One really encouraging thing about the past few days is that nobody seems to care about the stock market hitting new highs. Good judgment! The stock market is not the economy. Still, is there a puzzle here? Less than you might imagine 1/

In 2020, the stock market is dominated by a handful of tech giants that can expect to earn a steady stream of monopoly or quasi-monopoly rents for years to come. The value of these companies should depend on the discounted value of those streams2/

What affects this discounted value? The expected state of the economy over the next few quarters *shouldn't* matter much, as long as we're eventually going to recover. What should matter a lot, however, is the discount rate 3/

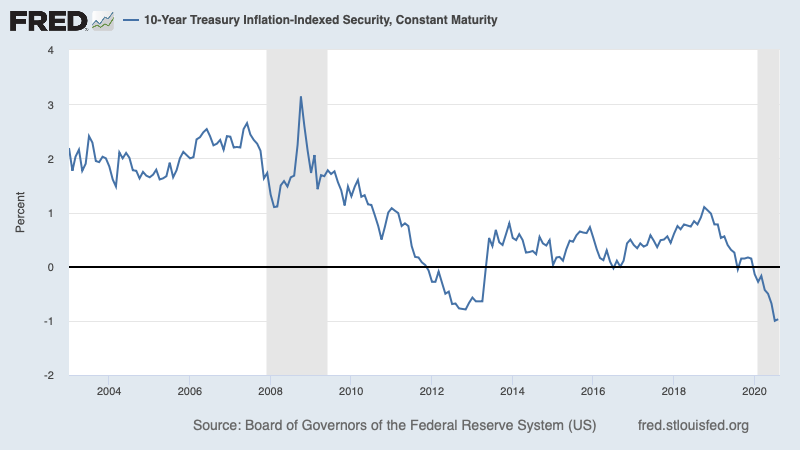

That is, how much should an expected dollar of FAANG profits 5 years from now be worth today? That depends on the returns on alternative assets — like, say, inflation-protected government bonds. And those returns are at record lows 4/

So even if you think 2020-21 is going to be lousy, if you think Amazon will be making money in 2025— and your alternative is govt bonds that yield 1% less than inflation — buying Amazon isn't that strange 5/

Not saying that this is the whole story, but anyone talking about stocks without mentioning bond yields is missing a large part of what's going on 6/

Read on Twitter

Read on Twitter