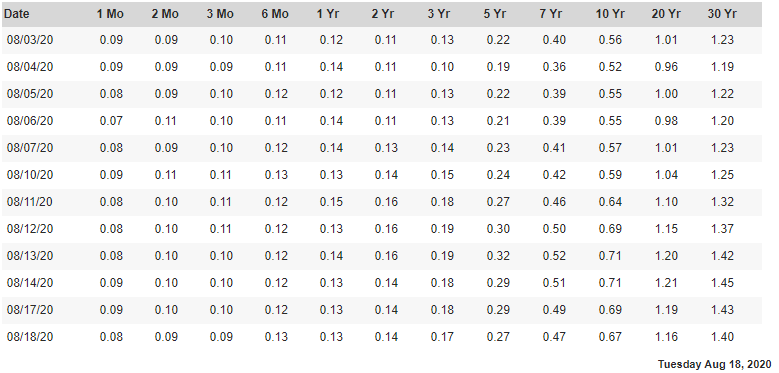

Just how crazy are current interest rates? A quick thread:

1/ A quick look at the US Treasury website gives us the following picture of the current yield curve

2/ The rates on treasuries seem really low by historical standards. Especially given that the 10 year rate is sub 1%. This seems kinda crazy that someone would be willing to buy these bonds at 1% right?

Let's dig in to see how crazy they actually are.

Let's dig in to see how crazy they actually are.

3/ Let's assume that investors care about Sharpe ratio and aren't looking at just gross returns.

Given the ability to buy futures on both stocks and treasuries, this isn't a big stretch as it would be easy to lever or delever as needed with futures.

Given the ability to buy futures on both stocks and treasuries, this isn't a big stretch as it would be easy to lever or delever as needed with futures.

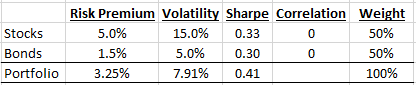

4/ Then, let's take a quick look at what history would have provided an investor that owns a 50/50 portfolio of stocks and bonds:

5/ Not a bad deal - stocks provide a nice 5% risk premium above cash and bonds provide a 1.5% return premium above cash. Both assets have about a .3 Sharpe ratio but when combined, they form a portfolio with a .4 Sharpe ratio. Pretty cool when diversification works.

6/ You will also notice, that the correlation between stocks and bonds is about 0%. This figure has ranged from positive to negative but 0% is pretty close to historical average.

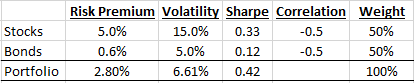

8/ I'm going to keep the stock risk premium above cash constant (we can debate about that later) and decrease the risk premium for bonds to their current spread above cash - about 0.6% (I'm also ignoring roll-down returns).

9/ Also notice that the correlation for bonds and stocks is currently quite negative. This negative correlation provides quite a bit of diversification to the portfolio - it decreases the standard deviation from about 8% to about 6.6%.

10/ Along with the decline in volatility for the portfolio, the risk premium declines from 3.25% to 2.8%...this stinks.

However, the Sharpe ratio of the portfolio doesn't change much as the decreased in risk premium is almost completely offset by decreased risk!

However, the Sharpe ratio of the portfolio doesn't change much as the decreased in risk premium is almost completely offset by decreased risk!

11/ This means that one can simply lever the portfolio to increase the volatility of the portfolio and capture nearly the same risk premium as before!

What's that? You can't or don't want to lever your portfolio? Have I got a deal for you!

What's that? You can't or don't want to lever your portfolio? Have I got a deal for you!

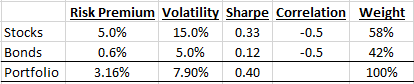

12/ We can just increase the allocation to stocks and decrease the allocation to bonds to increase the volatility of the portfolio.

13/ We see that by increasing the allocation to stocks to about 58% (and bonds down to 42%) we bring the volatility of the portfolio back up to 7.9% (historical average(ish)) and also the risk premium of the portfolio back up to around 3.2%!

14/ Perhaps the bond market isn't as insane after all! So what's the catch?

15/ The catch is that bonds and stocks are currently negatively correlated as we are facing deflationary risks and shocks.

Fin/ If/when we start to face inflationary shocks/risk then the correlation between stocks and bonds turns positive and we lose the diversification benefit.

Hopefully, this will be offset by much higher risk premiums!

Hopefully, this will be offset by much higher risk premiums!

Read on Twitter

Read on Twitter