaviest limiter on the price would be lifted. Looking at the previous run in July 9 to July 12, the Capital Pool Size increased by 60% but the price increased by nearly 4x, back when MCR increased 1%

14/ But for this run alone from the MCR% hitting 130% on Aug 3rd to now, the Capital Pool Size has already tripled from 20M to 60M now.

15/ Even If you look at the past 6 hours alone, large buys are still coming in:

https://etherscan.io/tx/0x520fb5c5a0023a56ce45bef639a17f0c27e0bbcfd8c6d01b52c6127279e55ba7 600 ETH

https://etherscan.io/tx/0xcb44a76c9c3b9c626c2a387baf5aedcc411506cfa36a9e51f49ef7dc10cda52b 300 ETH

https://etherscan.io/tx/0x30ffba90967e766b76a86ff57405f3d50081fed4c4cf322e9ec2b7bdcd72e3bc 260 ETH

https://etherscan.io/tx/0x3de48cc1f749950193863f49961e350563e2743f1d1e636d424add107b278f6a 260 ETH

https://etherscan.io/tx/0xb8e8a8005f6ef50ad1e0de9a25cd7ef92b7f8c1b73bb6269575aa6bce94e8952 200 ETH

https://etherscan.io/tx/0x520fb5c5a0023a56ce45bef639a17f0c27e0bbcfd8c6d01b52c6127279e55ba7 600 ETH

https://etherscan.io/tx/0xcb44a76c9c3b9c626c2a387baf5aedcc411506cfa36a9e51f49ef7dc10cda52b 300 ETH

https://etherscan.io/tx/0x30ffba90967e766b76a86ff57405f3d50081fed4c4cf322e9ec2b7bdcd72e3bc 260 ETH

https://etherscan.io/tx/0x3de48cc1f749950193863f49961e350563e2743f1d1e636d424add107b278f6a 260 ETH

https://etherscan.io/tx/0xb8e8a8005f6ef50ad1e0de9a25cd7ef92b7f8c1b73bb6269575aa6bce94e8952 200 ETH

16/ If we take the median growth rate of 4% a day and project it to the next 3 weeks, there’s potential for massive appreciation in value. Note :this depends on a significant increase in ETH inflows and contingent on recent additions being long-term, sticky capital

17/ Full disclaimer : Long $NXM.

Have posted this thread in my medium here, https://medium.com/@darrenlautf/nexus-mutual-21-8-20-3ee45c0f46bc

Will post more analysis over the coming weeks on other projects that catch my interest :D

Have posted this thread in my medium here, https://medium.com/@darrenlautf/nexus-mutual-21-8-20-3ee45c0f46bc

Will post more analysis over the coming weeks on other projects that catch my interest :D

Read on Twitter

Read on Twitter