ITC - Is it really cheap?

(Not a reco)

@dmuthuk

@Vivek_Investor

ITC came out with its IPO in 1970 at an issue price of ₹3 per share.

An investment of ₹9,999 in the IPO would have fetched 3,333 shares.

Thread below

(Not a reco)

@dmuthuk

@Vivek_Investor

ITC came out with its IPO in 1970 at an issue price of ₹3 per share.

An investment of ₹9,999 in the IPO would have fetched 3,333 shares.

Thread below

After accounting for splits an bonuses, these 9,999 shares in today's date would have become 11,51,460 shares.

The worth of this is ~₹23 crore - a staggering 22% CAGR that too without considering dividends.

The worth of this is ~₹23 crore - a staggering 22% CAGR that too without considering dividends.

FY20 dividend alone would amount to ₹1.17 crore which is over a thousand times the original investment.

All this is the past. Let's see what's baked in the current price.

For this we have to go to the annual results of FY20.

All this is the past. Let's see what's baked in the current price.

For this we have to go to the annual results of FY20.

We will be seeing ITC as 5 different businesses.

1. Cigarette

2. Non-cigarette FMCG

3. Hotels

4. Agri

5. Paper

1. Cigarette

2. Non-cigarette FMCG

3. Hotels

4. Agri

5. Paper

As of writing, the market cap of ITC is ~₹2.40 lakh crore.

ITC has ~₹37k crore worth of cash on its balance sheet.

Consider that you want to buy whole of ITC and you pay ₹2.40 lakh crore, you are effectively getting the company at ₹2.03 lakh crore as ₹37k crore is cash.

ITC has ~₹37k crore worth of cash on its balance sheet.

Consider that you want to buy whole of ITC and you pay ₹2.40 lakh crore, you are effectively getting the company at ₹2.03 lakh crore as ₹37k crore is cash.

First, let's look at the cigarette business.

It has PBT margin of 67% and revenues have grown at 10% CAGR in the past, despite high tax hikes.

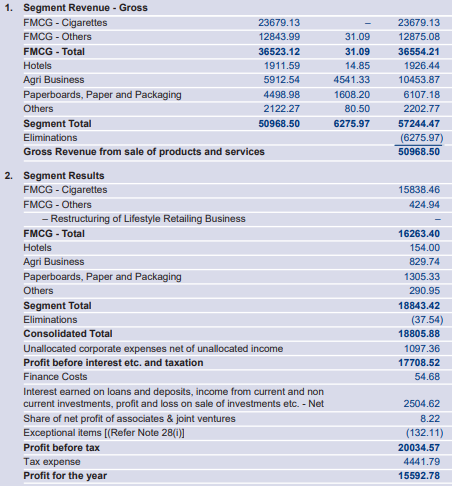

This division alone made a PBT of ₹15,836 cr (above img.)

It has PBT margin of 67% and revenues have grown at 10% CAGR in the past, despite high tax hikes.

This division alone made a PBT of ₹15,836 cr (above img.)

Consider this as a standalone company.

Then it would have a PAT of ₹11.7k crore assuming a tax of 26% (highest).

Now let us assume that the other 4 businesses do not exist and see what P/E multiple the market is giving for the cigarette business.

Then it would have a PAT of ₹11.7k crore assuming a tax of 26% (highest).

Now let us assume that the other 4 businesses do not exist and see what P/E multiple the market is giving for the cigarette business.

If we see, the market is giving a P/E multiple of 17.3 just for the cigarette business alone.

This multiple is at par with global peers like Philip Morris.

But the catch is Philip Morris is growing at ~4% as compared to ITC's cigarette business at 10% in the past decade.

This multiple is at par with global peers like Philip Morris.

But the catch is Philip Morris is growing at ~4% as compared to ITC's cigarette business at 10% in the past decade.

So, the market is willing to pay a multiple of a matured market to a company still growing its revenue at a decent rate with expanding margins in the cigarette business.

If one were to buy ITC at CMP, they would be paying for the cigarette business at a mature market multiple.

If one were to buy ITC at CMP, they would be paying for the cigarette business at a mature market multiple.

This means not only one would get the cigarette business cheaply, but all the other 4 divisions for free.

As for their FMCG business is concerned (which is mgmt's focus), it had revenues of ~₹13k cr (which is more than all FMCG companies except HUL).

All this within 2 decades.

As for their FMCG business is concerned (which is mgmt's focus), it had revenues of ~₹13k cr (which is more than all FMCG companies except HUL).

All this within 2 decades.

This itself is a commendable job considering the fact that companies like Britannia have been around for more than a century and ITC has surpassed their revenues within just 2 decades.

FMCG business earned PBT of ₹425 cr (3.3% margin)

FMCG business earned PBT of ₹425 cr (3.3% margin)

If you look closely, a huge amount has been spent in advertising and development of newer products.

The gross margins of FMCG division are at par with peers (~40%).

The gross margins of FMCG division are at par with peers (~40%).

Also, ITC has the agri division, reducing the cost of raw material, which in the long run will give higher margins for their FMCG business.

Even if we consider a conservative 10% growth in FMCG revenues over the next decade, and PBT margins improving to 10% from the current 3%, where Nestle & HUL have >20%, Britannia has 16%.

This would mean FMCG division would be earning roughly around ₹4k crore by 2030.

This would mean FMCG division would be earning roughly around ₹4k crore by 2030.

That itself would be twice that of Nestle, Britannia.

So, to conclude at the CMP, you get a cash cow cigarette business for cheap along with the other businesses for free, including the growth driver FMCG.

P.S.: Take these projections with a load of salt & do your own research

So, to conclude at the CMP, you get a cash cow cigarette business for cheap along with the other businesses for free, including the growth driver FMCG.

P.S.: Take these projections with a load of salt & do your own research

Correction: it is 3,333 shares instead of 9,999 in the 2nd tweet

Read on Twitter

Read on Twitter