— Fixed Income Investing —

Known for capital preservation and income.

It often takes a backseat to stocks.

Here’s what you need to know.

• What they are.

• Stocks vs Bonds.

• Pros and Cons.

• Should you own them?

— Thread —

Known for capital preservation and income.

It often takes a backseat to stocks.

Here’s what you need to know.

• What they are.

• Stocks vs Bonds.

• Pros and Cons.

• Should you own them?

— Thread —

Definition:

Typically includes government and corporate bonds, CDs and money market funds.

Normally these carry lower risk than individual stocks.

Because of this they can be used to offset losses from typical equities.

Typically includes government and corporate bonds, CDs and money market funds.

Normally these carry lower risk than individual stocks.

Because of this they can be used to offset losses from typical equities.

The B word:

Bonds are the most popular so we are going to talk about them.

Basically it’s debt issued by a company.

When purchasing their debt a company offers to pay you interest.

Then once the maturity date comes, investors are repaid the original amount.

Bonds are the most popular so we are going to talk about them.

Basically it’s debt issued by a company.

When purchasing their debt a company offers to pay you interest.

Then once the maturity date comes, investors are repaid the original amount.

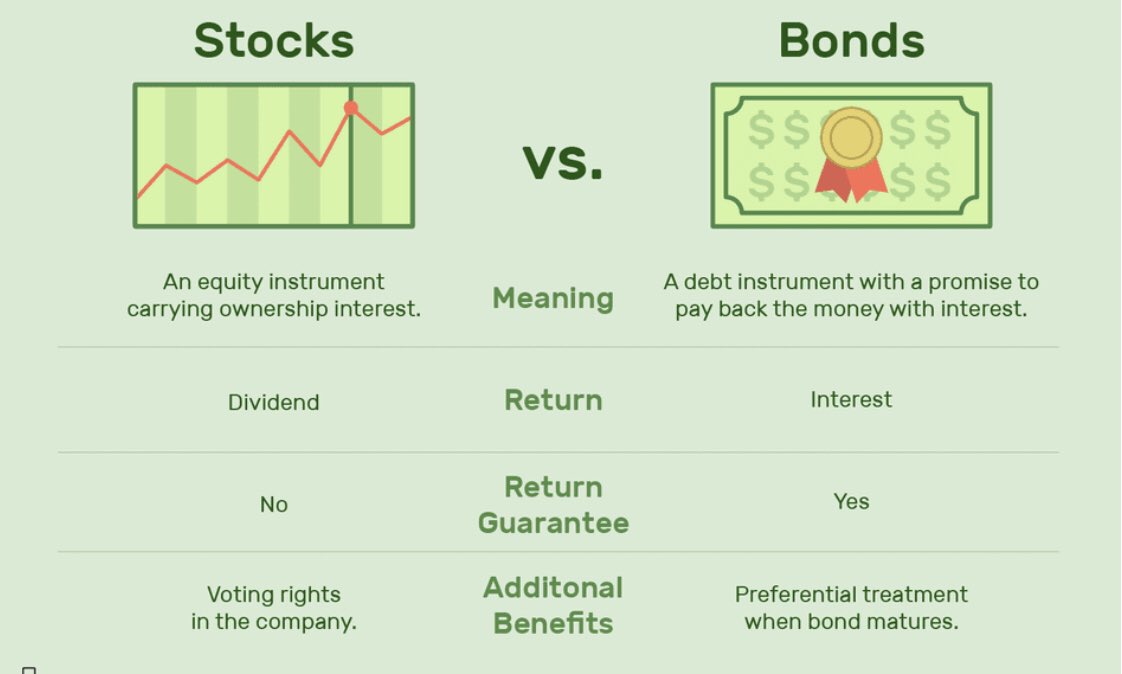

Stocks vs Bonds

This main difference is one is actually buying “ownership” in the business when buying stock.

For bonds one is buying debt.

This main difference is one is actually buying “ownership” in the business when buying stock.

For bonds one is buying debt.

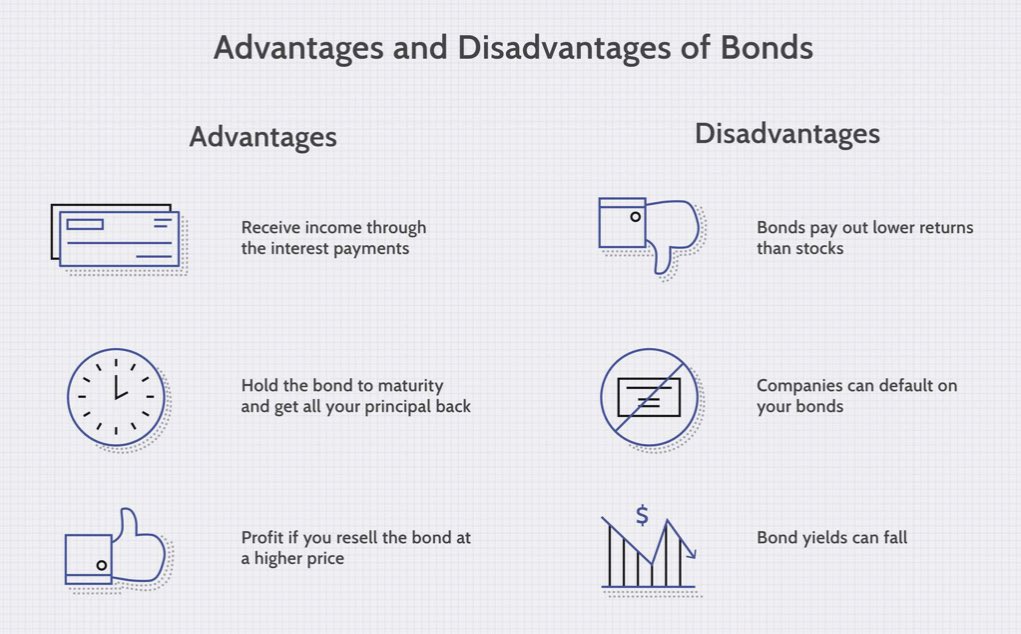

Pros and Cons:

Bonds are typically known for being more stable than stocks.

Though it’s important to note the major factors that influence bonds.

- Interest Rates

- Inflation

- Credit Risk

- Liquidity Risk

(to be covered in another thread)

The chart below provides a summary.

Bonds are typically known for being more stable than stocks.

Though it’s important to note the major factors that influence bonds.

- Interest Rates

- Inflation

- Credit Risk

- Liquidity Risk

(to be covered in another thread)

The chart below provides a summary.

Who are they for?

Typically fixed income is more popular among later-stage investors.

So if you aren’t in this stage don’t sweat it.

Do take the time though to learn more about fixed income investing.

It’s a key area of the markets that’s often overlooked.

Typically fixed income is more popular among later-stage investors.

So if you aren’t in this stage don’t sweat it.

Do take the time though to learn more about fixed income investing.

It’s a key area of the markets that’s often overlooked.

Read on Twitter

Read on Twitter