New @IIPP_UCL working paper out on nature-related Financial Risks

New @IIPP_UCL working paper out on nature-related Financial Risks

We @jryancollins & Hugues Chenet argue that central banks & financial supervisors must take precautionary action to manage environmental risks beyond climate change.

https://www.ucl.ac.uk/bartlett/public-purpose/publications/2020/aug/managing-nature-related-financial-risks

[THREAD]

Nature loss encompasses a highly complex set of phenomena:

multiple interconnected threats

multiple interconnected threats

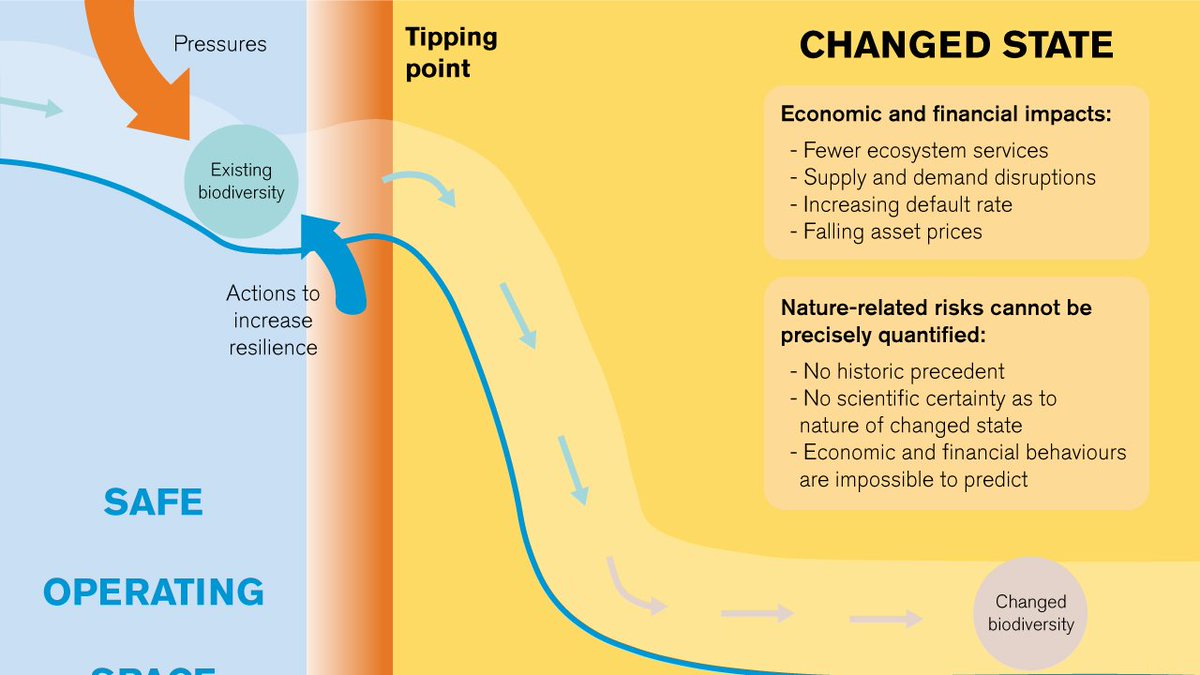

unprecedented irreversible impacts

unprecedented irreversible impacts

complex system dynamics, e.g. tipping points

complex system dynamics, e.g. tipping points

subject to 'radical uncertainty'

subject to 'radical uncertainty'

huge challenges for financial modelling

huge challenges for financial modelling

multiple interconnected threats

multiple interconnected threats unprecedented irreversible impacts

unprecedented irreversible impacts complex system dynamics, e.g. tipping points

complex system dynamics, e.g. tipping points subject to 'radical uncertainty'

subject to 'radical uncertainty' huge challenges for financial modelling

huge challenges for financial modelling

It is not clear that methodologies for information disclosure & quantitative risk estimates (e.g. Taskforce for Nature-related Financial Disclosures) can be sufficiently advanced in the time remaining for transformative action. https://www.theguardian.com/environment/2020/jun/01/sixth-mass-extinction-of-wildlife-accelerating-scientists-warn

Nature-related impacts are already occurring in the short-term, and well within financial and supervisory time horizons.

e.g. pollinator losses limiting crop production

https://www.weforum.org/agenda/2020/08/loss-of-bees-threatens-us-crop-yields/

https://www.weforum.org/agenda/2020/08/loss-of-bees-threatens-us-crop-yields/

e.g. pollinator losses limiting crop production

https://www.weforum.org/agenda/2020/08/loss-of-bees-threatens-us-crop-yields/

https://www.weforum.org/agenda/2020/08/loss-of-bees-threatens-us-crop-yields/

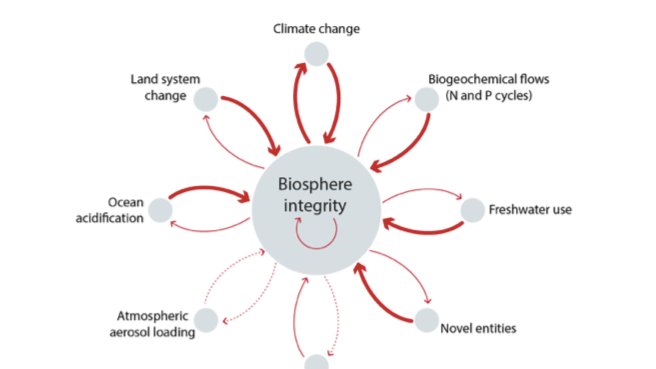

The climate crisis and broader environmental breakdown are intimately interconnected. Attempts to manage climate risk will be *underestimating* true impacts unless nature-related risk is also taken into account.

source: Steffen et al. 2015 https://science.sciencemag.org/content/347/6223/1259855

source: Steffen et al. 2015 https://science.sciencemag.org/content/347/6223/1259855

source: Steffen et al. 2015 https://science.sciencemag.org/content/347/6223/1259855

source: Steffen et al. 2015 https://science.sciencemag.org/content/347/6223/1259855

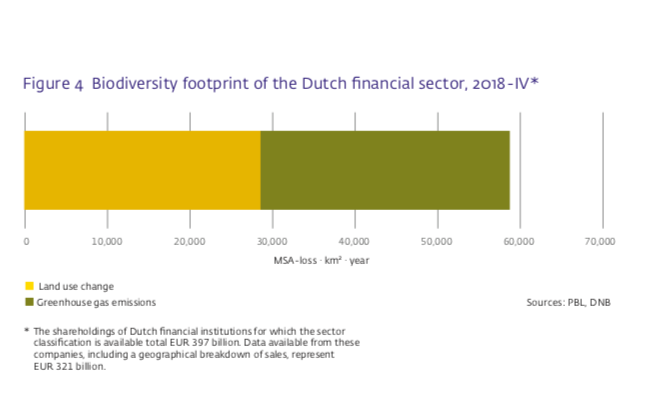

The financial sector is not only *exposed* to nature risks, but also *contributing* to them, through its lending, investing & advisory activities.

@DNB_NL estimate Dutch FIs responsible for nature loss equal to an area 1.7x larger than the Netherlands.

https://www.dnb.nl/en/news/news-and-archive/dnbulletin-2020/dnb389169.jsp

@DNB_NL estimate Dutch FIs responsible for nature loss equal to an area 1.7x larger than the Netherlands.

https://www.dnb.nl/en/news/news-and-archive/dnbulletin-2020/dnb389169.jsp

The failure of financial actors to cease facilitating harmful business practices risks ‘locking in’ future impacts.

Nature-related risks, therefore, may emerge endogenously from behaviours within the financial system itself.

@Global_Witness https://www.globalwitness.org/en/campaigns/forests/money-to-burn-how-iconic-banks-and-investors-fund-the-destruction-of-the-worlds-largest-rainforests/

Nature-related risks, therefore, may emerge endogenously from behaviours within the financial system itself.

@Global_Witness https://www.globalwitness.org/en/campaigns/forests/money-to-burn-how-iconic-banks-and-investors-fund-the-destruction-of-the-worlds-largest-rainforests/

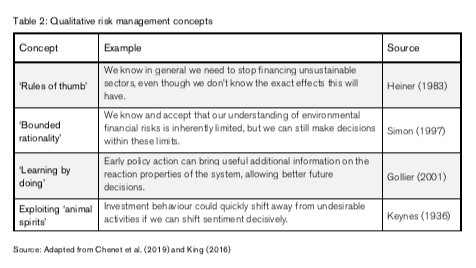

We argue for financial authorities to use a precautionary approach to managing nature-related risks:

Markets poorly manage systemic, endogenous risks

Markets poorly manage systemic, endogenous risks

Precise quantitative estimates may not be feasible...

Precise quantitative estimates may not be feasible...

... and waiting for them delays onset of urgent action

... and waiting for them delays onset of urgent action

Instead...

Markets poorly manage systemic, endogenous risks

Markets poorly manage systemic, endogenous risks Precise quantitative estimates may not be feasible...

Precise quantitative estimates may not be feasible... ... and waiting for them delays onset of urgent action

... and waiting for them delays onset of urgent actionInstead...

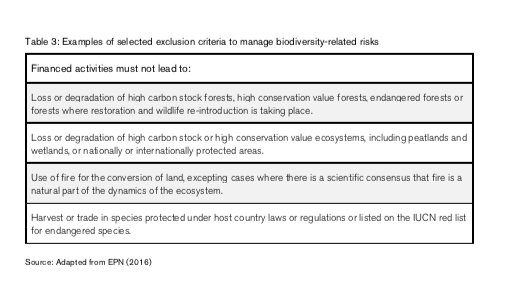

We suggest that central banks & supervisors determine – with govts – clearly harmful activities that cannot be financed in order to avoid critical natural tipping points.

Such an exclusionary list

exclusionary list can then determine eligibility criteria within monetary & prudential toolkits.

can then determine eligibility criteria within monetary & prudential toolkits.

Such an

exclusionary list

exclusionary list can then determine eligibility criteria within monetary & prudential toolkits.

can then determine eligibility criteria within monetary & prudential toolkits.

This requires financial authorities to embrace more of a 'market-shaping' role.

Central banks are not exogenous to the system. They are active market participants whose decisions influence market outcomes. A lack of intervention is itself a policy choice that carries risks.

Central banks are not exogenous to the system. They are active market participants whose decisions influence market outcomes. A lack of intervention is itself a policy choice that carries risks.

The full report can be found here: https://www.ucl.ac.uk/bartlett/public-purpose/publications/2020/aug/managing-nature-related-financial-risks

[END]

[END]

Read on Twitter

Read on Twitter![New @IIPP_UCL working paper out on nature-related Financial Risks We @jryancollins & Hugues Chenet argue that central banks & financial supervisors must take precautionary action to manage environmental risks beyond climate change. https://www.ucl.ac.uk/bartlett/public-purpose/publications/2020/aug/managing-nature-related-financial-risks[THREAD] New @IIPP_UCL working paper out on nature-related Financial Risks We @jryancollins & Hugues Chenet argue that central banks & financial supervisors must take precautionary action to manage environmental risks beyond climate change. https://www.ucl.ac.uk/bartlett/public-purpose/publications/2020/aug/managing-nature-related-financial-risks[THREAD]](https://pbs.twimg.com/media/EfyvXhhXoAA6ULm.png)