1/ When evaluating a company's growth prospects, its best to take a broad view (as broad as possible) of the market, the macroenvironment, the company's strategy, operations and competition. Only then, after developing this fundamental understanding, should one drill down.

2/ Some of our friends in $TSLAQ are eager to use data from smaller markets, markets where data is freely and readily available, to extrapolate/ reach conclusions that support their bias. These conclusions are then extended to the broader business. There are many such examples...

3/ ..of this practice, and each example suffers from the same limitation. Unless $TSLA is analyzed from a macro level with a clear view of the global operations and a deep understanding of the company's strategy, its easy reach the wrong conclusion(s) with cherry-picked data.

4/ The most obvious example of this exact phenomenon is the $TSLAQ position on Tesla's sales in Norway.

The thesis is: $TSLA has had a monopoly on the EV market for years, and now that "competition has arrived", $TSLA's market share has dropped. The proof? Model S/X share...

Model S/X share...

The thesis is: $TSLA has had a monopoly on the EV market for years, and now that "competition has arrived", $TSLA's market share has dropped. The proof?

Model S/X share...

Model S/X share...

5/ ...and declining Model 3 sales in 2020. Conclusion = once the backlog is filled, the same will happen in all markets, and eventually, $TSLA's sales will terminally decline unless DEEP price cuts occur = growth story dead & poor financial performance.

Here's why this is WRONG

Here's why this is WRONG

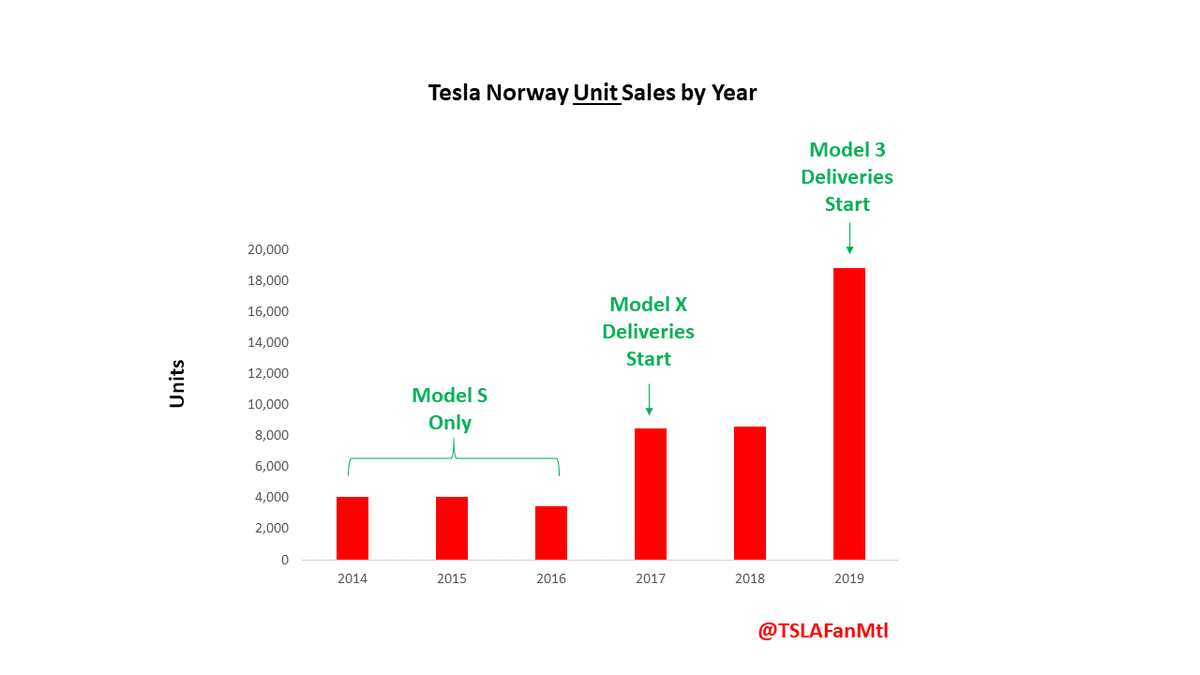

6/ Here are Tesla's Norway sales since 2014. Note - I have excluded 2020 since we do not yet have a full year of data. However, Tesla's Norway deliveries are as follows (as of Aug 20):

Model 3 =1821

Model S = 101

Model X = 213

These numbers will improve before EoQ as...

Model 3 =1821

Model S = 101

Model X = 213

These numbers will improve before EoQ as...

7/ Boats with EU inventory for Q3 are only just arriving.

It should be noted that Fremont was closed from March 23 to May 11 - leaving only 3 weeks in May for $TSLA to build/ship cars internationally, impacting Q2.

Also noteworthy, Tesla shifted GA4 to Model Y in Q1. This...

It should be noted that Fremont was closed from March 23 to May 11 - leaving only 3 weeks in May for $TSLA to build/ship cars internationally, impacting Q2.

Also noteworthy, Tesla shifted GA4 to Model Y in Q1. This...

8/...has removed ~300 Model 3s/day from production, lowering $TSLA's M3 production by 2.1k/week. Less Model 3 supply = less cars available for EU = lower EU sales.

Now, we have established why 2020 is a down year for $TSLA in EU, let's focus on , specifically. See this table

, specifically. See this table

Now, we have established why 2020 is a down year for $TSLA in EU, let's focus on

, specifically. See this table

, specifically. See this table

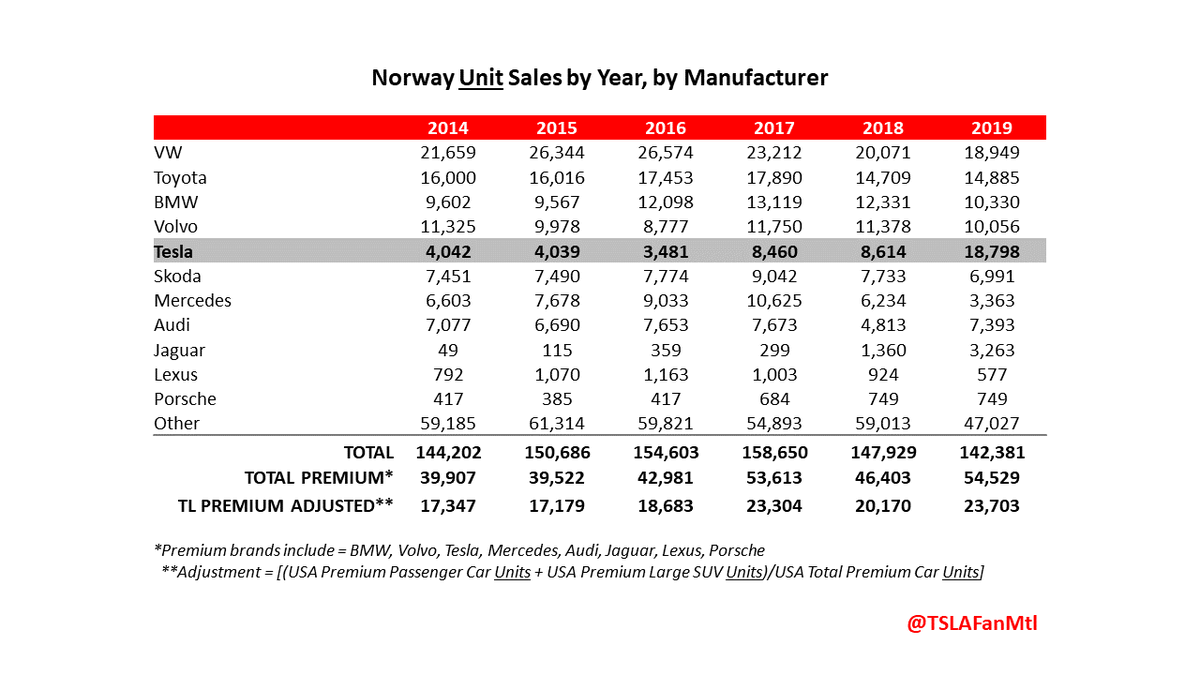

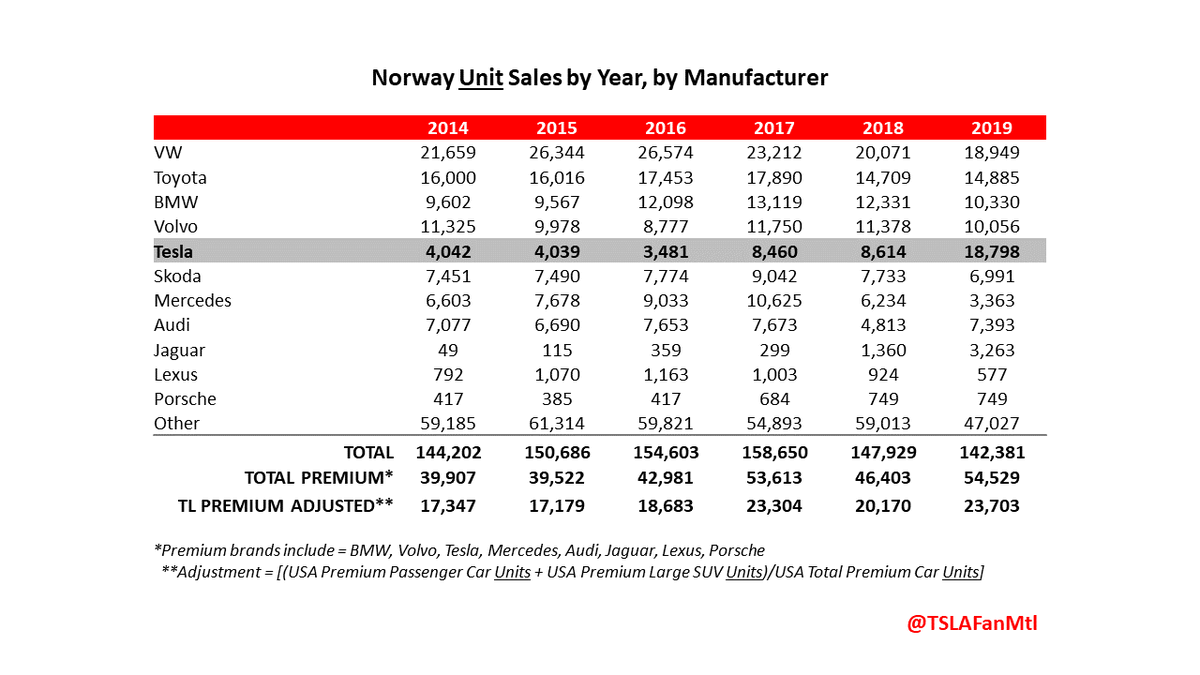

9/ This table breaks down Norway vehicle sales, by brand, by year. You will notice the market is TINY (~150k unit sales/yr). I broke the market down further to "Premium " and "Adjusted Premium".

To understand which brands I included in the "Premium" segment, see the footnote.

To understand which brands I included in the "Premium" segment, see the footnote.

10/ The "Adjusted Premium" segment is the share of the market in which Tesla competes. Given that Tesla has only had 3 models to sell, it cannot possibly address the entire Premium market in Norway. In 2021, with the Model Y, this will change, as Tesla's addressable market

11/ To determine the proportion of sales units to attribute to this "Adjusted Premium " segment, I leveraged total market data of the USA from http://autocharts.info . See 2nd footnote on the slide.

It's important to define $TSLA sales relative to the whole market, not just..

It's important to define $TSLA sales relative to the whole market, not just..

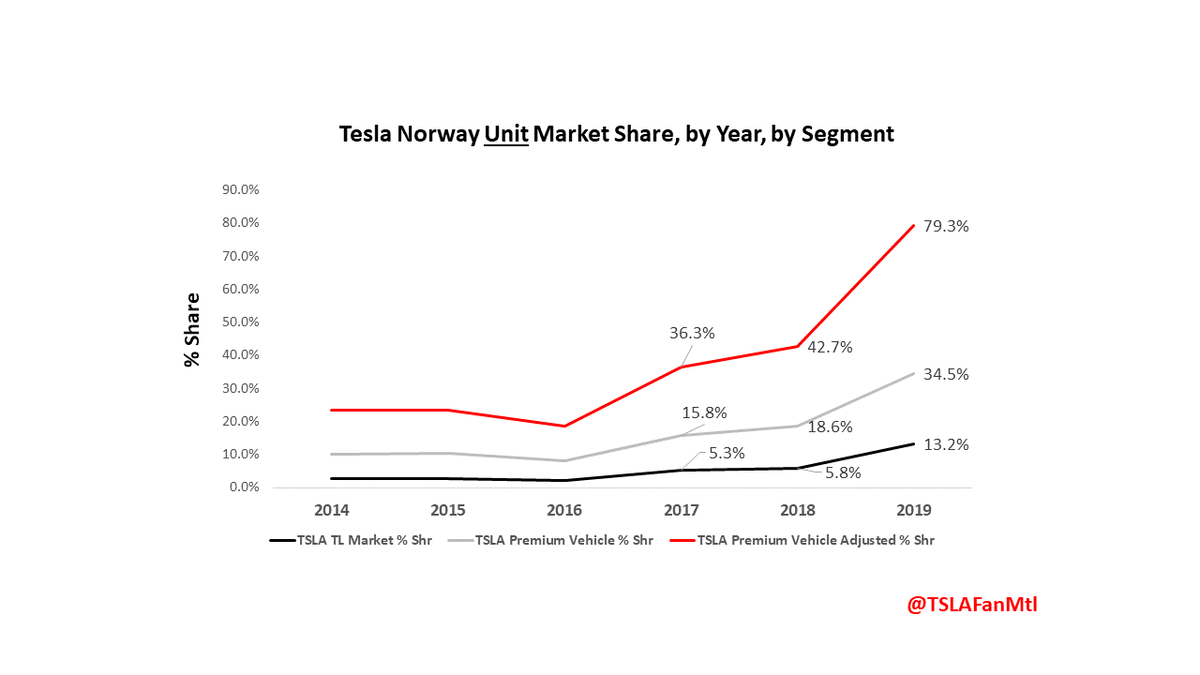

12/ ...EVs, as $TSLA pulls share from other manufacturers. We see this in Norway: as Tesla sales  over the years, its overall share increases - all other vehicle share decreases. When we drill down further to the subsegments, this share gain is greatly MAGNIFIED.

over the years, its overall share increases - all other vehicle share decreases. When we drill down further to the subsegments, this share gain is greatly MAGNIFIED.

over the years, its overall share increases - all other vehicle share decreases. When we drill down further to the subsegments, this share gain is greatly MAGNIFIED.

over the years, its overall share increases - all other vehicle share decreases. When we drill down further to the subsegments, this share gain is greatly MAGNIFIED.

13/ What I find incredible is that $TSLAQ love to cite Norway data, but they completely neglect to acknowledge this fact, and they absolutely refuse to expect this trend to repeat in other markets.

EVs are... https://twitter.com/TSLAFanMtl/status/1278150894673186817?s=19

EVs are... https://twitter.com/TSLAFanMtl/status/1278150894673186817?s=19

14/...substitutes for gas cars as much as they are substitutes for other EVs.

Getting back to Norway...these market share numbers are MASSIVE. So why the drop in 2020? Outside of everything I already discussed regarding COVID & Model Y production, there is another BIG reason...

Getting back to Norway...these market share numbers are MASSIVE. So why the drop in 2020? Outside of everything I already discussed regarding COVID & Model Y production, there is another BIG reason...

15/ And that reason, is $TSLA's performance in 2019. Allow me to elaborate. 2019 was the 1st year that $TSLA shipped the Model 3 internationally. Norway, being the market with the highest EV penetration per capita, clearly showed a lot of interest in the M3. When we look at...

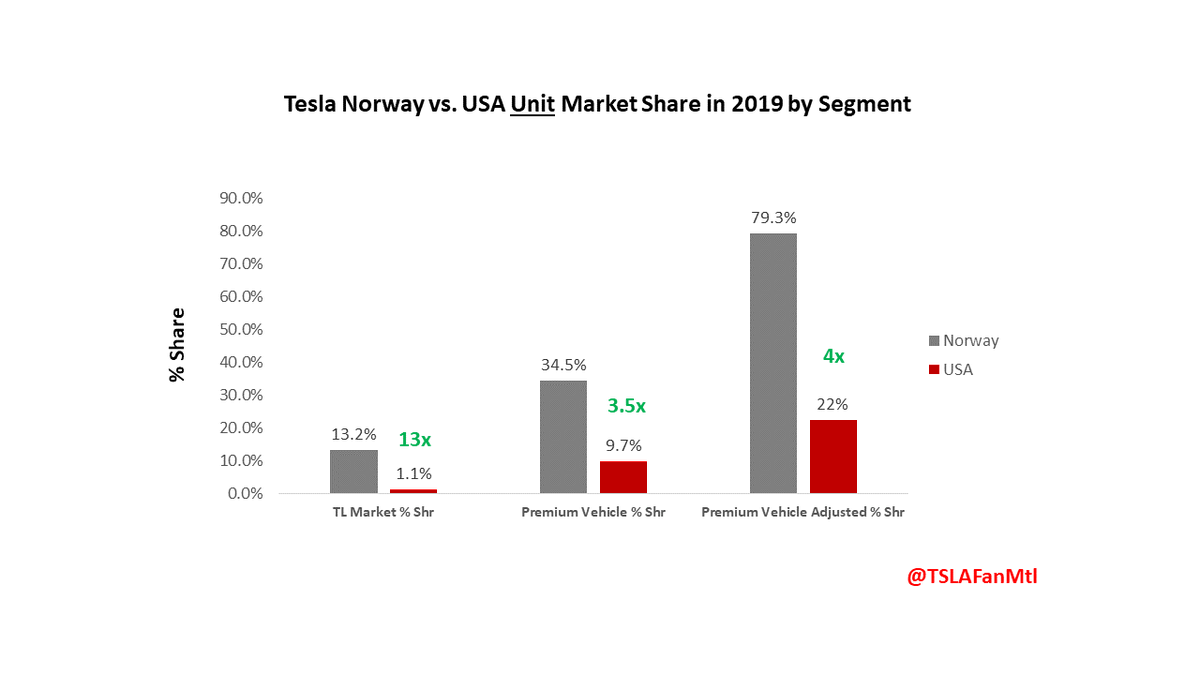

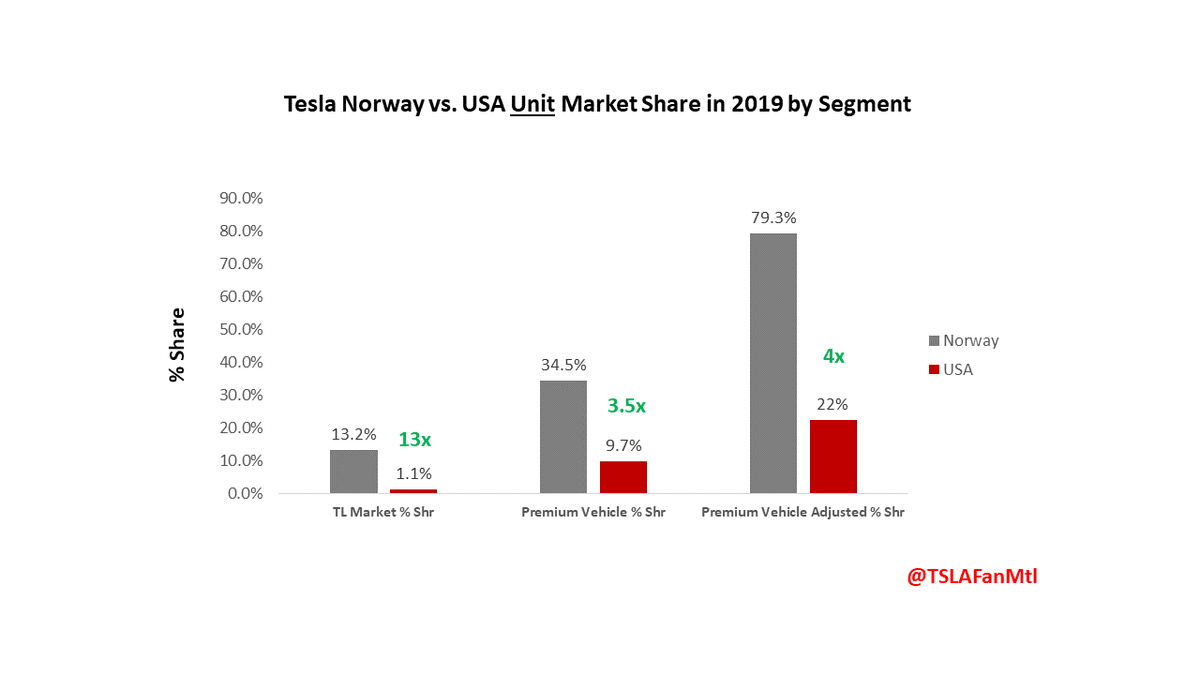

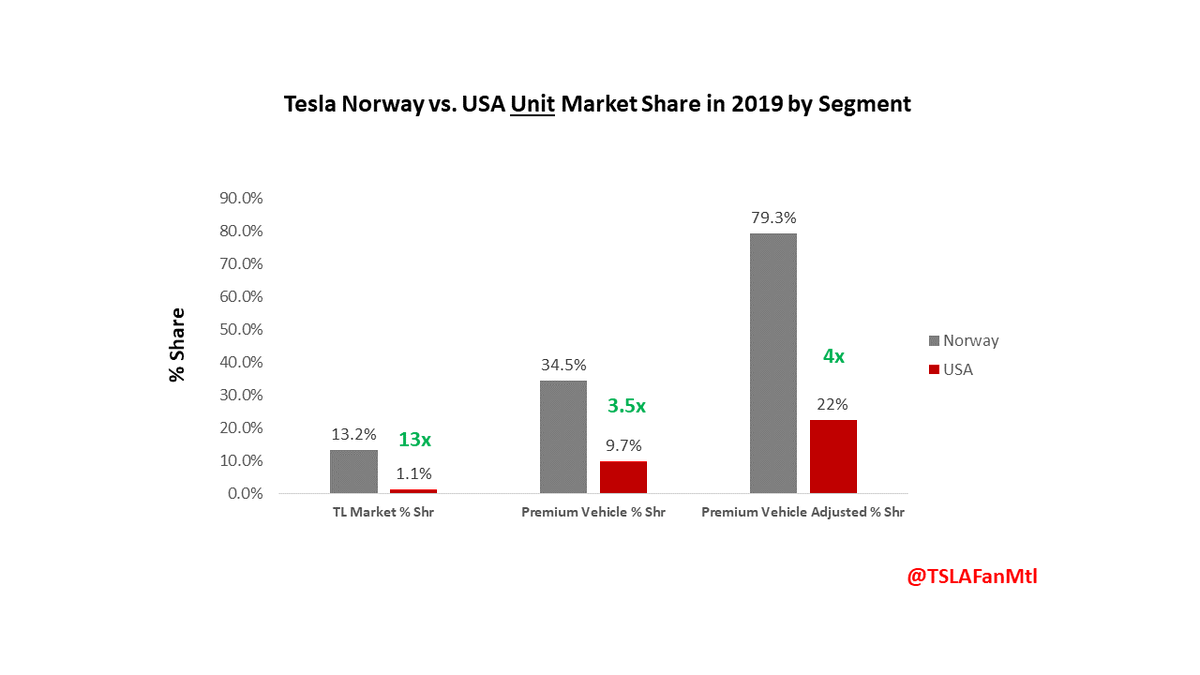

16/ ...$TSLA's Norway 2019 shares:

13% of TOTAL market

35% of Premium vehicle market

79% of Adjusted Premium vehicle market

We can see that this year was not a "normal" year, even by Norway standards. To illustrate this, let's compare with a reference market = the U.S.A.

13% of TOTAL market

35% of Premium vehicle market

79% of Adjusted Premium vehicle market

We can see that this year was not a "normal" year, even by Norway standards. To illustrate this, let's compare with a reference market = the U.S.A.

17/ I picked the USA because:

1. Its a large market and large sample

2. Its $TSLA's home market, with good supply from all players

3. Its where Teslas are appropriately priced relative to Premium OEM competitors

4. We have pretty good data from http://autocharts.info

1. Its a large market and large sample

2. Its $TSLA's home market, with good supply from all players

3. Its where Teslas are appropriately priced relative to Premium OEM competitors

4. We have pretty good data from http://autocharts.info

18/ When comparing Norway to our reference market, we see that $TSLA's share gains in Norway are MULTIPLES higher than its share in the USA.

Put simply, $TSLA's share in Norway is vastly over-indexed (4-13x depending on how you examine the market). This over-index...

Put simply, $TSLA's share in Norway is vastly over-indexed (4-13x depending on how you examine the market). This over-index...

19/...was at its HIGHEST in 2019, when Tesla introduced Model 3, well beyond an "organic" or "normal" share level, which is ~20% of addressable market, per the US data.

Why? I believe this is mainly due to pent-up demand from 2017 & 2018 being filled in 2019, artificially..

Why? I believe this is mainly due to pent-up demand from 2017 & 2018 being filled in 2019, artificially..

20/...inflating 2019 and making comparisons to 2020 even worse.

When looking at all of this information together, one should even EXPECT a terrible 2020 in Norway (relative to 2019). This is NOT "proof" of anything other than the importance of properly understanding...

When looking at all of this information together, one should even EXPECT a terrible 2020 in Norway (relative to 2019). This is NOT "proof" of anything other than the importance of properly understanding...

21/...the business.

Lets put Norway's 2019 performance into context. At 13% of total market units, Tesla would sell 2.2M cars in the US. In 2019, it sold under 200k.

Here's another example: to match the 2019 US % shr of premium cars, Tesla would need to sell 0 cars in ...

...

Lets put Norway's 2019 performance into context. At 13% of total market units, Tesla would sell 2.2M cars in the US. In 2019, it sold under 200k.

Here's another example: to match the 2019 US % shr of premium cars, Tesla would need to sell 0 cars in

...

...

22/ in both 2021 and 2022, which when added to its Norway sales from 2019, would then average to the US shr % in 2019.

This is *not* normal. YoY comparisons without the right context is foolish. Not understanding what's behind the numbers and cherry picking data is foolish.

This is *not* normal. YoY comparisons without the right context is foolish. Not understanding what's behind the numbers and cherry picking data is foolish.

23/ Extrapolating Norway (150k sales/yr) to the global market without understanding the market dynamics is FOOLISH.

The next time you read someone quote Norway Tesla sales and conclude that Tesla is facing impending doom, plz direct them to this thread.

$TSLA is not in decline

The next time you read someone quote Norway Tesla sales and conclude that Tesla is facing impending doom, plz direct them to this thread.

$TSLA is not in decline

Read on Twitter

Read on Twitter