1/ Crypto Twitter has a lot of great content. Putting it all together into a coherent investment thesis is hard.

Here's my take on what's happening in markets right now, and the incredible individuals behind the insights.

#bitcoin #GOLD #SPX #Silver #stocks

#GOLD #SPX #Silver #stocks

Here's my take on what's happening in markets right now, and the incredible individuals behind the insights.

#bitcoin

#GOLD #SPX #Silver #stocks

#GOLD #SPX #Silver #stocks

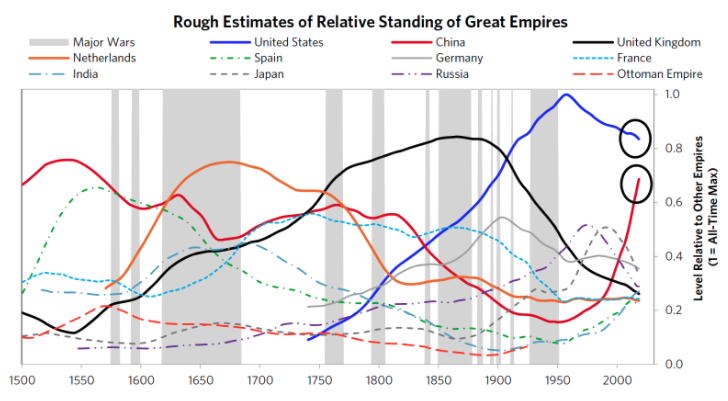

2/ Let's start at the ultra high level. Global reserve currencies come and go with periodicity.

@soonaorlater says it best. We are due! https://twitter.com/soonaorlater/status/1252439124771958788?s=20

@soonaorlater says it best. We are due! https://twitter.com/soonaorlater/status/1252439124771958788?s=20

3/ That's not to say predicting the end of global reserve currencies is precise. But to be aware it will happen, it will be a big deal and it likely could happen in many of our lives.

@RayDalio's book 'The Changing World Order' explains the lifecycle of empires sublimely.

@RayDalio's book 'The Changing World Order' explains the lifecycle of empires sublimely.

4/ For the geeks among us, you can dive further into reserve currencies with @CaitlinLong_ - https://twitter.com/CaitlinLong_/status/1249408201931407361

Or just take my word. Being the country (currently USA) with the reserve currency is a powerful benefit, but one that is inherently unstable.

Or just take my word. Being the country (currently USA) with the reserve currency is a powerful benefit, but one that is inherently unstable.

5/ Now let's talk stock markets. Everyone knows they're wacky post-covid. Every metric is at its extreme, with all time high prices for SPX and NDX, at the same time as record unemployment and declines in GDP.

As @datadater says, what happens next? https://twitter.com/datadater/status/1286527189005905925?s=20

As @datadater says, what happens next? https://twitter.com/datadater/status/1286527189005905925?s=20

6/ As @LynAldenContact points out, we are at the end of a 100 year long debt cycle and facing a situation that parallels the 1930's Great Depression. https://twitter.com/LynAldenContact/status/1265428373255454721?s=20

7/ Here's what happened last time, vs. where we are so far. @datadater shows it clearly. https://twitter.com/datadater/status/1294480806522413057?s=20

8/ Essentially 1929 massive crash, followed by 50% rally over 5 months, followed by annihilation over 2 years. https://twitter.com/hussmanjp/status/1283793073386991617?s=20

9/ So is this time different? Well, maybe. In 1929 there were no stimulus packages. This time, governments are printing HUGE sums of money to avoid financial collapse.

And it seems to work: @caprioleio https://twitter.com/caprioleio/status/1293266840962113537?s=20

And it seems to work: @caprioleio https://twitter.com/caprioleio/status/1293266840962113537?s=20

10/ More than work, they money supply appears to directly control the equity market and point to record gains coming for 2021. POST huge declines in Q420.

@DTAPCAP https://twitter.com/DTAPCAP/status/1291252534754062337?s=20

@DTAPCAP https://twitter.com/DTAPCAP/status/1291252534754062337?s=20

11/ Indeed I'd be cautious about being ultra bullish on equities just yet. @RamenofBinance https://twitter.com/RamenofBinance/status/1295754891437187073?s=20

12/ So we have the crazy situation where history would suggest we could follow the red line. Unprecedented levels of money printing suggest we could follow the green line, or with covid uncertainty, any yellow path in between!

13/ Ok, what else do we know? Well just about every analyst is sure of a commodities bull run. There's none better at predicting this than @PeterLBrandt https://twitter.com/PeterLBrandt/status/1291429003509796871?s=20

14/ Or indeed you see a similar thing with https://twitter.com/DTAPCAP/status/1286504265398259719?s=20

15/ @TeddyVallee highlights it best: "Over the next 10 years, 81% of all tradeable assets ($180T) produce a negative return for investors, leaving only the commodity and currency markets for some form of capital appreciation" https://twitter.com/TeddyVallee/status/1291048040212705289

16/ Which brings us to Bitcoin and other cryptocurrencies.

Even knowing nothing about global reserve currency, debt cycles, monetary stimulus or commodity booms. One can see Bitcoin is on a role. E.g. see:

@100trillionUSD https://twitter.com/100trillionUSD/status/1296005407983403008?s=20

Even knowing nothing about global reserve currency, debt cycles, monetary stimulus or commodity booms. One can see Bitcoin is on a role. E.g. see:

@100trillionUSD https://twitter.com/100trillionUSD/status/1296005407983403008?s=20

17/ Each successive cycle in Bitcoin is growing logarithmically. E.g. @Pladizow https://twitter.com/Pladizow/status/1295353964297441282?s=20

18/ Sceptics might point out "past is no prediction of future performance", or "there are only 4 data points of previous cycles to go by".

This is true, but the inverse relationship of Bitcoin against the Dollar is interesting.

@RJ_Killmex https://twitter.com/RJ_Killmex/status/1286959355590520833?s=20

This is true, but the inverse relationship of Bitcoin against the Dollar is interesting.

@RJ_Killmex https://twitter.com/RJ_Killmex/status/1286959355590520833?s=20

19/ Here's the same inverse correlation of the dollar vs. Bitcoin zoomed in.

@BTC_Schmitcoin https://twitter.com/BTC_Schmitcoin/status/1293625313893777411?s=20

@BTC_Schmitcoin https://twitter.com/BTC_Schmitcoin/status/1293625313893777411?s=20

20/ It gets even more intriguing when you see how correlated Bitcoin Dominance is with USD strength. Risk increases, people seek out the safety of the dollar in the legacy financial system and Bitcoin in the cryptocurrency system.

@AlexSaundersAU https://twitter.com/AlexSaundersAU/status/1295847828728635392?s=20

@AlexSaundersAU https://twitter.com/AlexSaundersAU/status/1295847828728635392?s=20

21/ That's not to say Bitcoin is a risk off asset just yet, or behaving like Gold / Silver. Indeed the covid black swan of this year shows Bitcoin couples with equities when fear and uncertainty are high. https://twitter.com/caprioleio/status/1274668460396687360?s=20

22/ So where does all of this leave us? We have a global reserve currency under stress, unprecedented monetary stimulus, potential booms in commodities / Bitcoin.

BUT, huge downside risks from equities that may bring down everything in Q4-2020, or shortly after.

BUT, huge downside risks from equities that may bring down everything in Q4-2020, or shortly after.

24/ At this point, we consult the traders. No-one has gathered more long term charting insights on Bitcoin than @davthewave.

His work on Fibonacci levels gives clear upward direction for Bitcoin in the coming cycle: https://twitter.com/davthewave/status/1295895883909742592?s=20

His work on Fibonacci levels gives clear upward direction for Bitcoin in the coming cycle: https://twitter.com/davthewave/status/1295895883909742592?s=20

25/ The bad news is this could still take another 2-4 years to rip up (which wouldn't be a surprise when you consider what might happen in the equities market):

@BTC_JackSparrow https://twitter.com/BTC_JackSparrow/status/1295802653461688322?s=20

@BTC_JackSparrow https://twitter.com/BTC_JackSparrow/status/1295802653461688322?s=20

26/ Expect the journey to be highly volatile. My money is on @CredibleCrypto and his application of Elliott Waves to this cycle. https://twitter.com/CredibleCrypto/status/1246254073919107079?s=20

Read on Twitter

Read on Twitter