1) We are short Blink Charging $BLNK. Our full report is now available at http://www.CulperResearch.com

2) $BLNK claims to "connect over 15,000 chargers" and be "the largest" owner-operator of charging stations in the industry. We believe $BLNK's functional public network approximates just 2,192 chargers, or 15% of these claims.

3) Our investigators visited 242 chargers in 88 locations across the U.S. and found an overwhelmingly decrepit assembling of assets. $BLNK claims high demand which has grown with EV growth, but its own disclosures show its chargers sit almost entirely unused by EV drivers.

4) $BLNK frequently claims to be "developing technology" and forming new "partnerships." However, Blink also claimed to work on car sharing, energy storage, and expansions into both China & SE Asia. None of these have happened, and revenues have been roughly flat for 6 years.

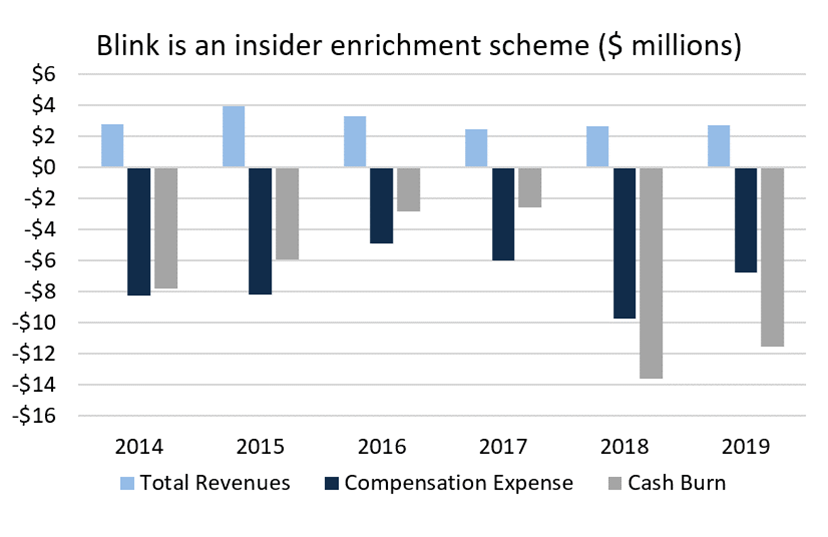

5) Nevertheless, $BLNK execs continue to ransack minority shareholders. Since 2014, total compensation of $43.8M is over 2x $BLNK's $18M in total revenues, despite $44.3M in cash burn. This scheme is spearheaded by Chairman and CEO Michael D. Farkas.

6) $BLNK's Farkas has a history of involvement in companies tied to money laundering, drug trafficking, and stock manipulation schemes. He was previously >50% owner of SkyWay, which collapsed after its "demonstration aircraft" was seized in Mexico with 5.6 tons of cocaine.

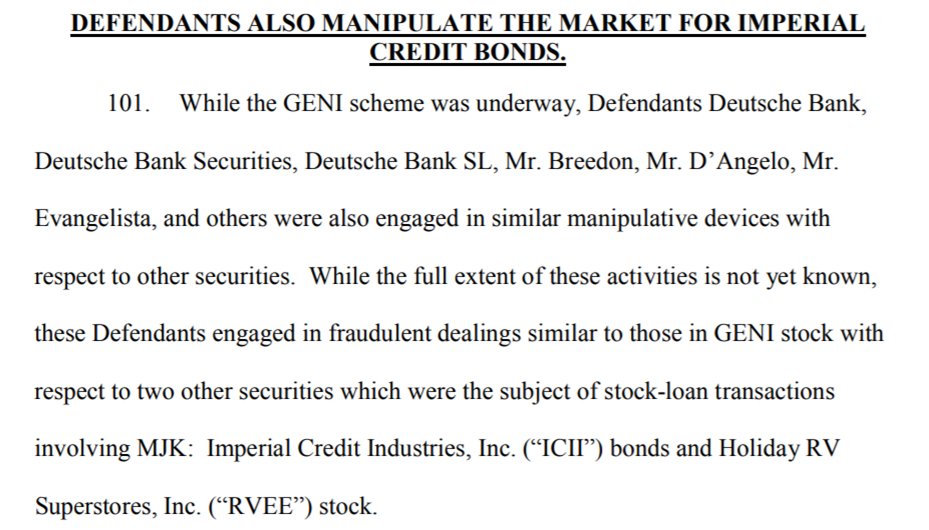

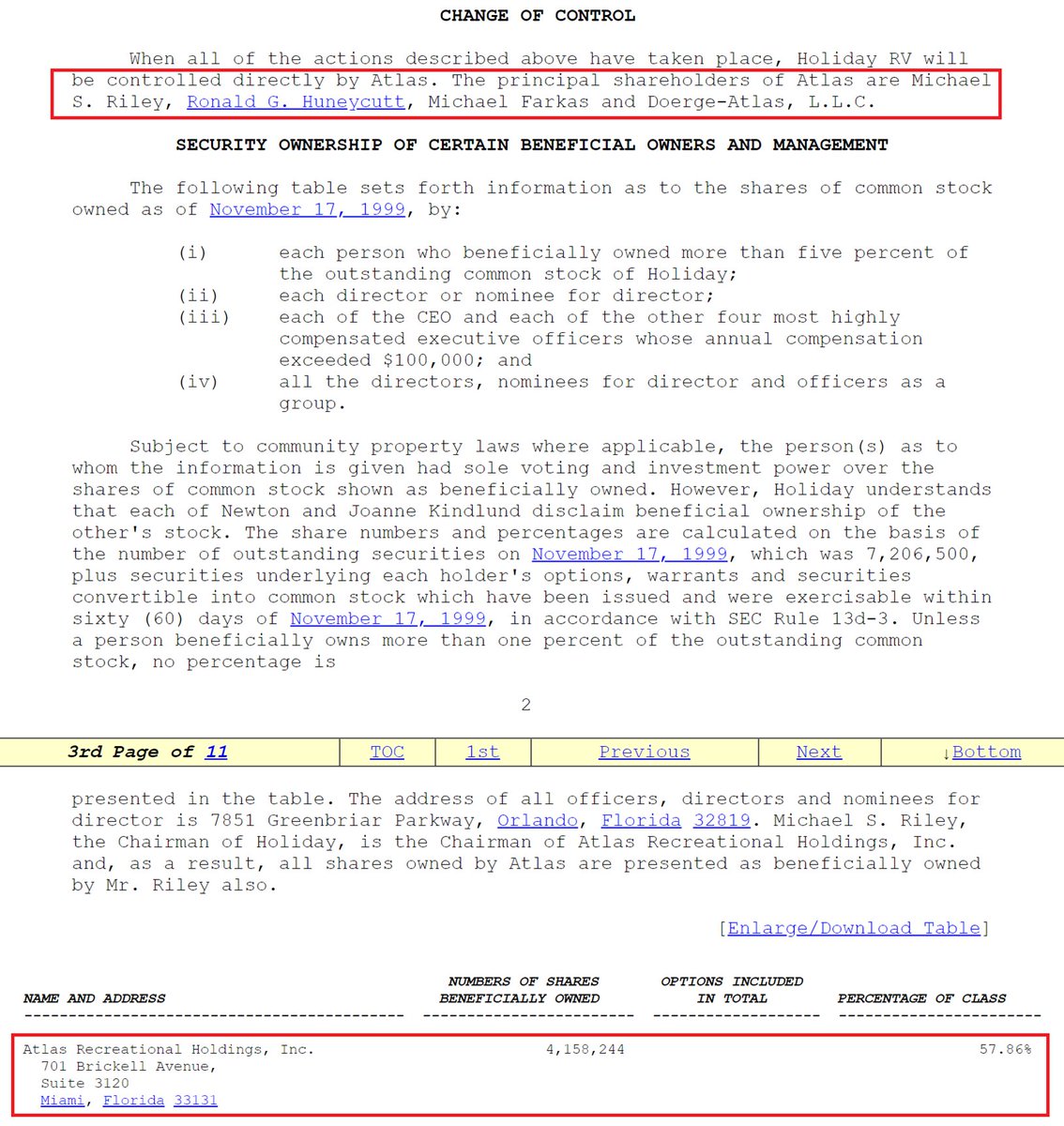

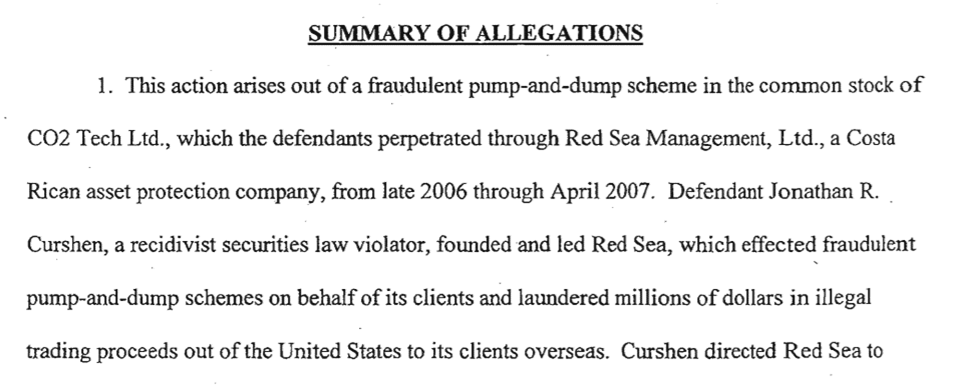

7) Farkas was majority owner of Holiday RV Superstores and at GenesisIntermedia. Each collapsed in connection with a multi-$100 million money laundering scheme. Finally, Farkas had ties to Red Sea Management, which was sued by the SEC for pump-and-dumps and money laundering.

8) Similarly, $BLNK is a product of a "shell factory" run by SEC-charged lawyer Gregg Jaclin, and its ownership included an offshore Belize entity traced to the Panama Papers. We believe this scheme is now unraveling. $BLNK's CFO left in February, and its COO in March.

9) $BLNK's former COO is now suing the Company, alleging numerous counts of securities fraud; we view the complaint as extremely telling. $BLNK's toxic lender, JMJ Financial, was also SEC-barred in March 2020, leaving BLNK in a precarious position as its cash balances dwindle.

10/10) $BLNK took PPP money which it has disclosed it already burned through and doesn't intend to repay, while Farkas has dumped over 1.8M shares over the past 2 years. We're following his lead and believe Blink shares are worthless.

Read on Twitter

Read on Twitter