Reasons to remain bullish on #Gold - a thread (1/7).

I wrote a post back in May on why I’m holding gold. Given the recent rise and correction I thought it worth revisiting the position.

Original post can be found here:

https://ben-the-trader.com/gold-why-im-holding-the-shiny-stuff/

I wrote a post back in May on why I’m holding gold. Given the recent rise and correction I thought it worth revisiting the position.

Original post can be found here:

https://ben-the-trader.com/gold-why-im-holding-the-shiny-stuff/

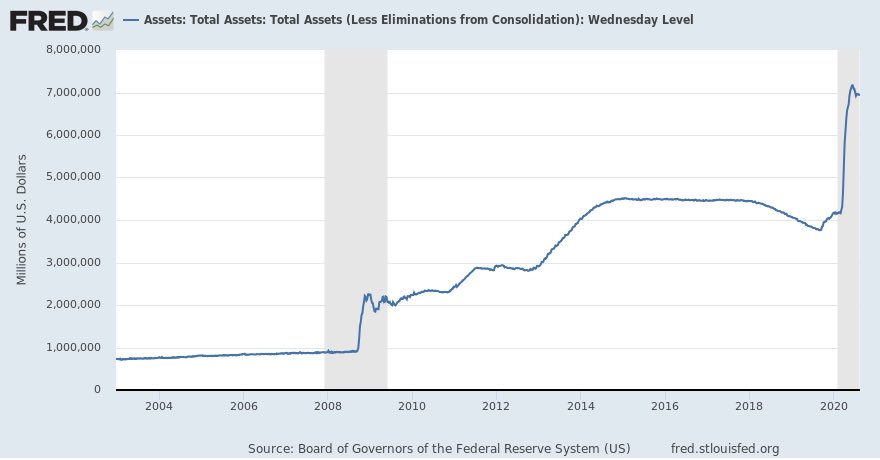

(2/7) The #Fed still remains committed to unparalleled levels of money printing. Whilst the balance sheet has more or less remained flat for a month, you can’t ignore the $7 Trillion of assets.

(3/7) The US dollar continues its bearish trend. Even if you’re not full on bullish gold, if you’re bearish on the $DXY then by default you are to some degree a gold bull.

(4/7) General geopolitical uncertainty continues. From the US-China ongoing relationship saga, civil unrest across the globe, a looming US presidential election, not to matter a small thing called #Covid_19... Having a hedging allocation in precious metals feels sensible.

(5/7) Interest rates are not going anywhere soon, well at least not upwards! Reference the Fed’s dot plot on members expectations below. This means the non income bearing property of gold becomes much less relevant, compared to say bonds.

(6/7) Buffett has, uncharacteristically bought shares in Barrick Gold. Whilst it is admittedly a small one we don’t know what might be revealed in future disclosures. It also may pave the way for more institutional money to follow suit. #buffett #barrick

(7/7) Feedback from the pros welcome! What have I missed? If you want to keep on the #gold pulse, follow these great accounts.

@hmeisler

@EdVanDerWalt

@GoldTelegraph_

@RonStoeferle

@LawrenceLepard

@IGWTreport

@PeterSchiff

@Caseforsilver

@hmeisler

@EdVanDerWalt

@GoldTelegraph_

@RonStoeferle

@LawrenceLepard

@IGWTreport

@PeterSchiff

@Caseforsilver

Read on Twitter

Read on Twitter