At the Green Climate Fund's Board meeting this week they will consider accrediting 3 new institutions to partner with on climate projects. This includes Sumitomo Mitsui Banking Corporation (SMBC), a Japanese bank that is a major investor in coal and other fossil fuels. THREAD:

We've been here before. @TheGCF has already accredited 5 other major private sector banks, with similar controversies about their fossil fuel lending and other issues. https://www.climatechangenews.com/2016/03/03/green-climate-fund-urged-to-ditch-links-to-hsbc-credit-agricole/

In response to these concerns, @theGCF's Board agreed that it would track how well accredited entities shift their overall portfolios to support low-carbon, climate resilient development, not just their performance on the specific projects the GCF funds. https://www.climatechangenews.com/2016/03/09/positives-emerge-from-green-climate-fund-link-with-hsbc/

Institutions' progress in shifting their portfolios will be taken into account when they come up for re-accreditation every five years. The theory is that @theGCF can use its partnership with entities to encourage greater shifts in finance than its direct project funding alone.

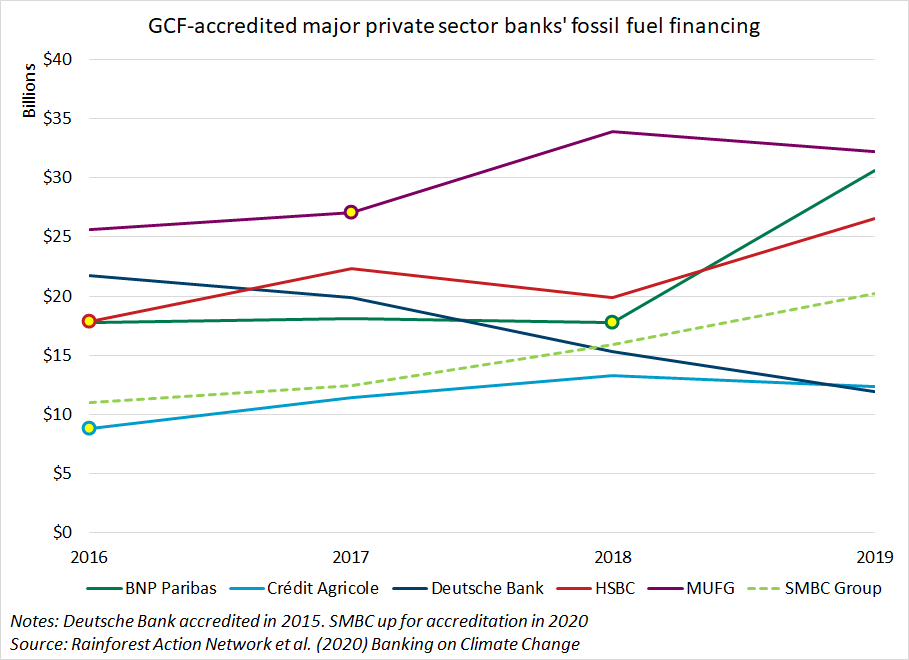

So how are GCF-accredited major banks doing? Using data from @RAN et al.'s "Banking on Climate Change" reports, we see every accredited bank except for @DeutscheBank has increased their fossil fuel finance since they were accredited with @theGCF (denoted by yellow dot).

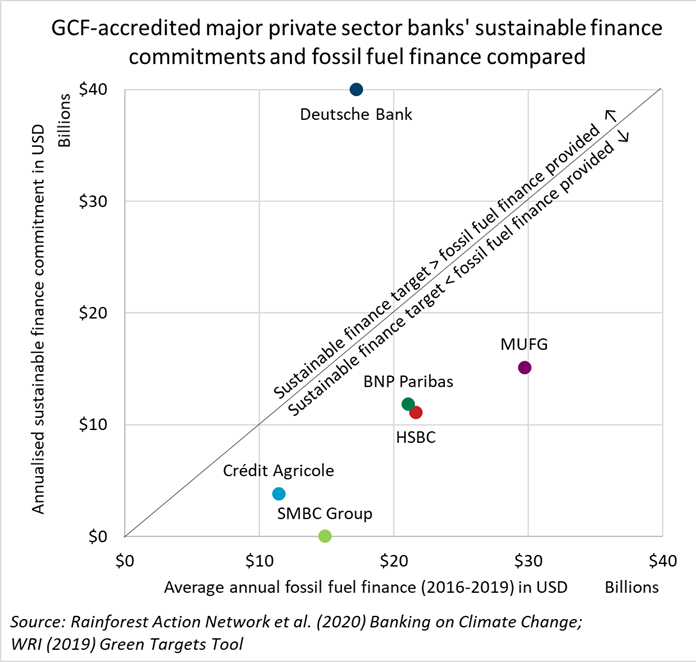

What about these banks' sustainable finance commitments? Using data from my @WRIFinance colleagues, we see that only @DeutscheBank has an annualized sustainable finance target larger than its annual fossil fuel finance. @smbc_midosuke hasn't even set a sustainable finance target!

This suggests @theGCF could do more to ensure the institutions it partners with align their portfolios with the #ParisAgreement, and that until they can demonstrate this theory of change with existing accredited banks, it might not be the best idea to accredit @smbc_midosuke.

For more on civil society concerns about accrediting @smbc_midosuke, see the letters to @theGCF and SMBC, and email campaign organised by @AsianPeoplesMvt @350EastAsia @FoEJapan_en and many more here: https://endfossilfuelsasia.net/fossil-free-gcf

If you're interested in digging into the data on private sector bank financing on fossil fuels, check out @RAN et al.'s excellent Banking on Climate Change reports: https://www.ran.org/bankingonclimatechange2020/

If you'd like to understand more about how to compare private sector banks' sustainable finance commitments to their fossil fuel financing, see @WRIFInance's excellent Green Targets tool produced by @giules_c and her team:

https://www.wri.org/finance/banks-sustainable-finance-commitments/

https://www.wri.org/finance/banks-sustainable-finance-commitments/

Read on Twitter

Read on Twitter