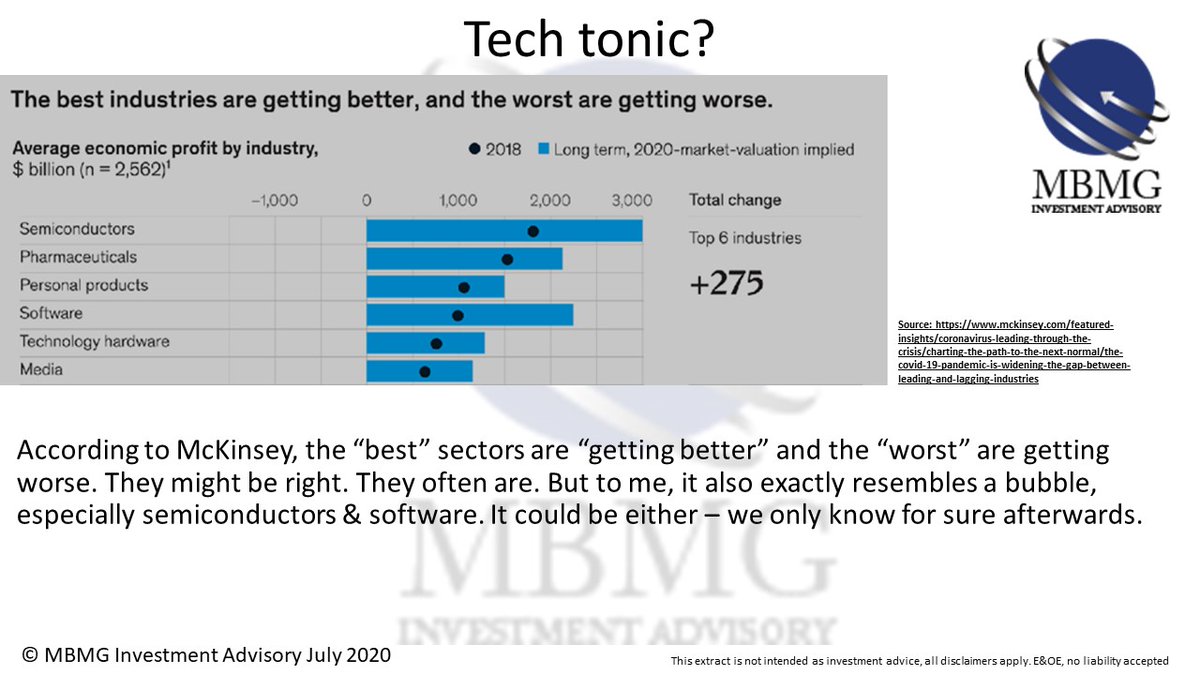

Tech tonic?

According to McKinsey, the “best” sectors are “getting better” & the “worst” are getting worse

They might be right

They often are

But to me, it also exactly resembles a bubble, especially semiconductors & software

It could be either– we only know for sure afterwards

According to McKinsey, the “best” sectors are “getting better” & the “worst” are getting worse

They might be right

They often are

But to me, it also exactly resembles a bubble, especially semiconductors & software

It could be either– we only know for sure afterwards

Great to chat this morning with @AdamBakhtiarCNA about the liquidity-driven new high in the S&P500 overnight, despite the COVID pandemic

My main concern is how much longer the liquidity wave will persist

At the margins, it seems to be starting to evaporate a little –

My main concern is how much longer the liquidity wave will persist

At the margins, it seems to be starting to evaporate a little –

over the last few weeks assets have become more directionless, or, in the case of gold, pull back from all-time highs.

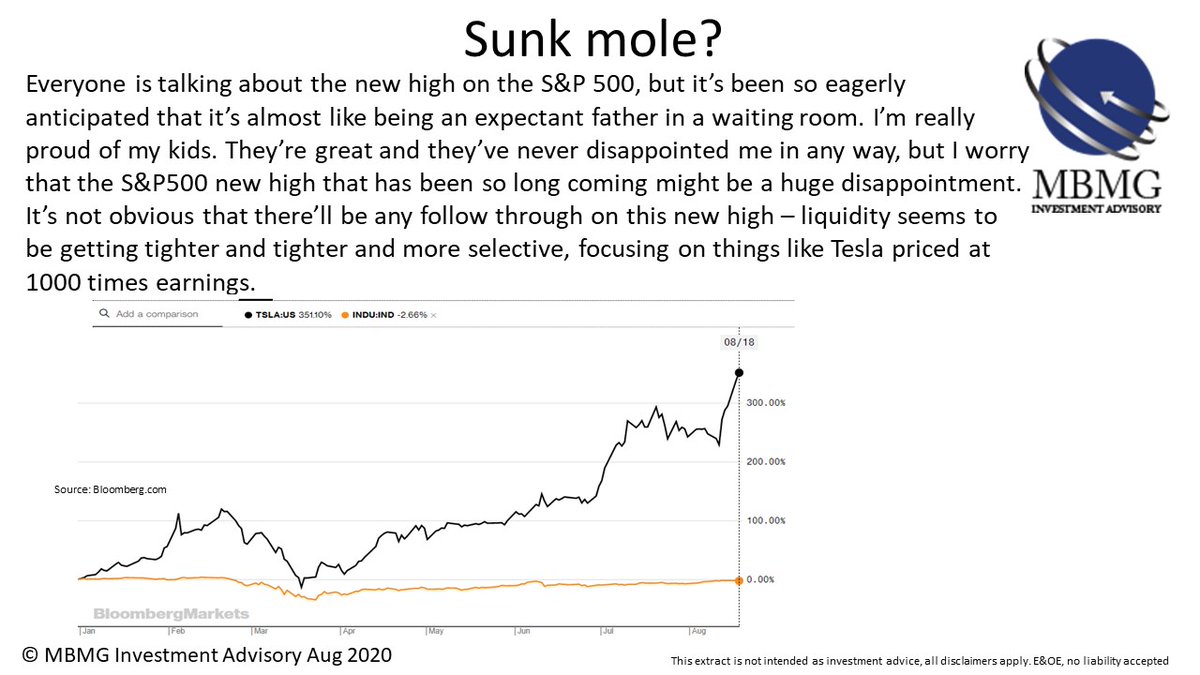

Everyone is talking about the S&P 500 new high

It's been so eagerly anticipated almost like being an expectant father in a waiting room

I’m really proud of my kids

They’re great and they’ve never disappointed me in any way, but I worry that the S&P500 new high that has been so

It's been so eagerly anticipated almost like being an expectant father in a waiting room

I’m really proud of my kids

They’re great and they’ve never disappointed me in any way, but I worry that the S&P500 new high that has been so

long coming might be a huge disappointment

It’s not obvious that there’ll be any follow through on this new high – liquidity seems to be getting tighter and tighter and more selective, focusing on things like Tesla priced at 1000 times earnings.

It’s not obvious that there’ll be any follow through on this new high – liquidity seems to be getting tighter and tighter and more selective, focusing on things like Tesla priced at 1000 times earnings.

Adam pointed out Elon Musk’s astounding ascent to 4th wealthiest person on the planet before questioning whether one of the lessons learned post-GFC recovery is ‘don’t fight The Fed’, especially in view of the scale of liquidity in 2020, when we have $trillions more than in 2008?

I agreed QE helped markets stabilize in '08 but in order to maintain momentum, required QE2, QE3 etc.

If the current wave of liquidity starts to dissipate, we’d need additional liquidity to keep the market momentum going

Liquidity works as a driver only as long as you constantly

If the current wave of liquidity starts to dissipate, we’d need additional liquidity to keep the market momentum going

Liquidity works as a driver only as long as you constantly

produce sufficient incremental liquidity

This is a worry right now because the primary liquidity driver, US policymakers are on summer holiday on top of political deadlock in both Congress & Senate.

The big worry therefore is that policymakers may fail to step up in time

This is a worry right now because the primary liquidity driver, US policymakers are on summer holiday on top of political deadlock in both Congress & Senate.

The big worry therefore is that policymakers may fail to step up in time

If we get more stimulus measures and more liquidity, that would be the shot in the arm to drive markets higher. The questions that markets are asking now are ‘Is that liquidity coming? Will it be enough? And will it arrive in time?’

Adam asked how damaging politics /geopolitics could be with heightened Sino-US tensions+ US elections coming up in November

It could be very damaging, at many levels, for many years to come

There’s been no shortage of western commentary about existential risks for Huawei but the

It could be very damaging, at many levels, for many years to come

There’s been no shortage of western commentary about existential risks for Huawei but the

broader risks seem to be going unnoticed.

It’s unlikely Huawei or China will take this lying down

The bigger question is whether nor not this could this be an existential crisis for TSLA priced at ~1000 PE, AMZN@ >100, NFLX@ >80, or MSFT, AAPL, GOOG &FB@ >30 PER

It’s unlikely Huawei or China will take this lying down

The bigger question is whether nor not this could this be an existential crisis for TSLA priced at ~1000 PE, AMZN@ >100, NFLX@ >80, or MSFT, AAPL, GOOG &FB@ >30 PER

At these levels, there’s significant vulnerability to at least a major correction. While Sino-US tensions, like most things emanating from Trump’s Oval Office, currently feel more like Kabuki Theatre than reality, these things can easily spin out of control

If this does, it not just a Huawei problem-

It’s a FANG problem, a US tech problem, a global tech problem

If we get a problem with those, that’s a really big US/global equity market problem

It’s a FANG problem, a US tech problem, a global tech problem

If we get a problem with those, that’s a really big US/global equity market problem

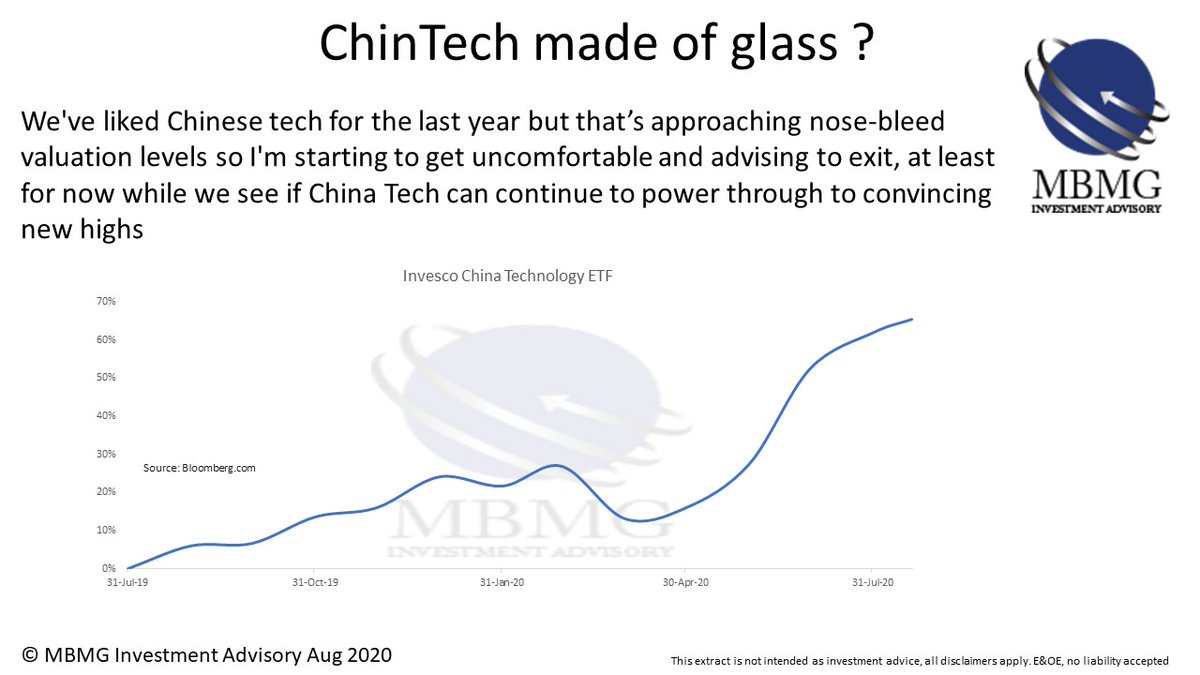

Adam pointed out I’d been bullish on China equities for some time, as one of the more robust global economies

I said I thought it was time to take money off the Chinese table because even there valuations have risen at the same time that risks have risen

I said I thought it was time to take money off the Chinese table because even there valuations have risen at the same time that risks have risen

We've liked Chintech for the last year but that’s approaching nose-bleed valuation levels so I'm starting to get uncomfortable and advising to exit, at least for now while we see if China Tech can continue to power through to convincing new highs

With so much uncertainty & such high valuations, many assets look ripe for selling right now but not many that look such great buys

By default, cash has become, for the first time in quite a few years, one of the largest single holdings in MBMG’s recommended allocations

By default, cash has become, for the first time in quite a few years, one of the largest single holdings in MBMG’s recommended allocations

Adam questioned whether the weaker$ might be a positive for Asia, buying some breathing space, while $liquidity flows to EMs, which could rebound strongly after COVID-19?

This is key point but there are 2 sides to this-

1) Sg +S Kr are the only Asian EMs to directly access $

This is key point but there are 2 sides to this-

1) Sg +S Kr are the only Asian EMs to directly access $

liquidity through swap lines- Thai, Mal & Indonesia arguably need it more but lack the same access to Dollar funding

2) Demand for Fed providing cheap$ to foreign counterparties hasn’t been sustained either for direct swap users or secondary demand from EMs

2) Demand for Fed providing cheap$ to foreign counterparties hasn’t been sustained either for direct swap users or secondary demand from EMs

So, while $strength for the last few years was a headwind to EMs because of $scarcity, we’re now seeing is greater supply of Dollar liquidity but reduced demand from EMs.

Recovering EMs would create demand-driven $strength vs. EM currencies but that creates headwinds of its own

Recovering EMs would create demand-driven $strength vs. EM currencies but that creates headwinds of its own

Thailand's collapse in tourism+exports has decimated local demand too

Unless that returns, increased $liquidity will only help asset markets short term but not economies longer term, creating a significant negative feedback loop in EMs, in South East Asia and more generally.

Unless that returns, increased $liquidity will only help asset markets short term but not economies longer term, creating a significant negative feedback loop in EMs, in South East Asia and more generally.

Adam summed up by agreeing that the fate of many markets will depend upon the return of demand and that might still require a solution to COVID, such as a vaccine.

@threadreaderapp unroll please

Read on Twitter

Read on Twitter