1/ how does #Bitcoin  fit into an investment portfolio? our latest @CoinSharesCo research “A Little Bitcoin Goes a Long Way” covers this topic

fit into an investment portfolio? our latest @CoinSharesCo research “A Little Bitcoin Goes a Long Way” covers this topic

we believe bitcoin has a place in portfolios as an alternative, diversifying asset. Let’s dive in!

https://coinshares.com/research/a-little-bitcoin-goes-a-long-way

https://coinshares.com/research/a-little-bitcoin-goes-a-long-way

fit into an investment portfolio? our latest @CoinSharesCo research “A Little Bitcoin Goes a Long Way” covers this topic

fit into an investment portfolio? our latest @CoinSharesCo research “A Little Bitcoin Goes a Long Way” covers this topicwe believe bitcoin has a place in portfolios as an alternative, diversifying asset. Let’s dive in!

https://coinshares.com/research/a-little-bitcoin-goes-a-long-way

https://coinshares.com/research/a-little-bitcoin-goes-a-long-way

2/ bitcoin is being increasingly financialized as an asset. the clearest evidence of the demand for bitcoin as a store of value is the rapid growth of AUM in financial products.

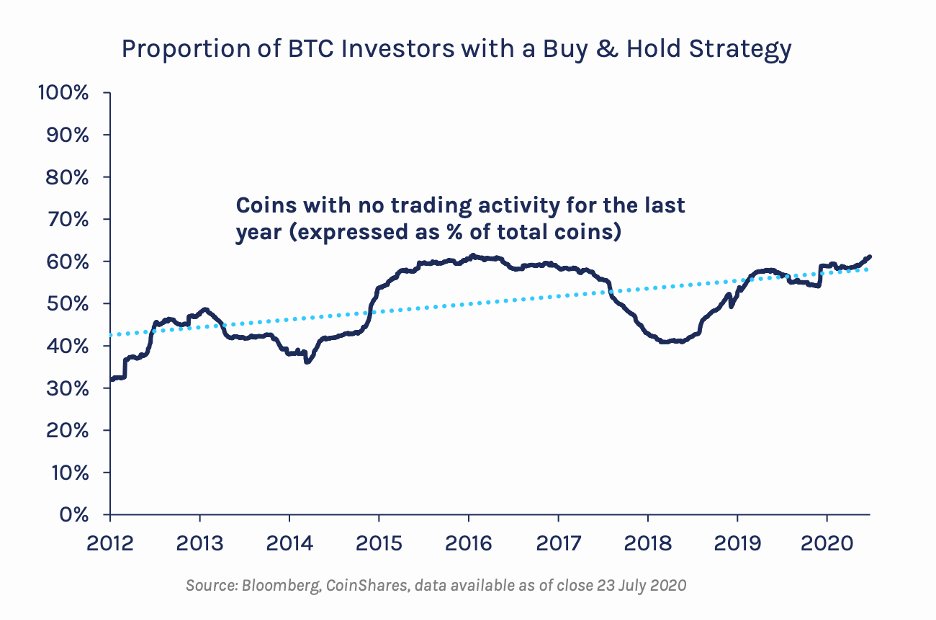

3/ data also supports the thesis that bitcoin is a savings technology - it is increasingly used as a store of value

data from @glassnode shows that this year alone, 8.7% of bitcoin has been taken off exchange, presumably for long term storage

data from @glassnode shows that this year alone, 8.7% of bitcoin has been taken off exchange, presumably for long term storage

4/ and the tide  is shifting w/ institutions!

is shifting w/ institutions!

an investor survey by @DigitalAssets - 22% say they are currently invested and 47% say digital assets have a place in their portfolio. https://www.fidelitydigitalassets.com/articles/institutional-digital-asset-survey-report

is shifting w/ institutions!

is shifting w/ institutions!an investor survey by @DigitalAssets - 22% say they are currently invested and 47% say digital assets have a place in their portfolio. https://www.fidelitydigitalassets.com/articles/institutional-digital-asset-survey-report

5/ the market has also evolved to accommodate institutional investors with services such as prime brokerage, trading tools and insured custody, paving the way for further financialization.

our @CoinSharesCo Ventures team covered this trend in Q2 https://coinshares.com/insights/the-future-of-capital-markets-summary

our @CoinSharesCo Ventures team covered this trend in Q2 https://coinshares.com/insights/the-future-of-capital-markets-summary

6/ inevitably, people will ask - what about what about volatility? let's look at gold.

gold purchased as an investment only took off after the 1970’s. until 1975, the possession of gold was illegal.

gold became financialized, and as this happened, its volatility declined.

gold purchased as an investment only took off after the 1970’s. until 1975, the possession of gold was illegal.

gold became financialized, and as this happened, its volatility declined.

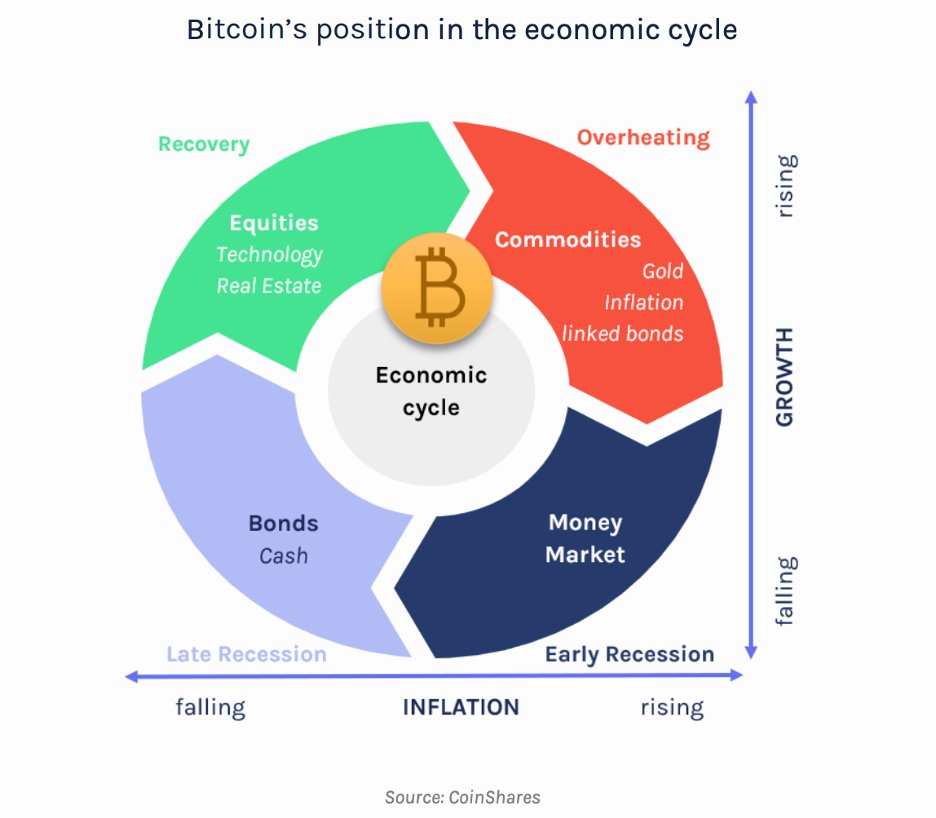

7/ so where does bitcoin sit in the economic cycle?

during periods of economic uncertainty and dollar weakness, #Bitcoin is likely to benefit in the same way as gold.

is likely to benefit in the same way as gold.

If bitcoin’s financialization continues, it will be unable to remain insulated from the financial system.

during periods of economic uncertainty and dollar weakness, #Bitcoin

is likely to benefit in the same way as gold.

is likely to benefit in the same way as gold.If bitcoin’s financialization continues, it will be unable to remain insulated from the financial system.

8/ so on to #Bitcoin  in a portfolio!

in a portfolio!

#Bitcoin is an asset in its infancy, leading many in the investment industry to struggle allocating it into the correct “bucket”.

is an asset in its infancy, leading many in the investment industry to struggle allocating it into the correct “bucket”.

in a portfolio!

in a portfolio! #Bitcoin

is an asset in its infancy, leading many in the investment industry to struggle allocating it into the correct “bucket”.

is an asset in its infancy, leading many in the investment industry to struggle allocating it into the correct “bucket”.

9/ we constructed a sample portfolio and found a 4% allocation to bitcoin produced optimal results in a traditional 60/40 portfolio.

our analysis highlights that it both enhances returns and increases diversification, regardless of the length of the backtest.

our analysis highlights that it both enhances returns and increases diversification, regardless of the length of the backtest.

10/ for those who are DARING, the most significant improvements in the Sharpe ratio are gained through an allocation of up to 10% bitcoin.

this show that even a SMALL addition of bitcoin has a BIG impact.

this show that even a SMALL addition of bitcoin has a BIG impact.

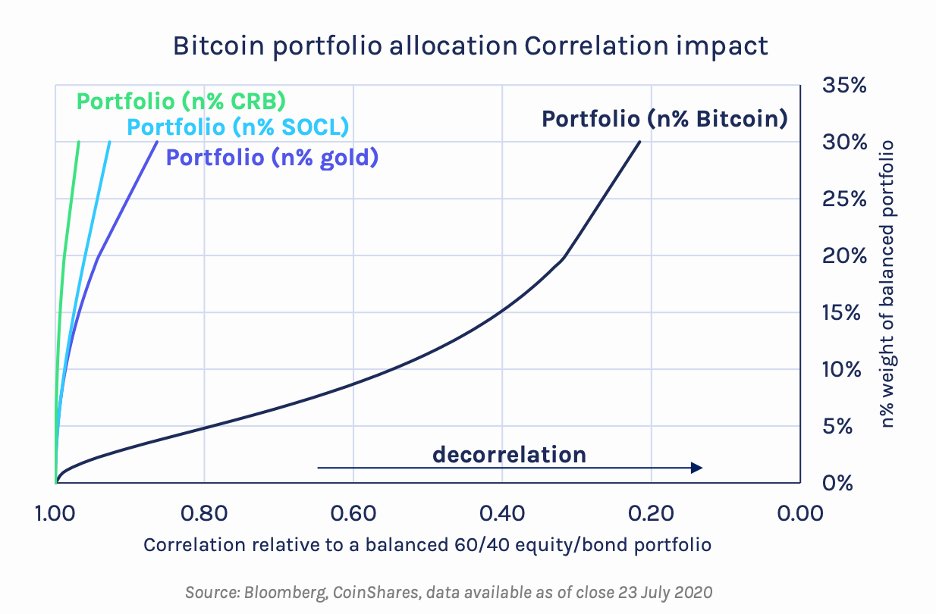

11/ and lastly, bitcoin may well be suited to fill the current gap in available diversifiers troubling portfolio managers.

* #Bitcoin is a unique asset*

is a unique asset*

we found it to be an effective diversifier in multi-asset portfolios, as indicated by the results below

* #Bitcoin

is a unique asset*

is a unique asset*we found it to be an effective diversifier in multi-asset portfolios, as indicated by the results below

12/ in conclusion, Bitcoin’s investment characteristics historically make it attractive as

- a driver of returns, and

- a portfolio diversifier

compared to other alternatives, Bitcoin delivers outsized positive impacts even at very low allocation sizes! https://coinshares.com/research/a-little-bitcoin-goes-a-long-way

- a driver of returns, and

- a portfolio diversifier

compared to other alternatives, Bitcoin delivers outsized positive impacts even at very low allocation sizes! https://coinshares.com/research/a-little-bitcoin-goes-a-long-way

13/ shout out to James Butterfill and @C_Bendiksen who put together this great investment research - let us know what you think

we'd love to hear what other types of research would be helpful for all the RIAs, wealth managers, and allocators out there

we'd love to hear what other types of research would be helpful for all the RIAs, wealth managers, and allocators out there

Read on Twitter

Read on Twitter