A friend reminded me that after the Spanish flu in 1918, which led to huge societal changes, but eventually led to the roaring 1920’s.

Could we be on the cusp on the Booming 2020’s?

A thread inspired by @Gavekal

Could we be on the cusp on the Booming 2020’s?

A thread inspired by @Gavekal

Conventional wisdom always extrapolates recent experience and the most decorated generals always prepare for the last war.

When deep transformations happen, in econ. or politics or even in science, there is a natural reluctance to believe that a big change has occurred.

When deep transformations happen, in econ. or politics or even in science, there is a natural reluctance to believe that a big change has occurred.

We are attached to the world we know and the strongest resistance to new ideas is often among those with most experience and expertise.

This is the way in most professions, it was either Max Planck or Neils Bohr who said: science progresses one funeral at a time !

This is the way in most professions, it was either Max Planck or Neils Bohr who said: science progresses one funeral at a time !

And this is why trend-following usually works in financial markets.

Even when an asset has been rising or falling for a long period, many investors continue to believe that it should still be valued at yesterday’s px and until these skeptics are all won over, the trend goes on.

Even when an asset has been rising or falling for a long period, many investors continue to believe that it should still be valued at yesterday’s px and until these skeptics are all won over, the trend goes on.

Could we be seeing a regime change in markets?

Could Covid mark the point when the reforms necessitated by the '08 crisis—turn into a new policy program.

Here is the (potentially) new regime:

Could Covid mark the point when the reforms necessitated by the '08 crisis—turn into a new policy program.

Here is the (potentially) new regime:

1. Long term investments driven by Keynesian economic management

We are seeing the rise of increased spending & investments globally, greater integration in Europe and in more technological self-reliance in China.

We are seeing the rise of increased spending & investments globally, greater integration in Europe and in more technological self-reliance in China.

This expansionary fiscal spending may lead to a structurally stronger world.

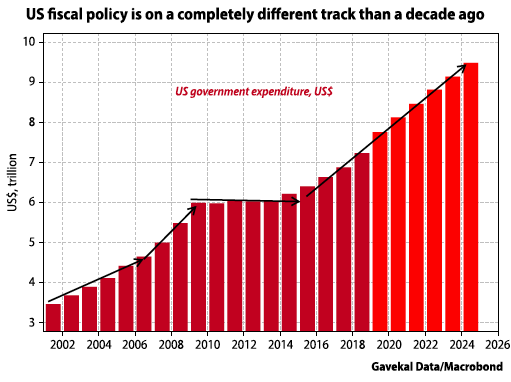

2. The scale and speed of monetary & fiscal stimulus have never been seen before

The most important difference between today and the post-2008 environment is fiscal.

2. The scale and speed of monetary & fiscal stimulus have never been seen before

The most important difference between today and the post-2008 environment is fiscal.

After the initial spending splurge in 2008 and 2009, most governments shifted their spending behaviours and embraced belt tightening. Fast forward to today and, regardless of where one looks, there are promises of more government spending, financed by more central bank printing.

3. Investor belief in macroeconomic policy

Investors now believe that Keynesian policies will restore the world economy to something like normality before the end of 2021.

Investors now believe that Keynesian policies will restore the world economy to something like normality before the end of 2021.

These expectations may prove right or wrong. But investors are now unlikely to change their minds about the success of the Keynesian experiment unless and until they see solid evidence that it is failing.

By definition this cannot happen until 2021 data appears a year or so.

By definition this cannot happen until 2021 data appears a year or so.

Meanwhile, another wave of Covid will only make govts. and CB's even more determined in their Keynesian convictions, and this could be treated by equity investors as bullish news.

As I told a friend:

“Good news is good news and bad news is also good news. Position accordingly.

As I told a friend:

“Good news is good news and bad news is also good news. Position accordingly.

Read on Twitter

Read on Twitter