Bank of Ireland (yes, I'm very Irish today) has some disclosure that illustrates the massive shock of Covid on the lending market, with the movements in their (internal) ratings. It's quite stunning 1/n

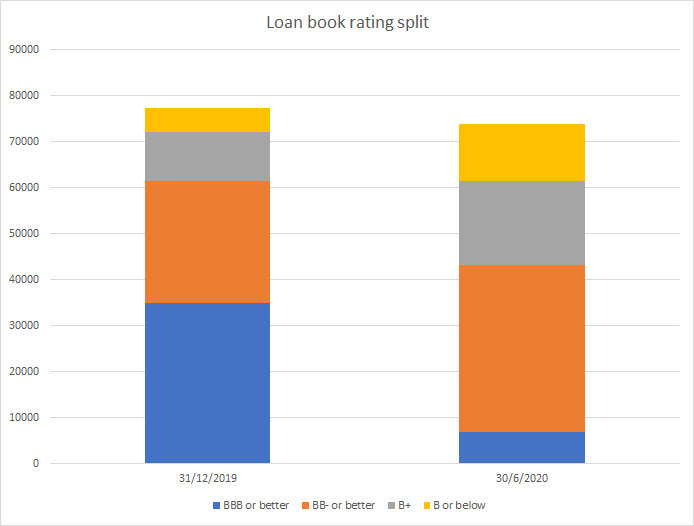

Here's what it looks like on the entire book.

Blue is investment grade, orange is BB, so medium risk, grey is high risk and yellow is real shit.

Down from 46% of the book being considered (super) safe, to only 7% !!!

From 7% shit to... 17% shit ! This is a massive shift.

Blue is investment grade, orange is BB, so medium risk, grey is high risk and yellow is real shit.

Down from 46% of the book being considered (super) safe, to only 7% !!!

From 7% shit to... 17% shit ! This is a massive shift.

And I suspect Bank of Ireland is not worse than other countries which are lending on a LTV basis (some countries are more lending on income basis), they are just more transparent.

Some book by book disclosure shows what's happening.

Some book by book disclosure shows what's happening.

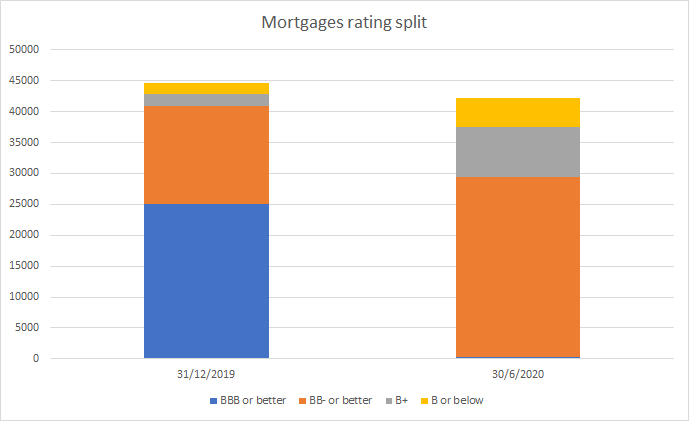

Mortgages: basically they believe they don't have a single safe mortgage left. Technically it's not 0, it's 1%, down from... 56%! I can hardly breathe.

From half the book super safe to zilch

From half the book super safe to zilch

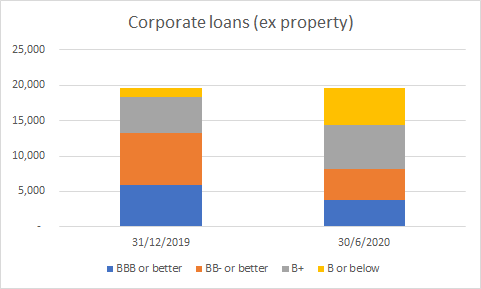

Corporate loans are a bit more robust (this is less an asset based business of course) but the share of super shit (hotels, transport etc.) goes from 7% to 26% !!!

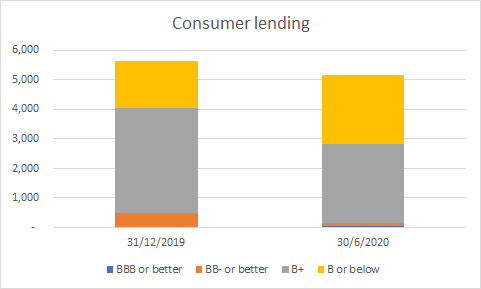

Consumer lending is going to be where you take the biggest losses ofc. (in % terms) but at least those were expected - the rating distribution is not totally transformed.

A side effect of this is of course how it will impact future loan pricing - once the government guaranteed programs are gone. Because there's no way banks are going to be happy originating B loans or worse for big amounts and low spread.

Read on Twitter

Read on Twitter