One of the most interesting parts of venture capital as an asset class is the persistence of funds. Persistence is when the next result has a high and positive correlation with the previous one. Funds that have done well tend to do well in the future.

Thread 1/

Thread 1/

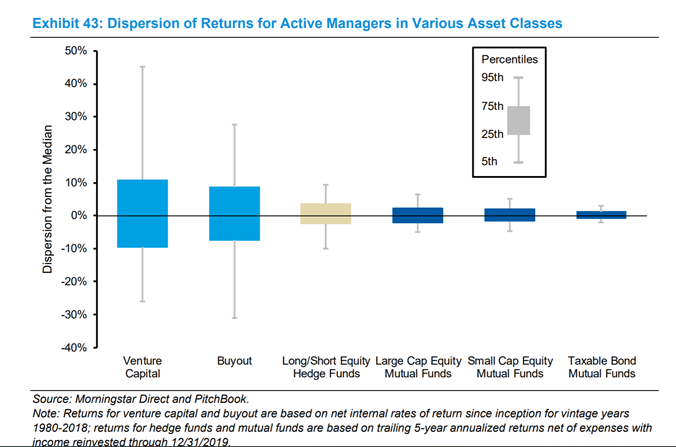

This data is from @mjmauboussin - if you compare venture capital funds to buyout funds, you see the difference in the persistence that has existed between the two asset classes 2/

In VC, almost half (48%) of the firms that had a prior fund in top quartile, had the next fund in the top quartile. Only 6% fell to the bottom quartile. For buyouts, these numbers are 24% and 25% respectively. If this were random, you'd expect all buckets to be 25% 3/

If you look at the dispersion across different asset classes, you see that venture has by *far* the biggest delta between the top managers and the bottom ones 4/

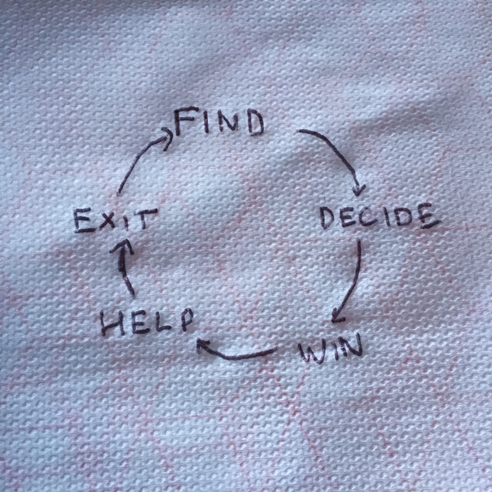

There are a bunch of reasons for this and I'll try to capture most of them, but I'm sure there are more.. I'll steal @nbt's napkin flow-chat to highlight the compounding effects 5/

Find

If you're a top firm you get preferential access to deals. Founders come to you and they want to work with you. There's a halo associated with being funded by a top firm and so you get better access 6/

If you're a top firm you get preferential access to deals. Founders come to you and they want to work with you. There's a halo associated with being funded by a top firm and so you get better access 6/

And there's a finite number of good investments (vs. buyout where there are near infinite good investments depending on the price). If you're a successful buyout fund, you also get preferred access but this is more based on ability to pay a high price (discussed more below) 7/

Decide

There are good pickers in both venture and buyout. Unclear if this is really a meaningful driver of persistence one way or the other for either asset class 8/

There are good pickers in both venture and buyout. Unclear if this is really a meaningful driver of persistence one way or the other for either asset class 8/

Win

This is in my opinion the biggest driver of the difference in persistence between venture and buyout. In buyout (and other asset classes), it's an efficient and rational market where people are mostly optimizing for the market clearing price 9/

This is in my opinion the biggest driver of the difference in persistence between venture and buyout. In buyout (and other asset classes), it's an efficient and rational market where people are mostly optimizing for the market clearing price 9/

Picture you're selling a house - you might want to see it in good hands with the next owner, but you won't care that much if means an extra $50K in your pocket. In venture, the highest price almost never wins. Or the founder almost never pushes price to the breaking point 10/

Why is this the case? A bunch of reasons but ultimately it's because you're not walking away after the deal. You're picking someone that you want on the journey with you. This is most true at the earliest stages of venture and least true at the latest 11/

For 20% of my company, do I want $3M ($15M val'n) or $4M ($20M val'n)? Rationally you'd want $4M but you might not ever touch that additional $1M and so people will often pick the partner they want. If it meant an additional $5M and you walked away, you'd choose differently 12/

Help

So why give preferential treatment firms? Because you think they can help. They can help because the specific partner has domain expertise in your space. They can help because they have a network of executives. They can help because they raise your visibility 13/

So why give preferential treatment firms? Because you think they can help. They can help because the specific partner has domain expertise in your space. They can help because they have a network of executives. They can help because they raise your visibility 13/

They can help because people want to follow them in future fundraises. They can help because they know the IPO or M&A markets. Every founder has their own calculus but help is what you're solving for outside of price 14/

Exit

Ultimately businesses will be judged on their own merits and not based on who their investors are, but it does help to have someone that knows the executives at someone that might purchase your business. Or the public investors that might buy in your IPO 15/

Ultimately businesses will be judged on their own merits and not based on who their investors are, but it does help to have someone that knows the executives at someone that might purchase your business. Or the public investors that might buy in your IPO 15/

And successful exits feed back on preferential ability to find, decide, win and help. It's an interesting and compounding flywheel that has and will likely continue to endure

End

End

And here’s a link to @mjmauboussin’s full report which is a fantastic read on all of this https://www.morganstanley.com/im/publication/insights/articles/articles_publictoprivateequityintheusalongtermlook_us.pdf?1596549853128

Read on Twitter

Read on Twitter