Old Dominion, $ODFL, stands out among transportation businesses

Capital allocation, operational execution, management / ownership all top notch

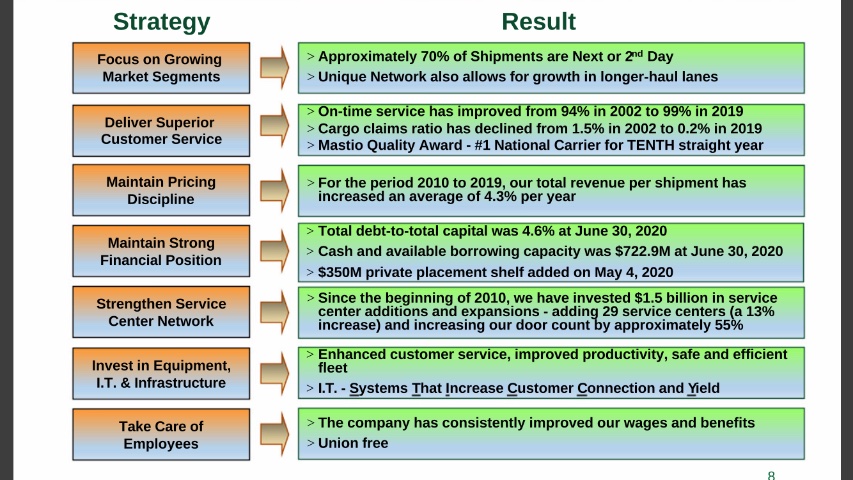

Below from their most recent deck

Capital allocation, operational execution, management / ownership all top notch

Below from their most recent deck

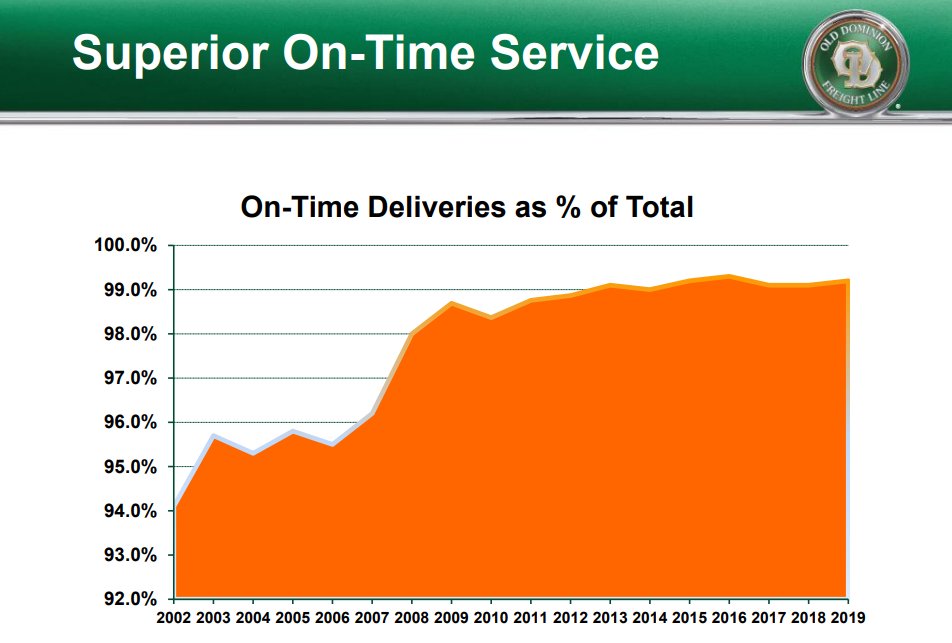

More on ODFL from their 2020-08-19 Investor Deck

1/ The top 25 Less-than-truckload ("LTL") shippers have grown their share of the total LTL market by 4.4% pa from 2002-2019

ODFL has gained 7.3% of market share in that time

1/ The top 25 Less-than-truckload ("LTL") shippers have grown their share of the total LTL market by 4.4% pa from 2002-2019

ODFL has gained 7.3% of market share in that time

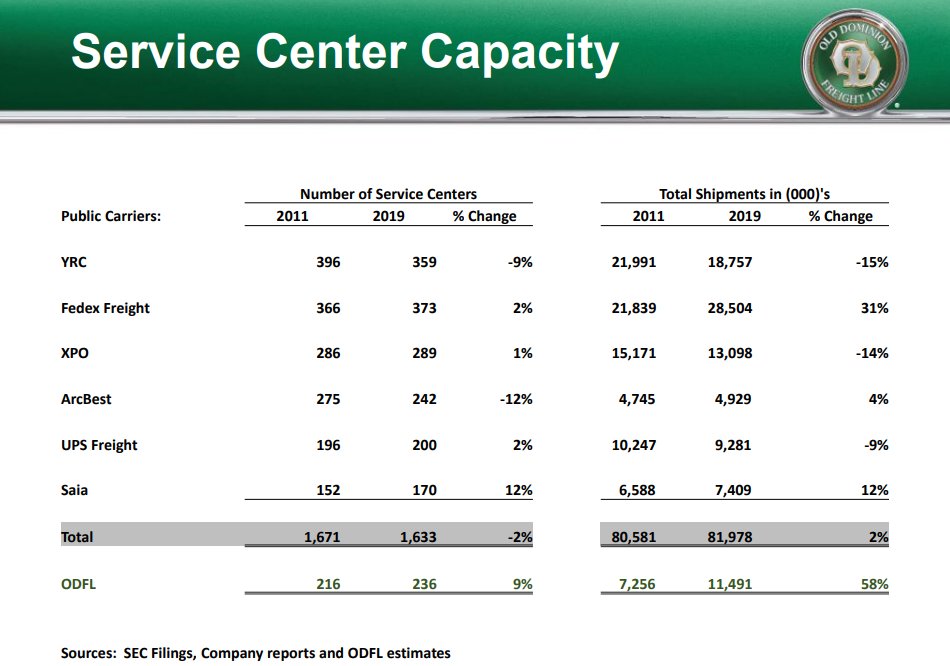

2/ Since 2011, ODFL has increased their service center count by 9% while their competition in aggregate has reduced their service centers by (2%)

In that same time, ODFL has increased shipments by 58% compared to +2% for the competition

In that same time, ODFL has increased shipments by 58% compared to +2% for the competition

6/ The Company is a family business;

- Earl Congdon, the son of one of ODFLs founders, is the Senior Executive Chairman

- David Congdon, Earl's son, is the Executive Chairman

- John Congdon, Earl's nephew, is a director

Combined, they own 12.4% of shares, worth $2.87B

- Earl Congdon, the son of one of ODFLs founders, is the Senior Executive Chairman

- David Congdon, Earl's son, is the Executive Chairman

- John Congdon, Earl's nephew, is a director

Combined, they own 12.4% of shares, worth $2.87B

7/ Compared to other LTL carriers, $FDX, $UPS, $XPO as well as J.B. Hunt /$JBHT, another well managed transportation business, ODFL's EV / EBITDA - Capex valuation is reasonable; http://snt.io/C6Fh1VnzK

8/ Over the last three years, ODFL's total return of 218% is by far the best among the group, with UPS and XPO next best at 55% and 49% http://snt.io/DeFh1VsSU

Read on Twitter

Read on Twitter