In 2018, SIFMA published a study on NYSE market data prices showing just how staggering the fee increases have been.

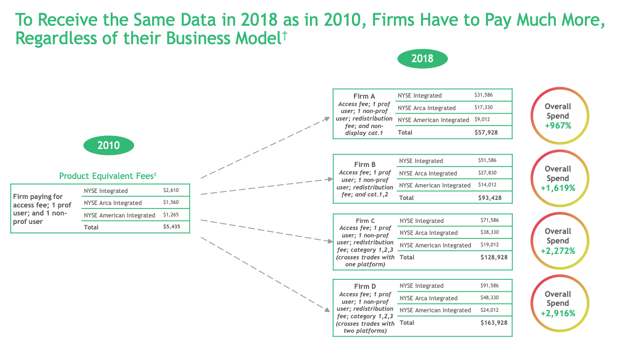

From 2010 to 2018, monthly exchange access fees rose as high as 2,916% to view the SAME DATA:

From 2010 to 2018, monthly exchange access fees rose as high as 2,916% to view the SAME DATA:

Lets put that into perspective:

In 2010 a Big Mac in the United States cost $3.58.

A 2,916% increase by 2018 would mean that same Big Mac would cost $107.98.

Would you accept that?

In 2010 a Big Mac in the United States cost $3.58.

A 2,916% increase by 2018 would mean that same Big Mac would cost $107.98.

Would you accept that?

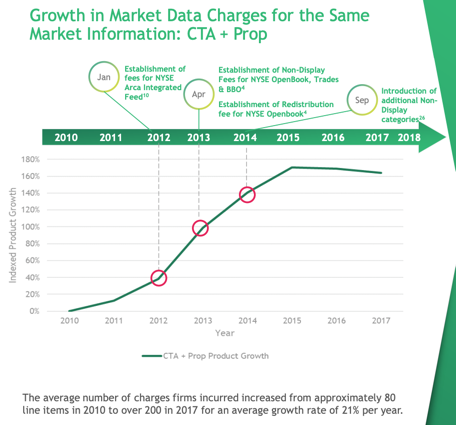

The pushback to this would be "the value of NYSE exchange data went up along with prices".

While it's hard to measure, I personally need more proof of this.

Prices have been allowed to go up as much as they have bc top HFTs are willing to pay more to be fastest.

While it's hard to measure, I personally need more proof of this.

Prices have been allowed to go up as much as they have bc top HFTs are willing to pay more to be fastest.

Sources:

https://www.sifma.org/wp-content/uploads/2019/01/Expand-and-SIFMA-An-Analysis-of-Market-Data-Fees-08-2018.pdf http://bigmacindex.org/2010-big-mac-index.html

https://www.sifma.org/wp-content/uploads/2019/01/Expand-and-SIFMA-An-Analysis-of-Market-Data-Fees-08-2018.pdf http://bigmacindex.org/2010-big-mac-index.html

Read on Twitter

Read on Twitter