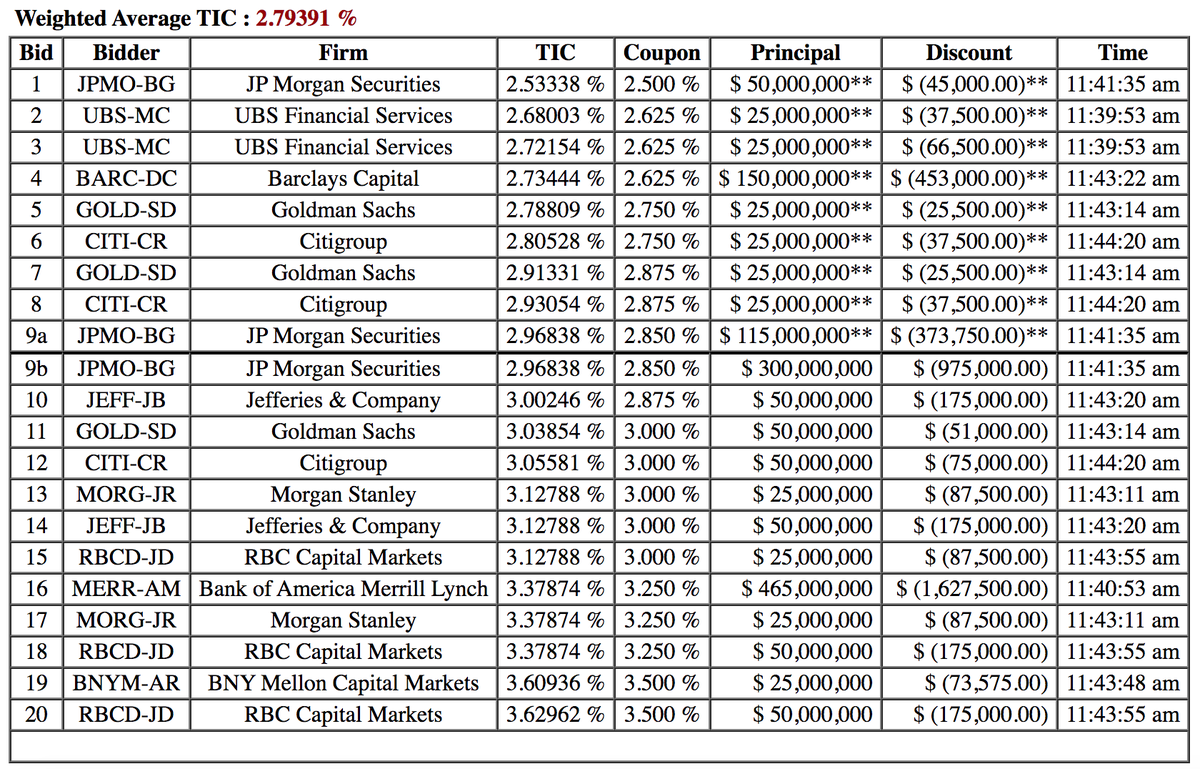

Here are the bids for the MTA's $465 million of revenue anticipation notes.

All REJECTED.

https://www.muniauction.com/pma/results/MTA.TRBAN.20B.Closed/bid_summary.html

All REJECTED.

https://www.muniauction.com/pma/results/MTA.TRBAN.20B.Closed/bid_summary.html

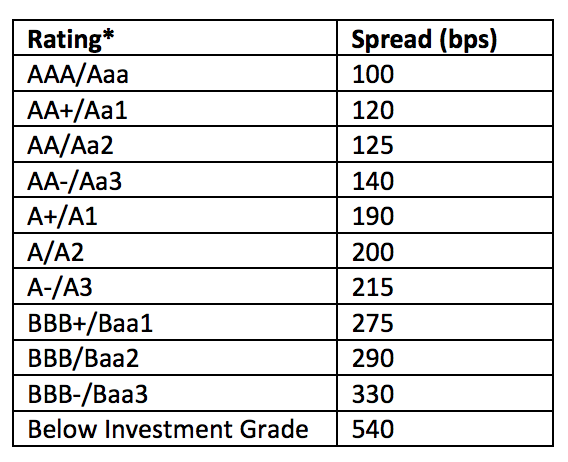

This makes sense. The MTA has split ratings (BBB+/A2/A+), but wherever it falls in the single-A category, it will get a better rate from the Fed after its 50bp cut to yield spreads.

I called the Fed's new pricing a "gentle nudge" to the muni market in my column yesterday.

Without it, the MTA probably would have been ambivalent between these bids and going to the Fed. https://www.bloomberg.com/opinion/articles/2020-08-17/fed-gently-nudges-muni-market-and-deadlocked-congress?sref=nNOdD5kh

Without it, the MTA probably would have been ambivalent between these bids and going to the Fed. https://www.bloomberg.com/opinion/articles/2020-08-17/fed-gently-nudges-muni-market-and-deadlocked-congress?sref=nNOdD5kh

Of course, Wall Street knew the Fed's pricing scale, so if the banks really wanted a piece of this note sale, they would have bid more aggressively.

My guess is they were fine letting it go to the Fed.

My guess is they were fine letting it go to the Fed.

Illinois and the MTA have always been the two most-likely candidates to use the Fed's facility.

Pricing may have to tighten further before it backstops any other muni borrowers.

Pricing may have to tighten further before it backstops any other muni borrowers.

Read on Twitter

Read on Twitter