A paradox of this economic crisis:

Employment is 13 million below its pre-Covid peak

Employment is 13 million below its pre-Covid peak

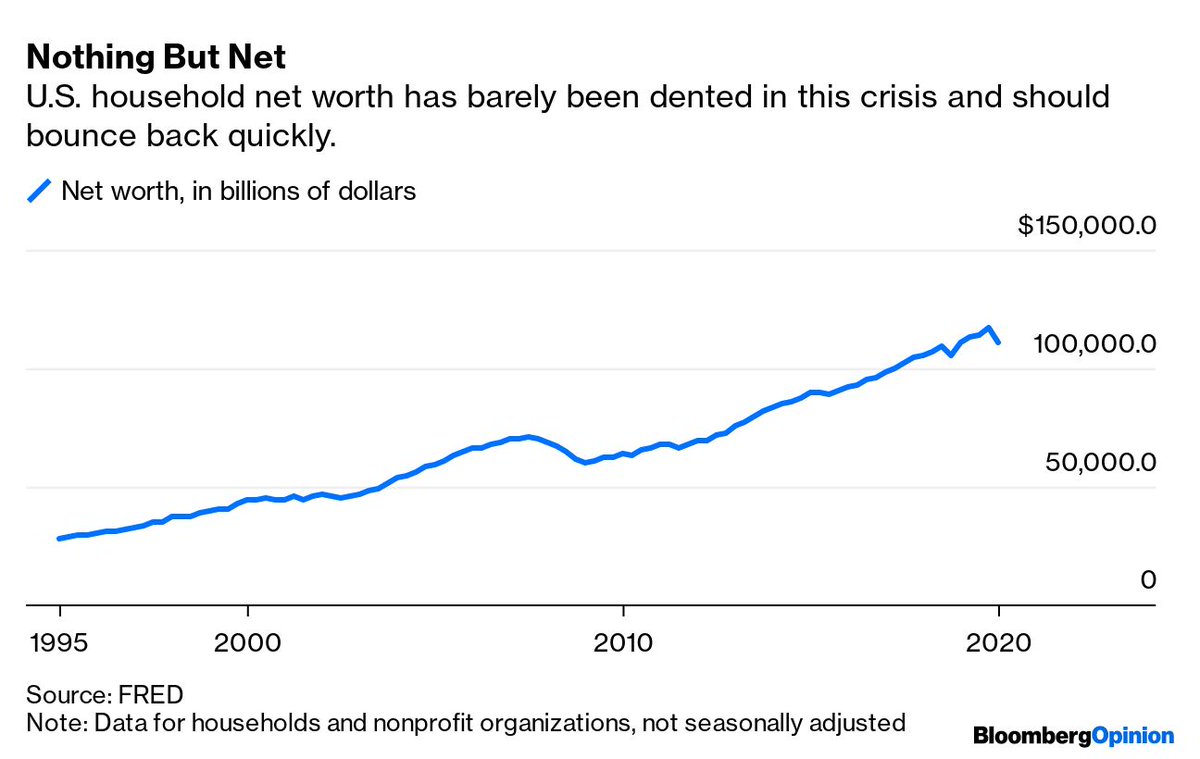

The net worth of American households may be at a record high, thanks to the soaring prices of stocks and homes https://trib.al/gP2brm9

The net worth of American households may be at a record high, thanks to the soaring prices of stocks and homes https://trib.al/gP2brm9

Employment is 13 million below its pre-Covid peak

Employment is 13 million below its pre-Covid peak The net worth of American households may be at a record high, thanks to the soaring prices of stocks and homes https://trib.al/gP2brm9

The net worth of American households may be at a record high, thanks to the soaring prices of stocks and homes https://trib.al/gP2brm9

It's an important difference from the recovery after the 2008 financial crisis.

Then, households spent five years repairing their balance sheets. They largely won’t have to do that again this time, which could help fast-forward the economic recovery https://trib.al/gP2brm9

Then, households spent five years repairing their balance sheets. They largely won’t have to do that again this time, which could help fast-forward the economic recovery https://trib.al/gP2brm9

The recovery after 2008 took longer:

Home prices crashed

Home prices crashed

Equity cushions tanked

Equity cushions tanked

Investment portfolios were bruised

Investment portfolios were bruised

Inequality grew, with home values in working-class and non-white neighborhoods lagging behind those in wealthier neighborhoods https://trib.al/gP2brm9

Home prices crashed

Home prices crashed Equity cushions tanked

Equity cushions tanked Investment portfolios were bruised

Investment portfolios were bruisedInequality grew, with home values in working-class and non-white neighborhoods lagging behind those in wealthier neighborhoods https://trib.al/gP2brm9

Part of that recovery from 2008 involved years of households paying down debt, while the housing market sat in the doldrums.

That’s partly why the recession felt like it lasted for years, even if it technically ended in 2009 https://trib.al/gP2brm9

That’s partly why the recession felt like it lasted for years, even if it technically ended in 2009 https://trib.al/gP2brm9

The Great Recession struck at the heart of middle-class wealth:

Home equity

Home equity

Investment portfolios

Investment portfolios

That’s why it took households so long to recover from it both financially and psychologically https://trib.al/gP2brm9

Home equity

Home equity Investment portfolios

Investment portfoliosThat’s why it took households so long to recover from it both financially and psychologically https://trib.al/gP2brm9

Barring an unexpected crash in the stock market, households seem to be in very different shape in 2020.

Net worth fell by $7 trillion in the first quarter, the most recent for which we have data; but all of that was due to tumbling stock prices https://trib.al/gP2brm9

Net worth fell by $7 trillion in the first quarter, the most recent for which we have data; but all of that was due to tumbling stock prices https://trib.al/gP2brm9

With stocks now at all-time highs, and home prices with them, we should expect third-quarter data to show a new high for net worth https://trib.al/gP2brm9

This doesn't discount the hardship millions of households and small businesses, nor argue against the need for fiscal relief.

The nature of this crisis is unique: some have called it a K-shaped recovery, with stark differences between winners and losers https://trib.al/gP2brm9

The nature of this crisis is unique: some have called it a K-shaped recovery, with stark differences between winners and losers https://trib.al/gP2brm9

The good news is that while today’s unemployment situation may echo that of 2009, household balance sheets are in much better shape.

We're not likely to go through years of a foreclosure crisis or households paying down debt https://trib.al/gP2brm9

We're not likely to go through years of a foreclosure crisis or households paying down debt https://trib.al/gP2brm9

The personal saving rate stands at 19%, versus a 2009 level of more like 5%, implying that at least some households have a significant cushion to spend more once they feel it's safe to do so https://trib.al/gP2brm9

Elevated levels of home equity could also kickstart a wave of small-business formation next year, perhaps offsetting some bankruptcies this year.

It couldn’t do this after 2008, when households lacked that excess equity https://trib.al/gP2brm9

It couldn’t do this after 2008, when households lacked that excess equity https://trib.al/gP2brm9

It remains the case that a sustainable economic recovery starts with getting the virus under control.

But once we do so, there are reasons to believe we're in a much better position to have a robust recovery than we were in 2009 https://trib.al/gP2brm9

But once we do so, there are reasons to believe we're in a much better position to have a robust recovery than we were in 2009 https://trib.al/gP2brm9

Read on Twitter

Read on Twitter