`A Model of the Fed's View on Inflation' w/ @ThomasHasenzagl, F. Pellegrino and @LucreziaReichli

has been accepted for publication at The Review of Economics and Statistics.

Our last draft is here: https://www.giovanni-ricco.com/single-post/2017/08/28/A-model-of-the-Fed%E2%80%99s-view-on-inflation

has been accepted for publication at The Review of Economics and Statistics.

Our last draft is here: https://www.giovanni-ricco.com/single-post/2017/08/28/A-model-of-the-Fed%E2%80%99s-view-on-inflation

(For the many that asked) replica codes are now available on GitHub: https://github.com/GRicco/replication-hasenzagl-et-al-2020

We are truly grateful to the Olivier Coibion, our Editor, and three friendly and insightful referees for great suggestions that improved our paper

(As a side note - what a difference good referees and a good editor, can make!)

(As a side note - what a difference good referees and a good editor, can make!)

𝐒𝐡𝐨𝐫𝐭 𝐬𝐮𝐦𝐦𝐚𝐫𝐲 𝐨𝐟 𝐭𝐡𝐞 𝐩𝐚𝐩𝐞𝐫

We ask: is it an understanding of inflation as determined by

- a long-run trend due to expectations

- a Phillps curve that connects slack to prices

- idiosyncratic/oil price fluctuations

consistent with US data?

We ask: is it an understanding of inflation as determined by

- a long-run trend due to expectations

- a Phillps curve that connects slack to prices

- idiosyncratic/oil price fluctuations

consistent with US data?

We employ a novel Bayesian medium-scale trend-cycle model with real-world expectations from professionals' and consumers' survey data extracting

- a long-run trend inflation

- a business-cycle/output gap component

- an energy price component separated from the bc

- a long-run trend inflation

- a business-cycle/output gap component

- an energy price component separated from the bc

The answer is yes!

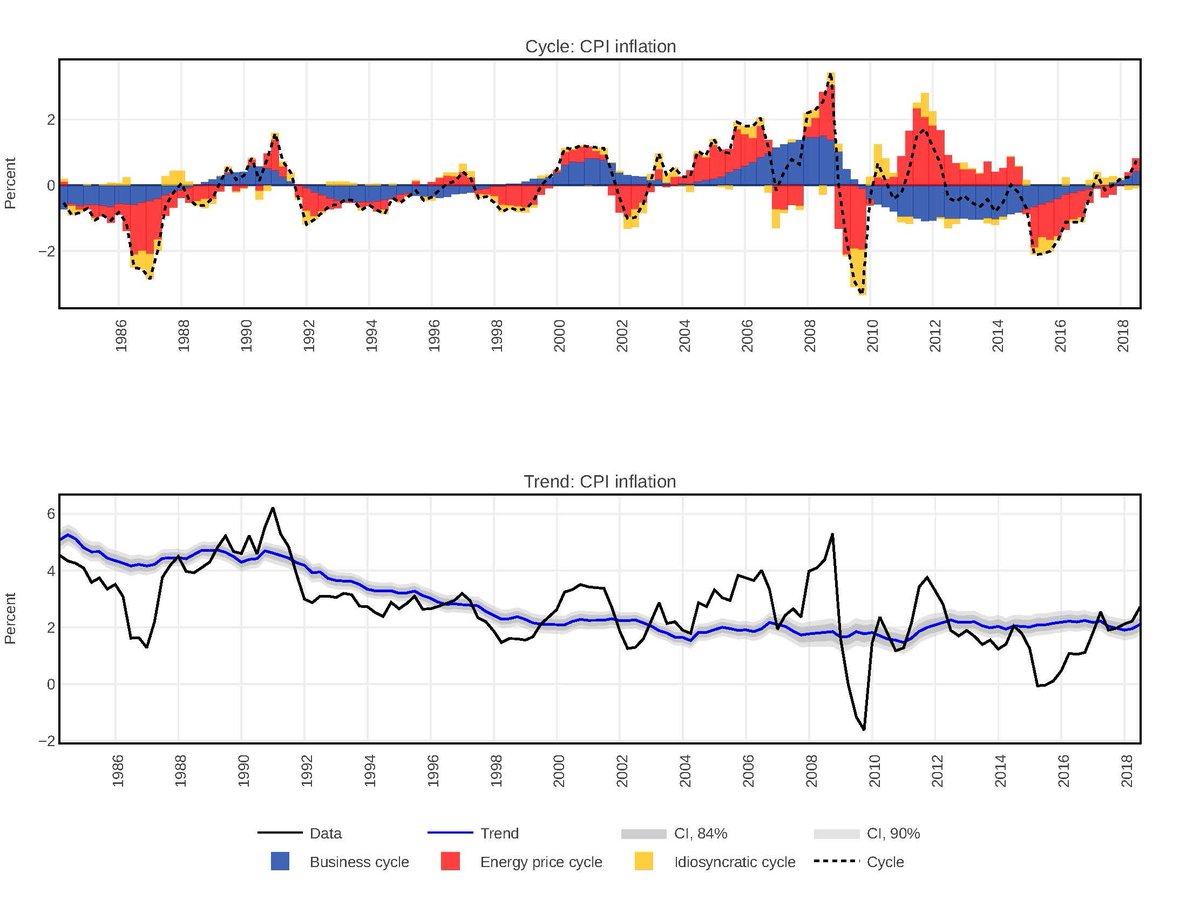

That's what this chart says.

The blue is the Phillips curve component due to the output gap. Nice and stable from the 80s.

Red is oil prices disturbances that impact prices via the energy component but also expectations - as in Coibion & Gorodnichenko, 2015

That's what this chart says.

The blue is the Phillips curve component due to the output gap. Nice and stable from the 80s.

Red is oil prices disturbances that impact prices via the energy component but also expectations - as in Coibion & Gorodnichenko, 2015

Also, the inflation trend is very stable declining from the 80s to be smack onto the 2% target

To us the chart shows how well the Fed managed inflation expectations over the years, in line with its policy target

To us the chart shows how well the Fed managed inflation expectations over the years, in line with its policy target

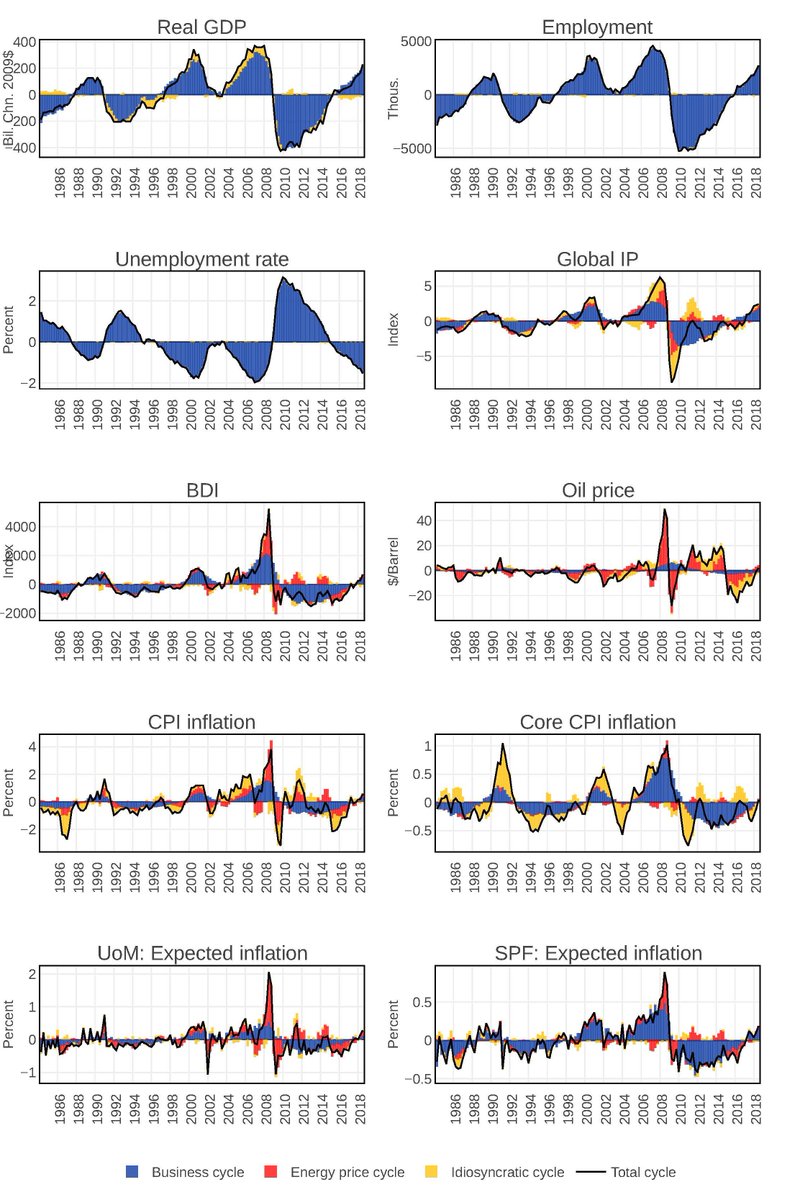

Where all of this oil disturbances are coming from?

It does not look like Global Demand, but still, they are originated at the global level in the commodity markets by

supply/financial shocks. In this chart, BDI is Baltic Dry Cargo Index

It does not look like Global Demand, but still, they are originated at the global level in the commodity markets by

supply/financial shocks. In this chart, BDI is Baltic Dry Cargo Index

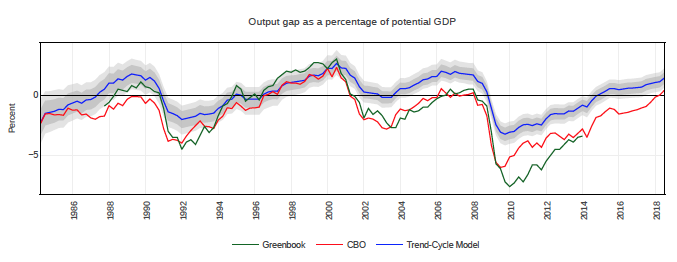

So the PC is stable...

BUT

our estimate of the output gap is much shallower than CBO's. The output potential in the US declined since at least the Great Recession

This is compatible with hysteresis or productivity long-run decline

BUT

our estimate of the output gap is much shallower than CBO's. The output potential in the US declined since at least the Great Recession

This is compatible with hysteresis or productivity long-run decline

Two `polar' views are compatible with the data:

1 Stable PC (and Okun's law) but decline of the potential due to hysteresis and long-run phenomena

2 Stable potential, large output gap and flattening PC

They depend on beliefs on the long-run so data do not tell them apart

1 Stable PC (and Okun's law) but decline of the potential due to hysteresis and long-run phenomena

2 Stable potential, large output gap and flattening PC

They depend on beliefs on the long-run so data do not tell them apart

If view 1, more than just demand but also supply intervention may be needed

If view 2, then just demand BUT at the peak pre-Great Recession and on top of a huge bubble the US economy was just scrapping by the potential! Can the Fed push up demand that much?

If view 2, then just demand BUT at the peak pre-Great Recession and on top of a huge bubble the US economy was just scrapping by the potential! Can the Fed push up demand that much?

Read on Twitter

Read on Twitter