Amazing @WhatBitcoinDid episode #252 with @TheCryptoconomy, @mrcoolbp, and @heavilyarmedc. These guys are all incredibly intelligent and talented speakers, but this @TheCryptoconomy monologue (timestamp) really hit the nail on the head for me

1/9

1/9

I'll attempt to summarize:

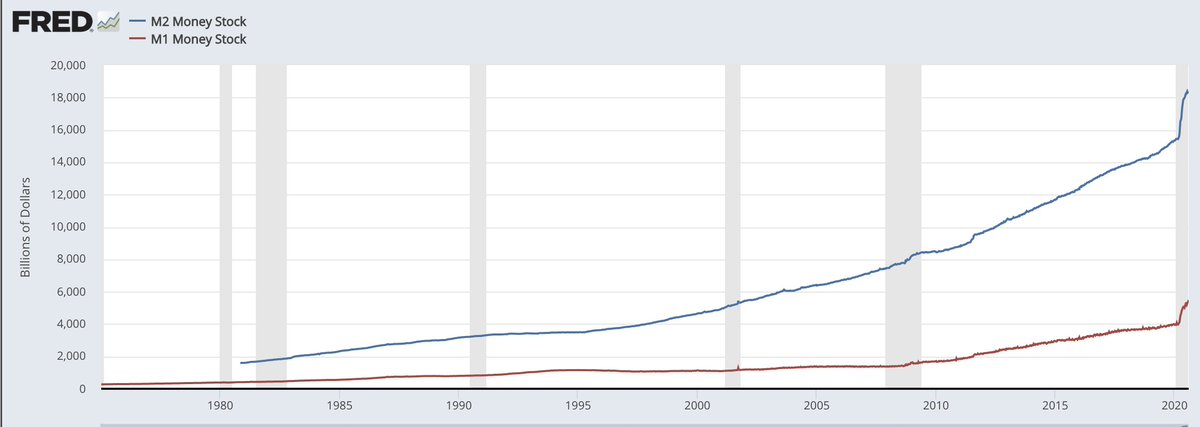

"Money Printing" i.e. M1 Money Supply isn't the biggest inflation driver. It's an amazing meme, but the expansion of credit (M2) is the real issue at hand

2/9

"Money Printing" i.e. M1 Money Supply isn't the biggest inflation driver. It's an amazing meme, but the expansion of credit (M2) is the real issue at hand

2/9

The expansion of M2 is entirely natural (H/T @RayDalio )

But fiat money backed by nothing - and more specifically Fractional reserve banking, government manipulated interest rates, and bailouts - drive up credit way faster and higher.

3/9

But fiat money backed by nothing - and more specifically Fractional reserve banking, government manipulated interest rates, and bailouts - drive up credit way faster and higher.

3/9

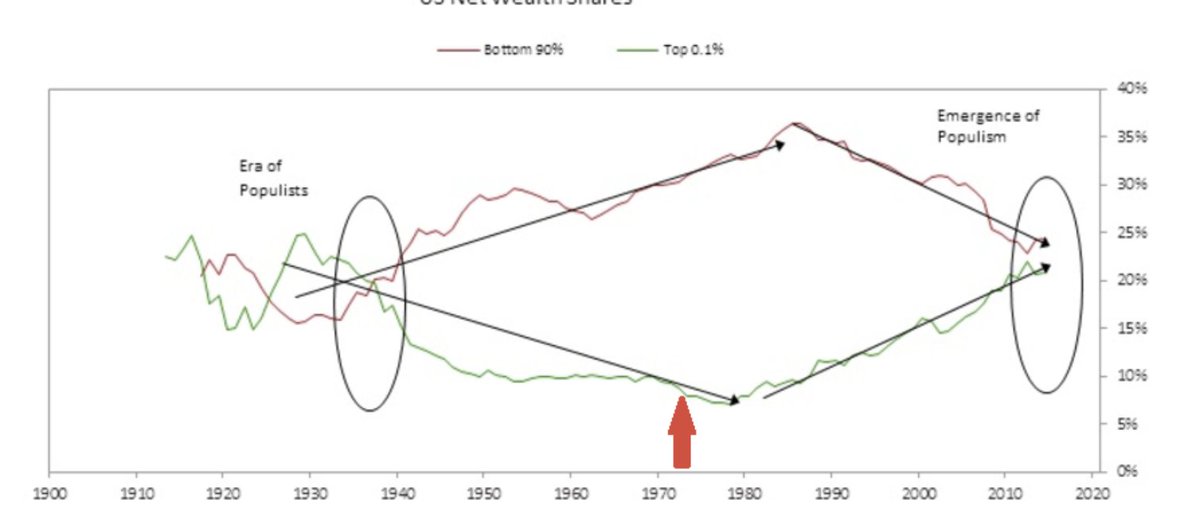

Rampant inflation means all goods get aggressively more expensive. Critically, this includes fixed supply assets like stocks and housing. If you're rich, and you own these things, you make more money. If you're poor, you get priced out of assets FOREVER.

h/t @WTF_1971:

4/9

h/t @WTF_1971:

4/9

Keynesians and MMT'ers aren't evil. They simply misattribute a lot of the complexity in the world.

A very lucid conflation is highlighted by @JeffBooth @priceoftomorrow: inflation isn't creating prosperity, productivity & technology is IN SPITE OF inflation

5/9

A very lucid conflation is highlighted by @JeffBooth @priceoftomorrow: inflation isn't creating prosperity, productivity & technology is IN SPITE OF inflation

5/9

Keynesians also have bad data. They claim inflation 2% because the basket of goods in CPI/CPE is changed to create the math they need.

Using real data, our CPI is likely 6-10%, or higher:

https://chapwoodindex.com/

http://www.shadowstats.com/alternate_data/inflation-charts

6/9

Using real data, our CPI is likely 6-10%, or higher:

https://chapwoodindex.com/

http://www.shadowstats.com/alternate_data/inflation-charts

6/9

We're still stuck in our '08 asset bubble. Continuing to inflate makes the reckoning worse every, single, day.

The way out is the simple: stop manipulating markets. Let the abundance created by society's increasing productivity create price deflation

7/9

The way out is the simple: stop manipulating markets. Let the abundance created by society's increasing productivity create price deflation

7/9

There will be short term pain, but within a year this will be tremendous for society. Asset prices like homes will crash to their actual values, making them accessible to those currently without access. The irresponsible, reckless deficit spenders will be punished.

8/9

8/9

Now for the good news: we don't need a miracle. We don't need charity. This WILL happen regardless.

How? Bitcoin will continue to outperform every other asset class, and for entirely selfish reasons we will enable it to take over the world.

Hodlers Companies

Companies Nations

Nations

9/9

How? Bitcoin will continue to outperform every other asset class, and for entirely selfish reasons we will enable it to take over the world.

Hodlers

Companies

Companies Nations

Nations9/9

Read on Twitter

Read on Twitter