A thread about a love triangle

Between a holding company of Legacy Brands

The largest mall operator in the US

And the worlds largest asset manager

Between a holding company of Legacy Brands

The largest mall operator in the US

And the worlds largest asset manager

2/ This story starts in 2010

Jamie Salter is the outgoing CEO of Hilco Brands (Linens & Things, Polaroid, Le Tigre, etc). He pours $250M into his new venture: Authentic Brands Group

Early acquisitions for ABG were modest, and include small apparel brands and celebrity licenses

Jamie Salter is the outgoing CEO of Hilco Brands (Linens & Things, Polaroid, Le Tigre, etc). He pours $250M into his new venture: Authentic Brands Group

Early acquisitions for ABG were modest, and include small apparel brands and celebrity licenses

3/ ABG makes its first major Legacy Brand acquisition in 2013 by scooping up Juicy Couture for $195M. By the end of the year, ABG is also the owner of likeness and rights to Elvis Presley, Muhammad Ali, and Marlyn Monroe https://fashionunited.com/en/v1/fashion/authentic-brands-group-acquires-juicy-couture/201310083916

4/ In 2016 Simon Properties Group teams up with ABG to purchase mall brand Aeropostale out of bankruptcy and by 2017 500 Aero stores were reopened

A critical point to the storyline is that SPG x ABG swung Aero from a -$100M loss at acquisition to +$80M in net income by 2019

A critical point to the storyline is that SPG x ABG swung Aero from a -$100M loss at acquisition to +$80M in net income by 2019

5/ In 2017, a third dancing partner enters the ABG x SPG relationship: BlackRock, who takes a 10% stake in SPG, becoming the second-largest shareholder

BlackRock is the world's largest Asset Management company (currently ~$7.4T AUM) and is widely considered a 'Shadowbank'

BlackRock is the world's largest Asset Management company (currently ~$7.4T AUM) and is widely considered a 'Shadowbank'

6/ By 2018 the ABG acquisition train is hitting full speed, with purchases of Nautica, Nine West, and the Camuto Group. Their rapidly growing collection of brands puts ABG into the Top 10 of all licensing groups worldwide

*below rank from 2019*

*below rank from 2019*

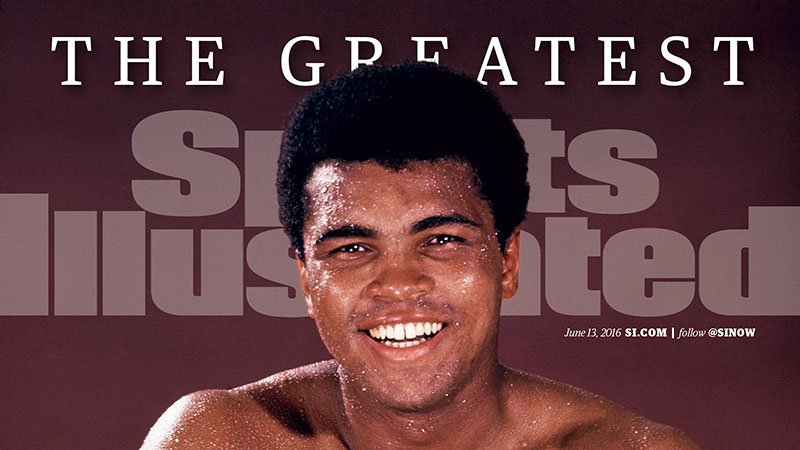

7/ 2019 yields the strategic acquisition of Sports Illustrated

This allows ABG to flank their core business with a valuable media property (see Linear Commerce)

They now also have licenses to Michael Jackson, Shaquille O'Neal and other prominent sports and film figures

This allows ABG to flank their core business with a valuable media property (see Linear Commerce)

They now also have licenses to Michael Jackson, Shaquille O'Neal and other prominent sports and film figures

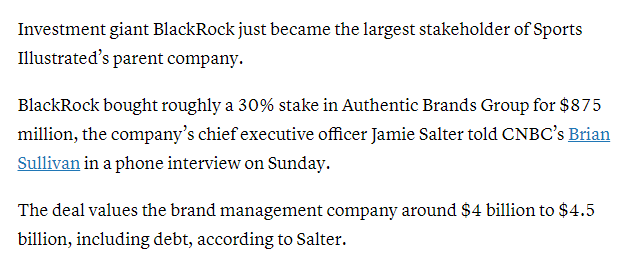

8/ The successful acquisitions and operation of the ABG portfolio and positive partnership with SPG bring BlackRock to the table for direct involvement with ABG

In August of 2019 BlackRock takes a 30% stake in ABG, and now has heavy leverage and interest in both ABG and SPG

In August of 2019 BlackRock takes a 30% stake in ABG, and now has heavy leverage and interest in both ABG and SPG

9/ In late 2019 ABG saves Barneys New York from bankruptcy

With pockets full of BlackRock capital, SPG x ABG continues its spending spree, this time acquiring fast-fashion brand Forever 21 https://www.glossy.co/fashion/authentic-brands-group-sees-revitalizing-forever-21-as-its-gateway-to-gen-z

With pockets full of BlackRock capital, SPG x ABG continues its spending spree, this time acquiring fast-fashion brand Forever 21 https://www.glossy.co/fashion/authentic-brands-group-sees-revitalizing-forever-21-as-its-gateway-to-gen-z

10/ March 2020 brings the COVID Pandemic, shaking up the entire retail landscape and resulting in a heavy demand swing out of B&M/Malls and into eCom

The retail world widely accepts the narrative that malls are dead...

But ABG x SPG x BlackRock doubles down again...

The retail world widely accepts the narrative that malls are dead...

But ABG x SPG x BlackRock doubles down again...

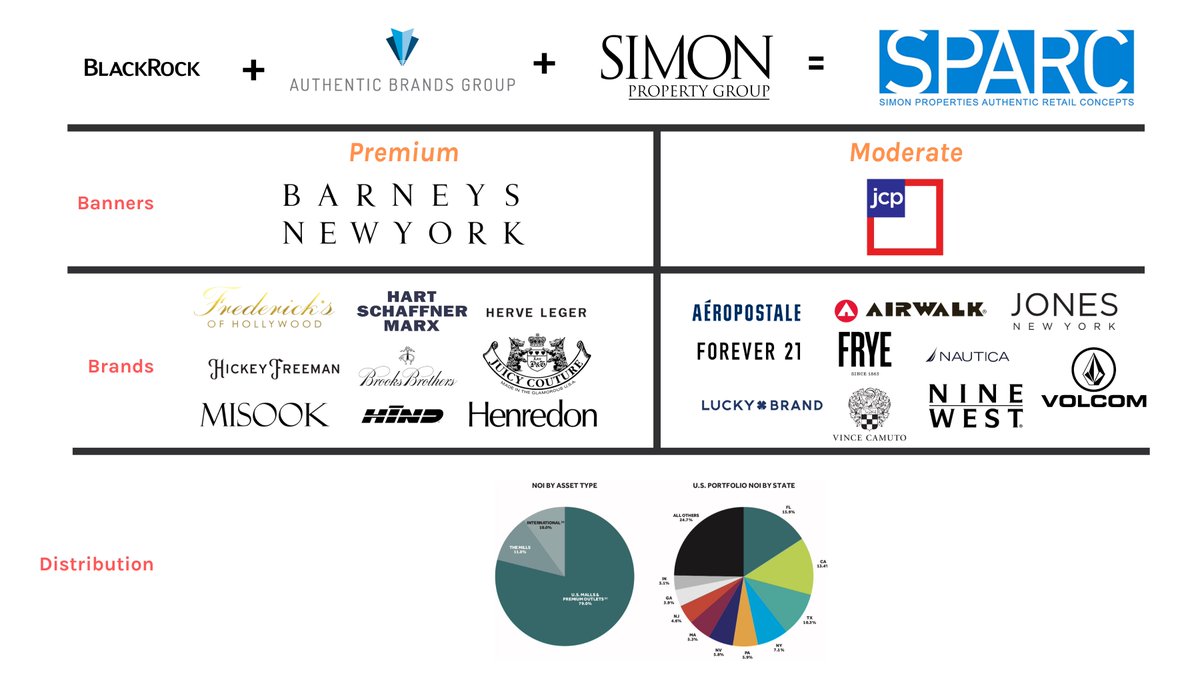

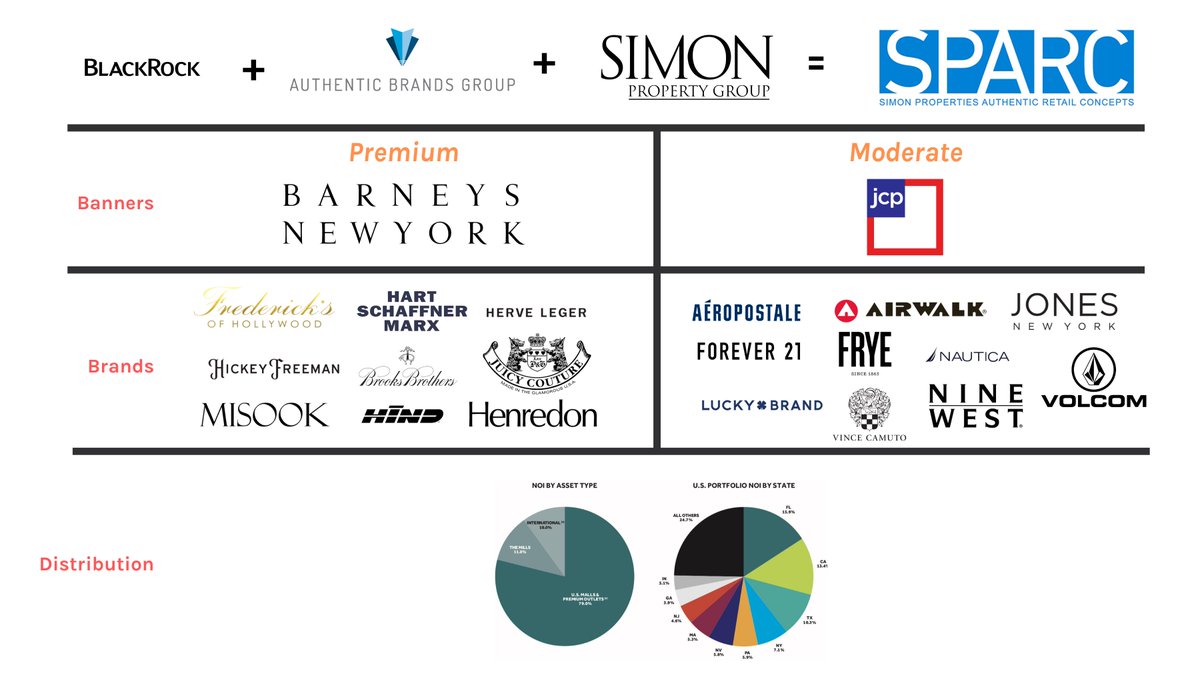

11/ ABG begins to use the accelerated distress facing legacy brands as an opportunity: They form a joint venture with SPG called SPARC

On August 12th SPARC acquires Brooks Brothers for $325M

And days later SPARC snatches up Lucky Brand (both out of Bankruptcy) for $140M

On August 12th SPARC acquires Brooks Brothers for $325M

And days later SPARC snatches up Lucky Brand (both out of Bankruptcy) for $140M

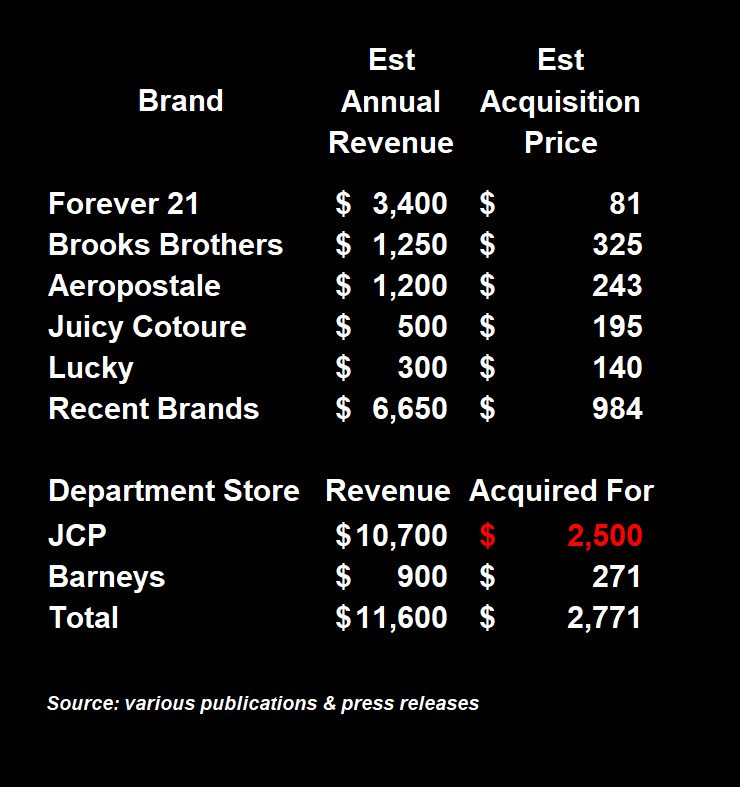

12/ Currently SPG is the leading candidate to acquire JC Penney.

The Department Store is one of Simons top clients and an anchor at many of their properties and an important partner due to co-tenancy clauses

But JCP may also become a massive conduit for ABG/SPARC Brands

The Department Store is one of Simons top clients and an anchor at many of their properties and an important partner due to co-tenancy clauses

But JCP may also become a massive conduit for ABG/SPARC Brands

13/ In many cases, by purchasing these formerly successful brands out of bankruptcy, ABG and SPARC have been able to take control of the asset while minimizing exposure to debt

This has allowed ABG and SPARC to build a $15B annual rev portfolio at a relative bargain

A few:

This has allowed ABG and SPARC to build a $15B annual rev portfolio at a relative bargain

A few:

14/ With the JCPenney acquisition pending, the three (maybe 4) pronged strategy is becoming clear:

1/ Banners - leverage JCP, expand Barneys

2/ Brands - assort Brands into Banners by price/equity

3/ Distribution - leverage Simon properties for scale

1/ Banners - leverage JCP, expand Barneys

2/ Brands - assort Brands into Banners by price/equity

3/ Distribution - leverage Simon properties for scale

15/ And the 4th will likely be the deployment of the Sports Illustrated media platform x the iconic celebrity and sports likenesses to help drive content behind these brands and lift them back up to their former glory in the eyes of the consumer

16/ While the retail world runs screaming from the blaze that is Mall retail in the United States

a powerful trio appears to be running in the opposite direction, prepared to fan the flames

and ready to restore the best parts of the American Mall complex to their former glory

a powerful trio appears to be running in the opposite direction, prepared to fan the flames

and ready to restore the best parts of the American Mall complex to their former glory

As new owners of JCP: Simon, look for a replacement CEO; they cited ABG as a strategic partner in the search

It’s all coming together.

I would expect the new CEO to be first or second degree to the ABG network of Brands

It’s all coming together.

I would expect the new CEO to be first or second degree to the ABG network of Brands

Why?

ABG needs to pump their brands through JCPs distribution network, so interests must be highly aligned

Again, just a hunch

ABG needs to pump their brands through JCPs distribution network, so interests must be highly aligned

Again, just a hunch

Simon Property Group (SPG) quietly creates its own $300M SPAC https://www.renaissancecapital.com/IPO-Center/News/75849/SPAC-Simon-Property-Group-Acquisition-files-for-a-$300-million-IPO

Read on Twitter

Read on Twitter